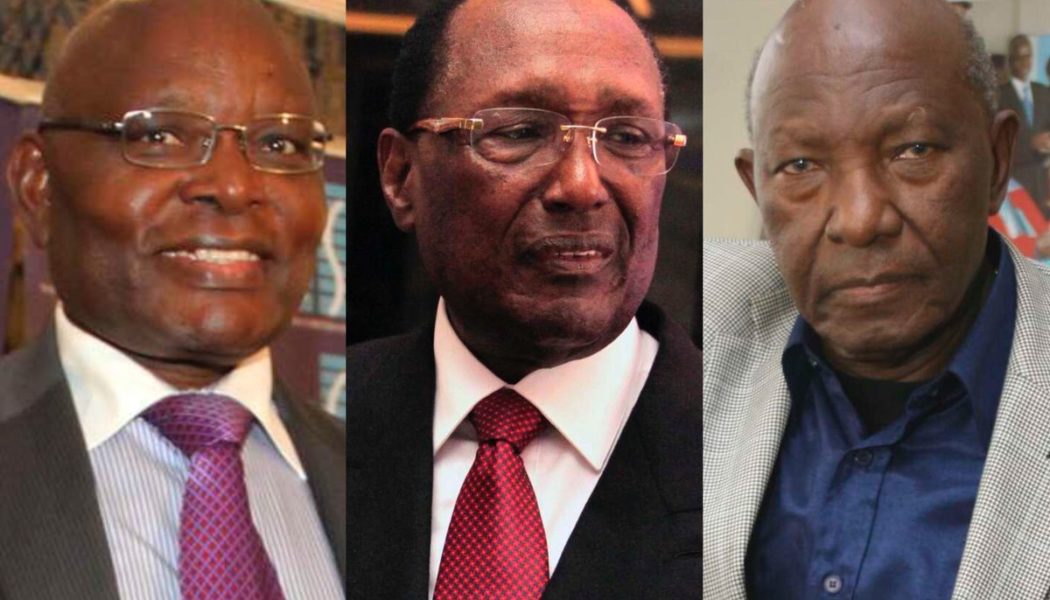

Three Kenyan billionaires –James Muguiyi and the late Chris Kirubi and Joe Wanjui— for years controlled UAP Holdings, which paid them substantial dividends from years of uninterrupted profitability.

The tycoons have also reaped billions from calculated share sales that have left a bad taste in mouth of minority investors—plagued with a dividend drought and no way out of the insurer.

The contrasting fortunes of the founders and the minority owners has triggered a court fight that marks a rare occasion when an investor has sued their own company for financial loss and demand to exit.

A law change in 2010 capping an individual’s ownership in an insurance company at 25 percent meant that something had to change.

Mr Wanjui by March 2012 held a 35.84 percent in the company that now trades as Old Mutual Holdings, meaning that an ownership restructuring was due if the insurer was to comply with the Insurance Act.

The solution was elaborate –sell some shares to the public and convert debt held by private equity firms into equity.

This would automatically dilute Mr Wanjui’s stake below 25 percent while simultaneously raising new capital and reducing debt.

At the time, Mr Muguiyi had a 10.52 percent stake while Mr Kirubi and his firm Centum Investment Company had interests of 16.88 percent and 24.23 percent respectively.

In marketing the public offer in 2012, the company said it had a target of listing its shares on the Nairobi Securities Exchange (NSE) in 2014 to enable greater liquidity and price discovery for investors.

The listing is yet to happen, and the shares continue to trade on the over the counter (OTC) market which is less liquid.

The founding shareholders have meanwhile sold out most of their shares to Old Mutual Limited of South Africa at a major profit, brewing frustration for minority investors who now face the prospect of a substantial dilution at a time when the insurer has gone for years without paying a dividend.

Mr Kirubi and Centum earned Sh3.2 billion and Sh4.5 billion respectively in February 2015 for their stakes of 9.58 percent and 13.75 percent.

At the same time, private equity firms AfricInvest, Aureos and Swedfund nearly tripled their money when they sold their 37.33 percent stake for Sh12.4 billion.

The PE firms had converted their Sh4.55 billion loans into shares just over a year earlier.

Mr Wanjui and Mr Muguiyi meanwhile had a separate agreement with the multinational which earned them the highest rates of returns when they sold a combined six percent stake for Sh3.2 billion in 2020.

In all, the multinational acquired a 66.6 percent stake in the insurer from the multiple deals over the six years and rebranded the company to Old Mutual Holdings.

The multinational disclosed the agreement it had with Mr Muguiyi and Mr Wanjui but the Kenyan insurer, then still trading as UAP, did not reveal the contract technically known as a put option.

The trades reduced Mr Muguiyi’s stake in the insurer to 4.6 percent as of December 2023 while the holdings of Mr Wanjui’s estate fell to 15.79 percent.

Mr Joel Kibe, who bought a total of 1.54 million shares of the company at a cost of Sh246.6 million on the OTC market between July 2014 and June 2015, has sued the Nairobi-based insurer seeking to be bought out at a price that is likely to top the Sh1 billion mark.

“The planned listing of the company at the Nairobi bourse within 2 years of the [public offer] was not undertaken,” Mr Kibe told the High Court in Nairobi.

“The company unilaterally made a decision to postpone the intended listing without reference to the petitioner whose investment of Sh246.6 million is now held up.”

He added that all the original major shareholders of the company were allowed to exit through sale of their shares to Old Mutual directly rather than through OTC, thereby disenfranchising him since he was not offered an opportunity to also sell to the multinational.

Mr Kibe is the first investor to sue a Kenyan public company seeking compensation for alleged financial loss arising from directors and managers’ misrepresentation or failure to disclose material facts.

The practice is common in developed markets where shareholders sometimes win substantial damages after proving that lack of disclosures or misrepresentation by companies resulted in a share price fall or revenue losses.

In its response to the court case, Old Mutual did not dwell on the NSE listing promise. The insurer however rejected all the other issues raised by Mr Kibe including the allegation that last year’s conversion of Sh8.8 billion loans from its parent firm into preference shares (with a priority claim on dividends) was done without shareholders’ involvement.

“In totality, the majority shareholder of the applicant acquired effective control of UAP Holdings lawfully,” Old Mutual’s chief executive Arthur Oginga said in a supporting affidavit.

“It is therefore not true that the acquisition was undertaken to the detriment of any minority shareholders. Furthermore, the majority shareholder of the applicant was under no legal obligation whatsoever to purchase shares from other shareholders having obtained the necessary exemptions from Capital Markets Authority (CMA).”

The insurer added that equity investments have no guaranteed returns, and that lack of dividend payouts is not a marker of shareholder oppression.

Old Mutual asked the court to lift its interim orders that it said are hurting its operations by restricting its ability to meet its obligations, borrow and sell assets.

This is the latest corporate battle for Mr Kibe who was previously involved in shareholder activism in CMC Holdings that was delisted from the NSE after its Sh7.5 billion buyout by Dubai’s Al-Futtaim Group in April 2014.