Following months of uncertainty, data from FNB shows that businesses are already seeing signs of recovery as card swipes at merchants point of sale devices rebound close to pre-pandemic levels.

Purchases recorded on FNB Speedpoint devices show that transactions recorded in August, when the country moved to level 2 of lockdown, recovered to 93.2% compared to February this year.

In the same month, merchant transactions recorded across six provinces were already above pre-pandemic levels, with Free State and Gauteng at 90%, followed by the Western Cape at 70%. Signs of recovery were already apparent in July when the country was still on level 3 of lockdown, where activity had recovered to roughly 86% compared to pre-pandemic levels.

Gordon Little, CEO of FNB Business, says “although merchant transaction volumes have improved, they are still lower compared to the prior year which shows that the strain on the economy continues. However, any increase in activity is a positive sign for economic recovery and we hope to see this accelerating in the months ahead. Early indications are that volumes recorded on FNB Speedpoint devices across the country would have largely recovered by the end of September in anticipation of further easing of operating restrictions.”

/* custom css */

.tdi_3_5b9.td-a-rec-img{ text-align: left; }.tdi_3_5b9.td-a-rec-img img{ margin: 0 auto 0 0; }

“It is encouraging to see card swipes at merchants point of sale devices picking up, indicating that consumers are gradually returning to pre-lockdown levels of foot traffic at merchants. Since the inception of lockdown in March, transactional activity had mainly been dominated by E-commerce with consumers turning to online shopping for essential goods and services,” says Thokozani Dlamini, CEO of FNB Merchant Services.

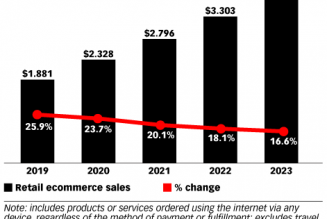

“Average E-commerce spend recorded on FNB Merchant devices grew 30% year-on-year during the first half of 2020 compared to 2019. During the same period, the active eCommerce merchant base had increased by 15%. We are now seeing a combination of online sales and brick and mortar store activity which bodes well for businesses as they try to recover lost income,” adds Dlamini.

Between March and July spending was mainly driven by essential goods and services including, grocery stores, educational services, computing equipment, home office furnishing, gaming and entertainment. In August, the Bank saw demand also moving towards non-essential stores such as clothing, home improvement, hardware and household goods stores.