One of the factories slated to help meet that demand is a $2.6 billion plant in Commerce, Ga., being built by South Korean battery maker SK Innovation. If the plant is completed, the firm says, it will employ 2,600 workers and provide batteries for a suite of Volkswagen vehicles, as well as the electric version of the Ford F-150, the single most popular vehicle in the country.

But construction of the landmark facility is being threatened by an international trade dispute. The U.S. International Trade Commission ruled in February that SK Innovation stole trade secrets from rival South Korean company LG Chem, and ordered that the U.S. block SK from importing components to build batteries. Although the independent agency gave a two-year grace period for Volkswagen and a four-year cushion for Ford, SK says the ruling will likely force it to abandon the factory.

That’s where the White House comes in. Federal law allows the president and the U.S. trade representative to overrule an ITC decision within 60 days — April 11 in the battery case.

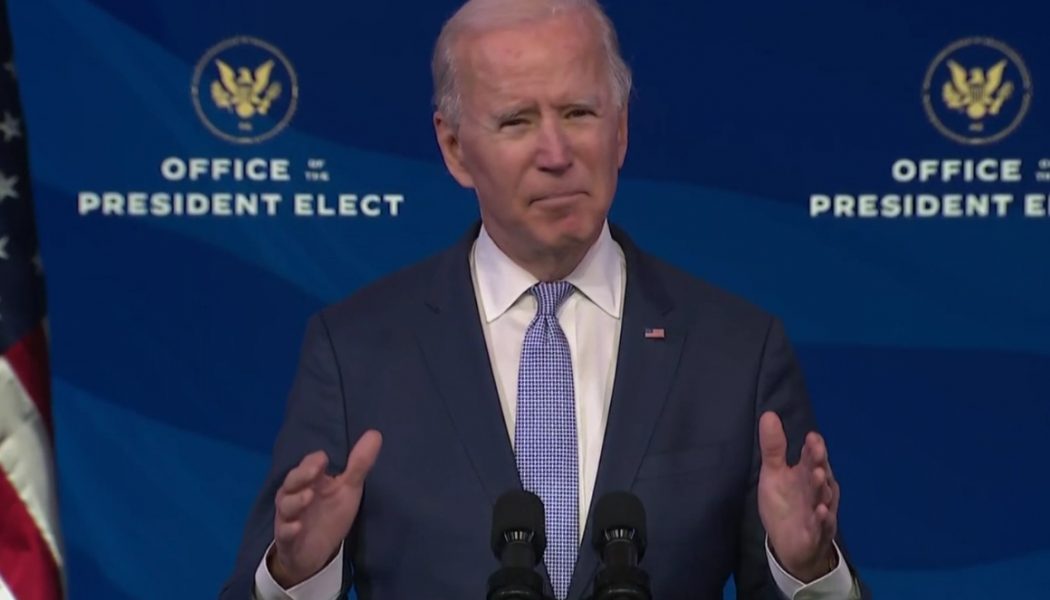

“If the president does not disapprove of the ITC decision, I think it’s very hard to envision SK staying in the U.S.,” said Carol Browner, who served as EPA administrator during the Clinton administration and White House climate chief under former President Barack Obama and is now working with SK to pressure Biden.

The decision is especially tricky for the Biden administration. Overturning the ITC decision would allow SK to finish its factory, letting the president brag about saving thousands of jobs in a swing state that he won by less than 12,000 votes and that later elected two Democrats to the Senate, giving the party a razor-thin majority.

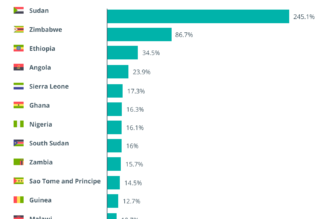

But throwing out the ruling would also undermine intellectual property laws that the U.S. fights to uphold worldwide. And the action would come as the White House resists calls from developing nations at the World Trade Organization to lift intellectual property restrictions for Covid vaccines — sending the message that saving American jobs justifies breaking the rules, while saving lives in developing nations does not.

Overruling the ITC decision may be necessary for the “prosperity of the American people,” but that argument applies “just as strongly” to the vaccine waiver, said an aide to Sen. Bernie Sanders (I-Vt.), who is pushing the White House to issue the waiver.

“The prosperity and security of the American people is the U.S. government’s primary concern, but we need to recognize that our security is bound up with the security of people all around the world, especially in a pandemic,” the aide said.

SK Innovation, Georgia’s governor and the state’s two newly elected Democratic senators are pushing the president to dismiss the ITC ruling, warning that Chinese companies may replace the lost battery capacity if the plant is scrapped. China is by far the global leader in battery manufacturing today, with more than 90 major factories, compared with three in the U.S., according to analytics firm Benchmark Mineral Intelligence.

“The U.S. won’t be producing enough of its own batteries in the next five years to make up” for the loss of the Georgia factory, said Simon Moores, managing director at Benchmark. “You’re going to have to import them, because the U.S. doesn’t have the capacity, and European battery sales are for European customers, so the only other place left is China.”

The competition against China worries the White House, where Biden and top energy officials openly voice concern about Beijing’s dominance in the sector. Last week, Secretary of Energy Jennifer Granholm fretted that China has “got the corner of the market” on batteries and other clean energy components, like solar panels and computer chips.

LG Chem, owned by the South Korean electronics giant LG Corp., says that’s nonsense. The company says it has not sourced any components or materials from China for its U.S. battery manufacturing since 2019. It also recently unveiled plans to invest $4.5 billion in new battery manufacturing in the U.S., including potentially in Georgia. Company executives say that if LG doesn’t claim the SK site, some other firm will.

“Multiple investors and manufacturers … will be interested in the Commerce plant due to increased demand for electric vehicle batteries,” LG CEO Jong Hyun Kim wrote last month in a letter to Sen. Raphael Warnock (D-Ga.).

Presidential action to overturn the ITC is rare, but not unprecedented. Obama and his U.S. trade chief, Michael Froman, did so in 2013 when they tossed out a ruling that would have prevented Apple from importing older iPhone models that infringed on patents owned by Samsung.

Though federal law vests the president with the power to overturn ITC decisions, the U.S. trade representative has had the final say on such matters since 2005.

The Office of the U.S. Trade Representative declined to comment beyond saying that it is working with the White House and the review will be completed “within the 60-day deadline outlined by federal law.” But former officials say it’s an especially tricky issue for the agency’s new leader, Katherine Tai.

“This is a very big deal,” said one former USTR official, who asked to remain anonymous because of continuing business with the agency.

SK’s investment in Georgia was “spurred in large part by the U.S.-Mexico-Canada Agreement” the source added, referencing the updated free trade deal that Tai helped shape as a congressional staffer. And some USMCA compliance plans that the agency approved for automakers were contingent on them having access to SK Innovation batteries in Georgia.

Some new car and truck models may not qualify for tariff-free treatment under the trade deal if they don’t have American-made batteries, added Kristin Dziczek, a senior vice president at the Center for Automotive Research.

“All those factors militate in favor of overturning the ITC order,” the former USTR official said, “but of course that’s seldom done.”

There are opposing considerations as well. In its decision, the ITC chastised SK for destroying documents related to the trade case, saying the action was “ordered at a high level and was carried out by department heads throughout SK.” The commission also criticized Ford for doing business with SK, saying it “deliberately chose to continue to cultivate prospective business relationships predicated on SK’s trade secret misappropriation.”

If the Biden administration does overrule the ITC decision, it might send a signal to other companies that the U.S. will look the other way on intellectual property disputes when jobs or other policy goals are at stake.

“The U.S. has an interest in the consistent enforcement of intellectual property laws,” the former official said. “This will be a big challenge for the new regime at USTR.”

Amid criticism from progressives, some trade veterans dispute the comparison between Covid vaccines and the SK Innovation case.

Former Trump trade adviser Clete Willems called it a “false equivalence,” saying India and other nations pursuing the waiver are “refusing to use” licensing agreements already available to them in an effort to weaken American intellectual property rules. But even if that’s the case, the comparison between the intellectual property cases “would certainly be a talking point” in Washington if Biden throws out the ITC case, the anonymous former USTR official said.

The companies could still throw the White House a lifeline. LG has said it is open to a settlement that would allow SK to finish its factory in return for “compensation” for the stolen intellectual property.

That could also resolve a parallel case in the D.C. Circuit Court, where LG is suing SK. The two sides have so far been unable to agree on a deal, but trade officials have been pushing the companies to the table since before Biden took office.

“That’s certainly how we hoped this would end,” said the former official.