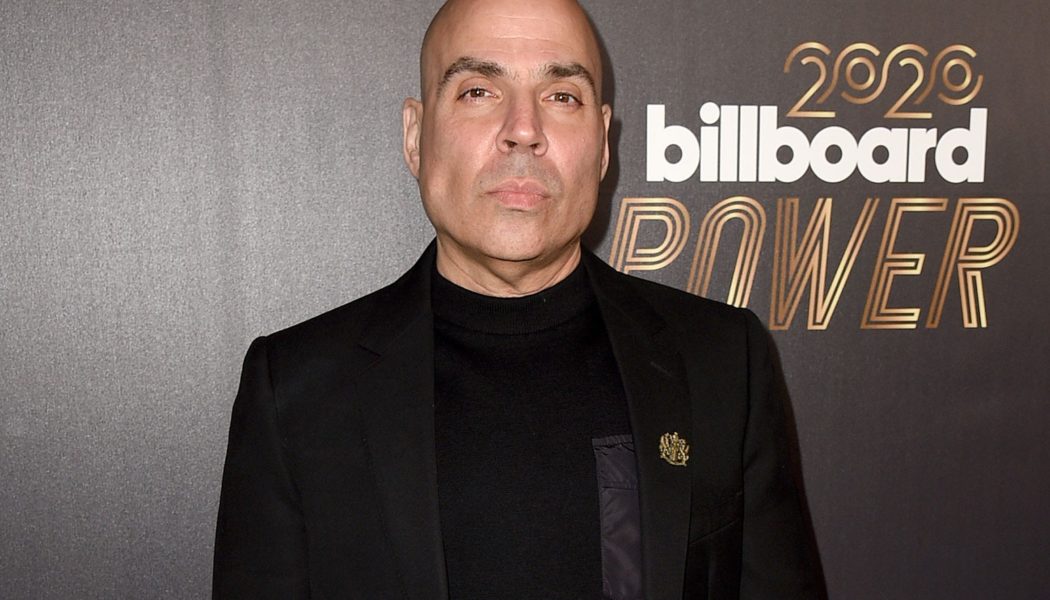

“I am once again delighted with the support from both our existing and new shareholders with an oversubscribed raise of over $215 million, £156 million,” said Hipgnosis founder Merck Mercuriadis in a statement. “We will deploy this immediately into our pipeline of songs and I am incredibly appreciative of the incredible songwriters who have entrusted us with their iconic works. We will now have a portfolio of almost $2.5 billion of extraordinarily successful and culturally important songs, which offers a massive opportunity for us to add value with our Song Management which manages these songs with bandwidth and responsibility.”

As the company announced last month, Hipgnosis expects to use the proceeds from the placing to acquire catalogs already lined up by The Family (Music) Limited, the Mercuriadis-founded investment advisory firm that recommends purchases to Hipgnosis and uses what it calls “song management” to extract value on the back end. Mercuriadis previously announced that this latest round was investors’ last chance to buy into Hipgnosis for at least a year.

Prior to today’s announcement, Hipgnosis had raised a total of £1.1 billion ($1.5 billion) through a 2018 IPO and six subsequent raises, the most recent one in February 2021.

Hipgnosis, which is a member of the FTSE 250 Index, had revenue of $138.4 million in the year ended March 31, 2021, a 66% increase year-over-year, and earnings before interest, taxes, depreciation and amortization of $106.7 million, according to finalized financial figures the company released this week. During that 12-month period, the company spent $1.06 billion on the purchase of full or partial stakes in 84 music catalogs, including those of Neil Young, Barry Manilow, Shakira, Jimmy Iovine, Enrique Iglesias, Fleetwood Mac’s Lindsey Buckingham and Wu-Tang Clan member RZA. Its total portfolio now includes 138 catalogs encompassing 64,098 songs.