Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Hipgnosis Songs Fund has slashed the value of its music portfolio by more than a quarter and said it would need to use free cash to pay down debt, in the latest blow to investors in the UK-listed music rights investment company.

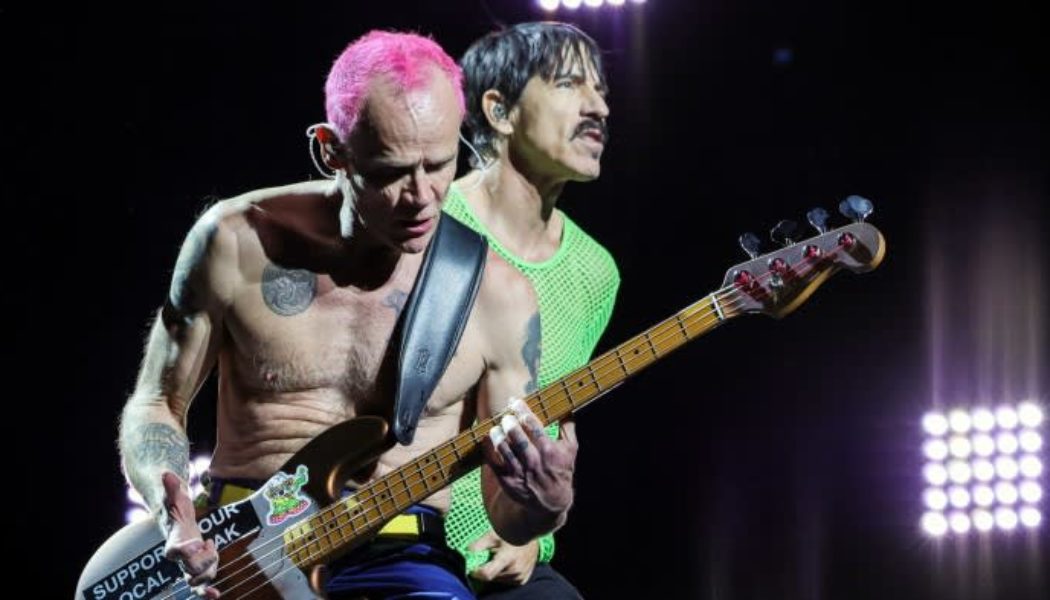

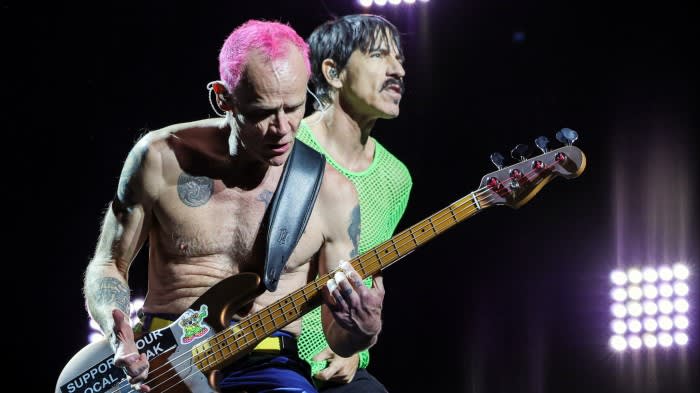

The company’s board, which was revamped last year to oversee a strategic review that could lead to the sale of the group, had asked a new adviser to value a music rights portfolio that includes music by artists including Red Hot Chili Peppers and Shakira.

Shot Tower Capital, which carried out the work, estimates a midpoint value of the portfolio of $1.9bn, or a reduction of 26.3 per cent compared with the valuation at September 30 2023.

Because of the cut to its net asset value, the board said it would need to reduce debt using the company’s free cash flow. It said it did not intend to restart paying dividends “for the foreseeable future”.

Shares in Hipgnosis have halved over the past two years as investors started to question the value of its underlying music assets, and raised concerns over the governance and debt levels of the group.

In early trading on Monday, shares fell by another 10 per cent, trading at about 56p. This means that the company is still trading at a sizeable discount to even the new, reduced valuation. The latest estimate of the value of its music rights has given the company an NAV per share of 92p.

Hipgnosis chair Robert Naylor said the recently constituted board “remains focused on identifying all options to deliver shareholder value”.

Hipgnosis was founded by music executive Merck Mercuriadis in 2018 to turn music rights into a mainstream asset class, using the royalties from streaming, radio play and performances to provide income for investors.

However, the attractiveness of this income has been hit by the rise in interest rates, which has pushed up the “discount rate” used to calculate asset values into the future.

Hipgnosis launched a strategic review looking at options including changing its adviser or a sale of its assets after it lost a shareholder vote last October that put its future as an investment trust in doubt.

Investors last year also blocked a deal to sell a $440mn music rights portfolio to a sister fund run and backed by private equity group Blackstone.

Shot Tower has estimated the fair market value of the portfolio at between $1.8bn and $2.06bn, or between $1.74bn and $2bn after deducting bonuses to artists. This compares with fair value as of 30 September 2023 of $2.62bn, and $2.55bn after bonuses.

As a result of the new valuation, Hipgnosis said its operative net asset value per share would be about $1.2, a sharp fall from the $1.7 reported in September 2023.

The board had previously asked for an opinion from Hipgnosis Song Management (HSM), the company’s investment manager run by Mercuriadis and majority-owned by Blackstone. However it subsequently said HSM at first declined to give an opinion and then provided one that was “heavily caveated”.

Analysts at JPMorgan said the announcement increases the “likelihood of a bid from HSM, backed by Blackstone, that would no longer be seen as low ball”. They added: “Previously, we thought that a bid would have to be 100-110pps [pence per share] to succeed, but 90pps would now look like a more realistic outcome.”