Bitcoin (BTC) price swings might be impossible to predict, but there is a strategy frequently used by pro traders that yields high returns with minimal cost.

Typically, retail traders rely on leveraged futures positions which are highly susceptible to forced liquidations. However, trading Bitcoin options provide excellent opportunities for investors aiming to maximize gains while limiting their losses.

Using multiple call (buy) options can create a strategy capable of returns six times higher than the potential loss. Moreover, these can be used in bullish and bearish circumstances, depending on the investors’ expectations.

The regulatory uncertainty surrounding cryptocurrencies has long been a significant setback for investors and this is another reasons why neutral market strategies have drawn traders’ attention since Bitcoin’s rally stagnated near $47,000 on March 30.

How to profit in a sideways market

The long butterfly strategy allows a trader to profit even if Bitcoin’s price remains flat. However, it’s important to remember that options have a set expiry date. This means the desired price outcome must happen during a specified period.

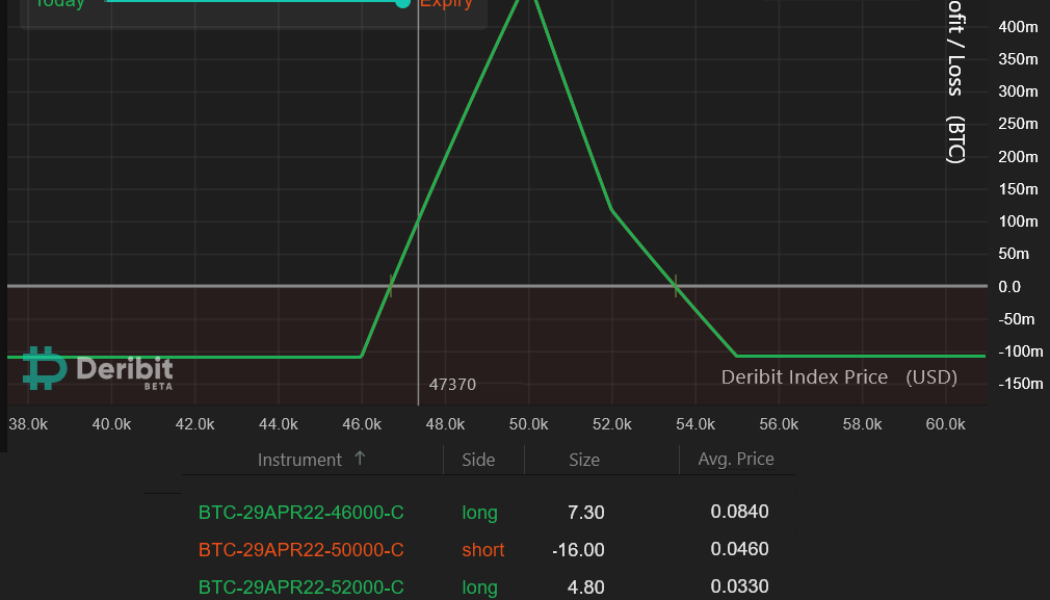

The Bitcoin options were set for the April 29 expiry, but this strategy can also be used on Ether (ETH) options or a different time frame. At the time of writing, Bitcoin was trading at $47,370 and although the costs will vary, their general efficiency should not be affected.

The suggested bullish strategy consists of buying 7.3 BTC call (buy) options with a $46,000 strike to benefit from a price increase. Meanwhile, selling 16 BTC call (buy) options at 50,000 creates a negative exposure above that level.

The trader should buy 4.8 BTC worth of $52,000 call options and 3.9 BTC at $55,000, balancing out the risk above this price.

The gains can be four times higher than the potential loss

As the estimate above shows, any outcome between $46,700 (down 1.5%) and $53,500 (up 12.9%) yields a net gain. The best possible outcome happens at $50,000 and results in a 0.47 BTC net gain. Meanwhile, this strategy’s maximum loss is 0.11 BTC if the price on April 29 trades below $46,000 or above $55,000.

The allure of this butterfly strategy is the trader can secure gains that are 6 times larger than the maximum loss. Overall it yields a much better risk-reward versus leveraged futures trading, considering the limited downside.

This options strategy trade provides upside even if Bitcoin’s price remains flat and the only upfront fee required is 0.11 BTC, which also reflects the maximum loss.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

Tagged: Bitcoin Price, crypto blog, Crypto news, cryptocurrencies, cryptocurrency exchange, How to Crypto, Market Analysis, Markets, Trading101