My name is George. I earn a net salary of Sh24,500 per month. My expenses are as follows: rent Sh7,000, water Sh300, Kenya Power tokens Sh200, garbage Sh200, shopping Sh3,000, food and groceries Sh2,000, savings Sh4,000, money market fund Sh2,000.

Whatever I try, I just can’t seem to make my money work. My expenses are too many and I cannot survive on this salary and lifestyle. Some months things get so bad that I am unable to pay tithe or even buy things for myself. What can I do to change my situation?

Josephine Murage, an investment banker and personal finance consultant

From your breakdown, your total expenditure is Sh18,700 against a net pay of Sh24,500. This leaves you with some Sh5,800 that is unaccounted for. Do not assume that scarcity is justification for poor budgeting.

The amount you are unable to account for of Sh5,800 is quite significant as it totals to Sh69,600 per year. If this money were to be saved at a Sacco with at least 10 percent return, the amount of growth would be at least Sh6,900, pushing your savings to Sh76,500.

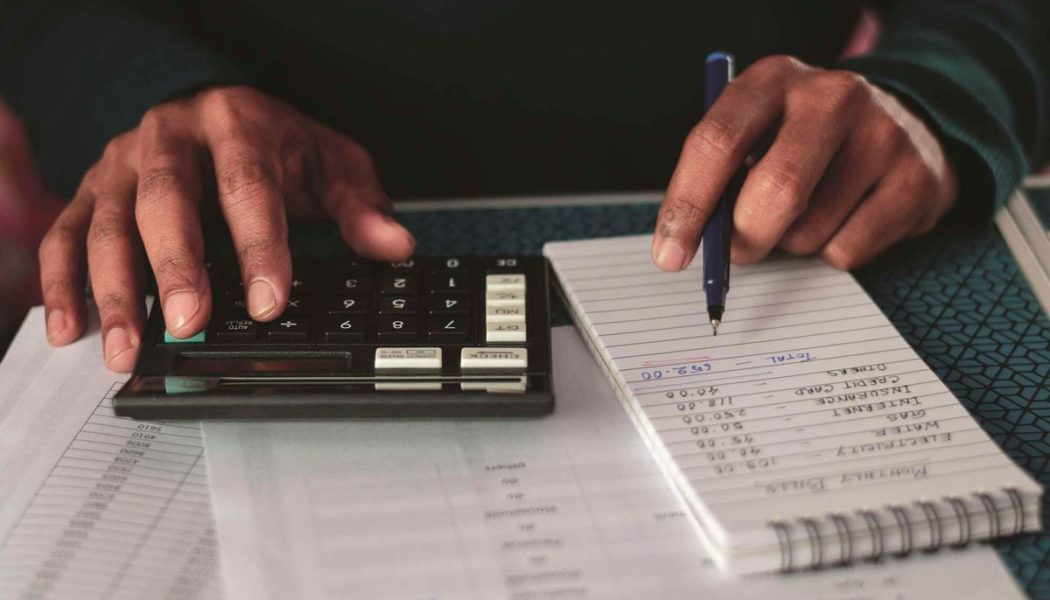

Start tracking and monitoring your expenses. Get a small notebook or use a downloadable online expenses tracker to record your daily expenses that can ultimately help you do weekly and monthly analysis of your expenditures in line with various items.

This will help you to evaluate the workability of your budget, know where every shilling goes, cut down on costs, and save even more.

A beginner who is struggling with budgeting, like you, can try the envelope budgeting method. This is a simple method that is best suited for those who have just started earning a salary and don’t know how to budget their income, and those who have been struggling to follow a budget.

The envelope method works by ensuring that once cash in a particular envelope is exhausted, you are not allowed to spend on that category until the next budgeting cycle – which falls within the next pay cycle.

For example, you can label your envelopes as rent, food and groceries, water and tokens and shopping. Put money in each envelope. For example, you can put Sh7,000 in the rent envelope, Sh3,000 in the food and groceries envelope and so on. You will stop spending on an item once the allocation in that envelope runs out.

While it is possible to use physical envelopes, the risk of poor spending is high due to the easy access to liquid cash that envelopes provide. You may opt instead for digital envelopes that are available on Google Play Store.

You need to find an extra stream of income to supplement your current earnings. For instance, get a side hustle you can engage in during your spare time.

You can scan your immediate environment and find a business or service you can target for the extra income such as car washing, which could earn you an extra Sh50 per car between 5pm and 9pm on weekdays and Saturdays.

If you want to go down the business route, consider low-capital businesses for a start as your financial status and savings are too vulnerable for bigger risks.

Other ideas to consider include selling services for a commission, such as insurance, holiday packages and entertainment tickets.

Nonetheless, the growth of your net income will largely depend on your skill set in the coming years. Make an effort to explore how you can improve your marketability and competitiveness in the job market by upgrading your skills and education.

This can be through taking master classes and upgrading your current papers, for example from a diploma to a degree. Given that this is a capital-intensive undertaking, you may have to utilise some of the Sh5,800 disposable amount.

For example, you can set a medium-term school reentry target of September 2025 and start with savings of Sh3,800 out of the Sh5,800.

This money should be saved in an interest-earning account such as a Sacco account or a money market fund (MMF) account. These savings plus interest at a rate of 10 percent will give you Sh50,000, which can be a good startup fund for your pursuits.

You can then use the balance of Sh2,000 for investment in relevant, certified masterclasses (always ensure you get certified for each course you take). As is now clear, your priority will be to enhance your competitive edge for better remuneration at work.

Paying tithe is not wrong if you believe in the concept. However, it should not be at your expense to the point where you barely survive. Put your finances in order before you consider this as a recurrent expenditure.

You have indicated that you save Sh2,000. If you are not doing it already, put this money in a Sacco account where you will not only build up your kitty but ready yourself for future financing. Make sure you are in a reputable and well-governed Sacco. The MMF should act as your emergency kitty because of its ease of access. Keep it going.

If you have any money problems, send us an email at [email protected] and leave your number for contact. Money questions will be answered on this column.