The longstanding argument regarding Bitcoin and Gold and which one is the best hedge against inflation continues.

Legendary hedge fund manager and billionaire investor Paul Tudor Jones has lent his voice to the argument regarding cryptocurrencies and gold. Jones stated that he prefers cryptocurrencies over gold as an inflation hedge.

He revealed his preference during an interview with CNBC Squawk Box, adding that he believes cryptocurrencies are winning the race against gold right now. Jones said he would prefer cryptocurrencies over gold at the moment. “Clearly, there’s a place for crypto. Clearly, it’s winning the race against gold at the moment.”

When quizzed about the size of his portfolio in cryptocurrencies, he said it is only a single digit at the moment. Jones has been bullish about Bitcoin for a while now and has previously stated that storing his wealth in the cryptocurrency over the long term protects it against inflation. He called Bitcoin the biggest store of wealth.

Jones also voiced his concerns about the rising inflation levels in the US and other parts of the world. According to the hedge fund manager, he is worried that inflation poses a major threat to the United States financial markets and the recovering economy.

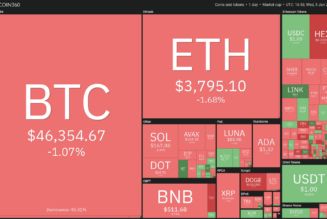

The argument about Bitcoin and Gold has been going on for the past few years. Bitcoin has outperformed Gold over the past decade. In the past 12 months alone, gold has lost 8% of its value against the US Dollar while Bitcoin is up by more than 437%.

Bitcoin has been performing excellently in recent months. The leading crypto touched a new all-time high above $67k a few hours ago despite being in a bearish trend for the most part of the second and third quarters of the year.

The leading cryptocurrency is expected to surge higher in the short and medium-term. Some market experts and participants are confident Bitcoin could hit six figures ($100,000) before the end of the year.