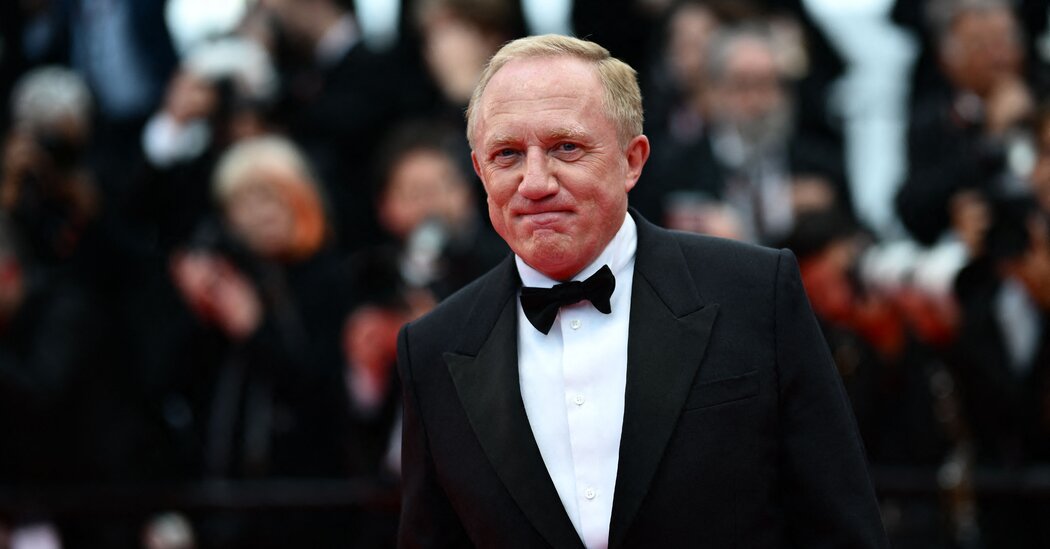

The deal for Creative Artists Agency by François-Henri Pinault’s family office reflects the growing convergence of celebrities and fashion.

In a deal that shows the ever-growing convergence of fashion and fame, François-Henri Pinault, the French billionaire and chief executive of the luxury goods company Kering, said on Thursday that his family office had bought a majority stake in one of Hollywood’s biggest talent agencies, Creative Artists Agency.

Mr. Pinault’s family office, Artémis, already has investments that include the auction house Christie’s and a stake in Puma. Like them, CAA will be managed separately from Kering, which owns such brands as Gucci, Saint Laurent and Balenciaga.

Talent — actors, singers, filmmakers — has become a uniquely powerful tool in selling products. Celebrities, be they actors, athletes or social media stars, give a brand direct access to legions of followers and are handsomely paid for that access. Fashion brands are increasingly racing to lock in relationships with the next big name.

“There’s no separation between fashion and entertainment anymore,” said Robert Burke, the eponymous founder of a luxury consultancy, calling the deal a “natural, if unprecedented, evolution.”

CAA’s clients include some of the biggest celebrities: Tom Hanks, Steven Spielberg and Zendaya — as well as Mr. Pinault’s wife, the actress Salma Hayek Pinault, who is often next to her husband in the front row of fashion shows, and who often wears Gucci and Balenciaga gowns on the red carpet.

The deal offers Artémis “increased diversity, both in terms of geographical footprint and business activities, to our other assets,” Mr. Pinault said in a statement. “CAA’s exceptional insight, relationships and access across key sectors, combined with their widely regarded level of collaboration and innovation, gives the company a formidable role in driving global opportunities.”

CAA has been led by the powerhouse team of Bryan Lourd, Kevin Huvane and Richard Lovett, and they will remain as chairmen, according to a news release about the deal. Mr. Lourd will be named chief executive when the deal closes.

Along with the appointment of the music producer Pharrell Williams as creative director of Louis Vuitton men’s wear, the CAA acquisition reflects just how important access to celebrity has become to the fashion world — and how important fashion is to celebrities. Especially during the actors’ strike, as commercial work with brands remains one of the few avenues of income and profile-raising that the union, SAG-AFTRA, approves.

In 2010, the private equity firm TPG took a 35 percent stake in CAA, then broadened its hold on the talent agency to 53 percent four years later. Artémis is acquiring that majority stake, according to the news release, though it did not specify the price.

The agency’s rivals, meanwhile, have raced to scale up to strengthen their negotiating power with streaming powerhouses like Amazon, Netflix and Apple.

United Talent Agency, which represents celebrities like Chris Pratt, Bad Bunny and Lizzo, bought the literary agency Fletcher & Company in January after acquiring the London-based Curtis Brown agency last year. The Endeavor Group, a CAA rival, acquired full control of the wrestling business Ultimate Fighting Championship in 2021 ahead of Endeavor’s initial public offering. This year, Endeavor struck a deal to merge UFC with World Wide Wrestling as part of a new company.

As these talent agencies grow — and further intertwine themselves with fashion — new questions may emerge about the nature of these relationships. Even if the new CAA is separate from Kering, for example, would LVMH, the world’s dominant luxury group, want to pay millions to celebrities to represent its brands when it knows that a percentage of that payment will enrich a company with a relationship to its competitor?

After all, “even if it’s managed separately, this offers enormous access to talent,” Mr. Burke said.

The CAA acquisition is the latest in a series of moves from Mr. Pinault. This year, Kering bought a 30 percent stake in Valentino, the Roman fashion brand and red carpet staple, with an option to acquire the whole thing by 2028. That deal followed the Kering purchase of Creed, the high-end fragrance brand, for $3.83 billion.

And Kering itself has also ventured into film. Saint Laurent became the first luxury fashion brand with a movie subsidiary when it introduced Saint Laurent Productions in April; its debut short, directed by Pedro Almodóvar, premiered at the Cannes Film Festival in May. (Kering became an official partner of the film festival in 2015.)

As to whether other luxury moguls might follow Mr. Pinault’s lead and look to acquire their own talent agency, Mr. Burke added, “I’m never surprised by anyone in fashion following someone else’s smart idea.”