Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week.

This past week, there were some major developments in the run-up to the upcoming Ethereum Merge slated for Sept. 15. Bitfinex became the latest crypto exchange to throw its support behind the chain split token.

While DeFi bridge hacks have become a norm this year, developers behind Rainbow Bridge managed to foil an exploit attempt within seconds, leading to the hacker losing their safety deposit.

The Tornado Cash developer who was arrested last week was sent to 90-day judicial custody awaiting charges. It didn’t go down well with the crypto community, who have actively rallied behind the developer and have accused the authorities of throttling freedom.

Cardano’s testnet and Vasil hard fork ran into trouble again this week as founder Charles Hoskinson took to Twitter to claim that the issues surrounding the hard fork as “incredibly corrosive and damaging.”

The top-100 DeFi tokens had a mixed week in terms of price action, with the majority of them trading in the red on the weekly charts, barring a few tokens that have shown even double-digit growth.

Hacker tries to exploit bridge protocol, fails miserably

Cross-chain bridges have increasingly become targeted by malicious entities. However, not all hackers can run away with millions in their exploit attempts. Some end up losing money from their own wallets.

In a Twitter thread, Alex Shevchenko, the CEO of Aurora Labs, told the story of a hacker who attempted to exploit the Rainbow Bridge but ended up losing 5 Ether (ETH), worth around $8,000 at the time of writing.

Bitfinex offers new chain split tokens ahead of Ethereum Merge

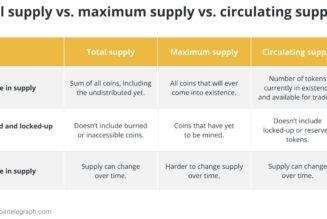

iFinex, the company responsible for Bitfinex Derivatives, announced on Tuesday the launch of a new service offering available to users before the highly-anticipated Ethereum Merge. The exchange now offers Ethereum Chain Split Tokens (CSTs).

Tokens available to users represent the two systems involved in the Merge: ETHW, which is proof-of-work (PoW) and ETHS, which is proof-of-stake (PoS). Bitfinex released the new trading tokens so users would be able to trade on the potential forking event. The coins will be available through the Bitfinex derivatives platform.

Ruling to keep Tornado Cash developer in jail for 90 days sparks backlash

A judge in the Netherlands ruled that Tornado Cash developer Alexey Pertsev has to stay in jail for 90 more days while waiting for charges. Puzzled by the decision, the crypto community rallied to demand the release of the developer.

In a Tweet, crypto investor Ryan Adams argued that the developer did something good for the public with his code contributions, stating that “a few bad guys” decided to use Pertsev’s code and now the developer has to suffer the consequences.

What’s going on with Cardano’s testnet and Vasil hard fork?

Cardano founder Charles Hoskinson has continued to refute claims that the Cardano’s testnet is “catastrophically broken,” implying the need to finally move forward with the long-delayed Vasil hard fork.

In a Twitter thread on Sunday, Hoskinson shared his frustration concerning some of the videos claiming Cardano’s testnet has a “catastrophic” issue, which stems from a Friday thread from Cardano ecosystem developer Adam Dean.

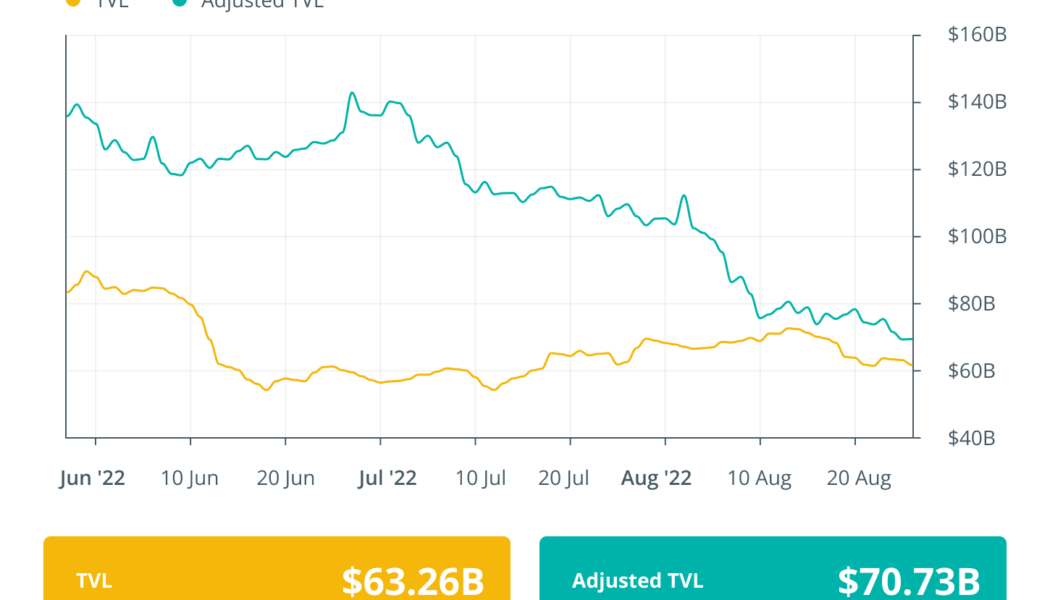

DeFi market overview

Analytical data reveals that DeFi’s total value locked registered a $3 billion decline from the past week thanks to the market dip toward the end of the week. The TVL value was about $63.26 billion at the time of writing. Data from Cointelegraph Markets Pro and TradingView shows that DeFi’s top 100 tokens by market capitalization had a mixed week, with several tokens trading in red while a few others even showed double-digit gains.

Theta Fuel (TFUEL) was the biggest gainer with a weekly rise of 19.94% followed by Curve DAO token (CRV) with an 11.76% surge. Convex Finance (CVX) rose by 9.48% on the weekly charts and Pancake Swap (CAKE) saw a weekly gain of 7.56%.

Thanks for reading our summary of this week’s most impactful DeFi developments. Join us next Friday for more stories, insights and education in this dynamically advancing space.

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

Tagged: Bitfinex, Cardano, Charles Hoskinson, crypto blog, Crypto news, cryptocurrencies, Hacks, Lending