Less than seven years after Richemont acquired the entirety of Yoox Net-a-Porter (“YNAP”) in a headline-making deal that was slated to transform its own business and the luxury landscape as a whole, the Swiss luxury goods giant is reportedly preparing to sell off the e-commerce platform for next to nothing. Faced with a company that barely resembles what it did back in 2018 when YNAP was valued at €5.3 billion ($5.9 billion) and boasted sizable revenue growth and a firm hold on profitability, Richemont executives are said to be meeting with investment banks and private equity firms to secure a deal to offload the loss-making e-commerce operator.

Fellow online fashion platform MyTheresa, along with Bain Capital and Permira, are reportedly among a pool of prospective suitors that want to take YNAP off Richemont’s hands. But hardly a done deal, those looking to take over YNAP have “reservations” due to “ongoing losses” for the luxury e-commerce platform, the Financial Times recently reported.

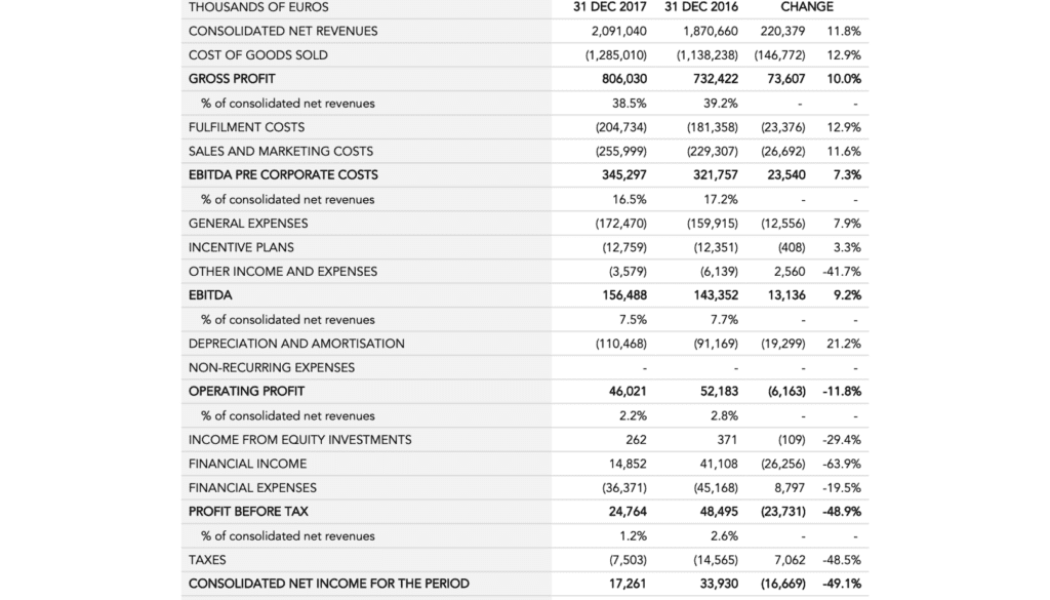

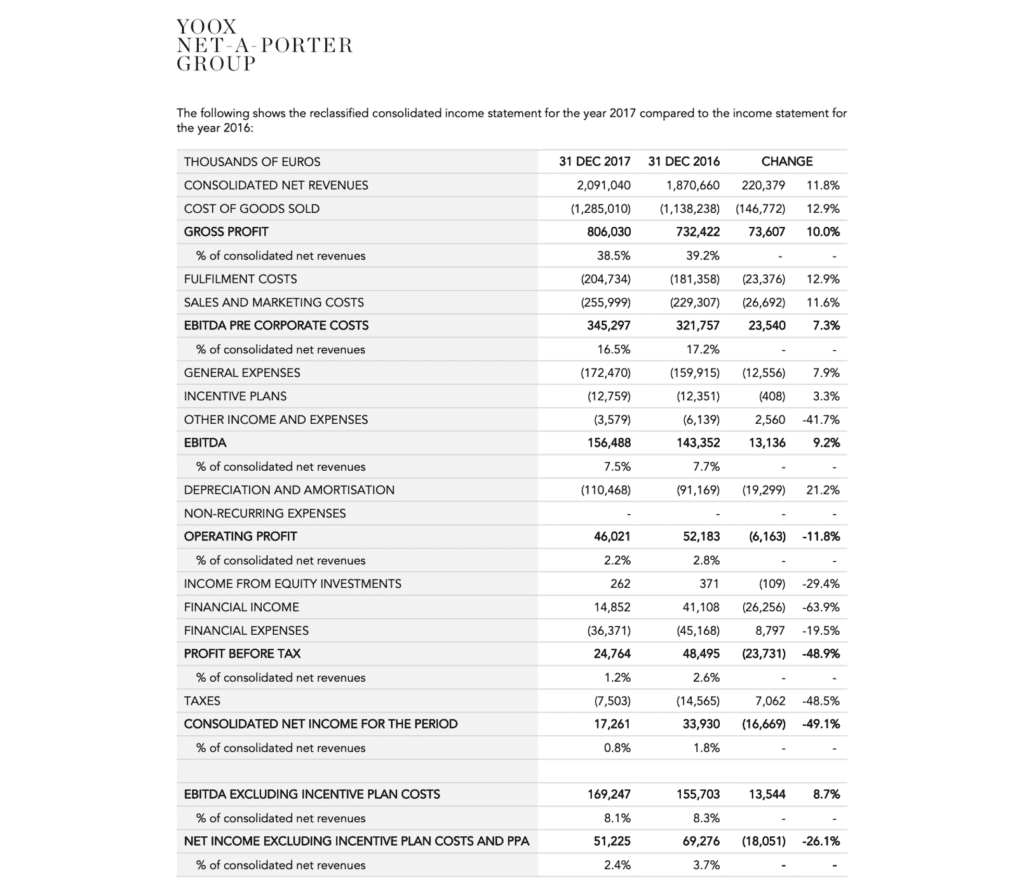

Chances are bidders are not only spooked by YNAP’s losses. Richemont’s ability to sell the luxury e-commerce company also may be complicated by its falling sales. In December, Richemont revealed that YNAP experienced an 11 percent drop in revenue for the fourth quarter, but more broadly, sources suggest that YNAP’s revenues probably have not increased since Richemont acquired it back in 2018. A review of YNAP’s 2017 annual report – its final full-year reporting as a publicly-listed company – shows that it was in healthy state leading up to its acquisition by Richemont: It was generating nearly €2.1 billion in annual revenue with an 8.1 percent EBITDA (excluding incentive plan costs) and a trajectory of high growth.

Fast forward to 2024, and YNAP’s revenues very well may still be in the realm of €2 billion and the company is said to be suffering losses of hundreds of millions of euros. Recent reports put YNAP’s losses at €128 million for the first half of Richemont’s current fiscal year.

Elements of the Eventual Downfall

At the root of YNAP’s post-acquisition decline are likely a few critical elements. Primarily, there has been a lack of synergy between Richemont – whose brands include Cartier, Van Cleef & Arpels, Vacheron Constantin, Jaeger-LeCoultre, IWC, and Panerai, among others – and YNAP from the outset, according to Bernstein senior analyst Luca Solca, who told TFL, “There was never much of a cultural fit between a relatively slow-paced luxury goods conglomerate and a fast-paced tech driven start-up.”

Richemont’s lack of technological know-how – which can be garnered, in part, from the succession planning carried out by the group’s leadership after it acquired YNAP – almost certainly had a hand in YNAP’s struggles. In addition to the short tenure of Geoffroy Lefebvre, whose less-than-two-years as CEO coincided with rising costs, making profitability “elusive” for YNAP, per media reports, and the subsequent appointment of PR and marketing-focused executive Alison Loehnis as interim CEO, the revolving door of Chief Technology Officers at Richemont can be interpreted as an indication of the dearth of a viable tech strategy.

At the same time, Richemont’s apparent efforts to prioritize the growth of – and investment in – its existing brands potentially over progress at YNAP (on the back of previous underinvestment in YNAP) also may have worn on the e-commerce company. Richemont chairman Johann Rupert seemed to hint at his plan to leverage YNAP’s digital proficiencies for the group’s own brands, saying in a YNAP acquisition-specific release in January 2018, “With this new step, we intend to strengthen Richemont’s presence and focus on the digital channel, which is becoming critically important in meeting luxury consumers’ needs.”

A read between the lines (plus a bit of hindsight) suggests that Richemont leadership was looking to use YNAP mainly as a way to sell the products of Richemont-owned brands on the web. And this may have come at the expense of investments in and advances for YNAP as a standalone company, particularly since it “became clear” in the wake of its initial investment in Net-a-Porter that Richemont “acquired little knowledge about the mechanics of digital,” according to GAM’s luxury brands investment strategy manager Flavio Cereda.

Distracted – and then Deserted – by Farfetch

Growth for YNAP may have been stunted further by a number of distractions at play. In addition to intensive “replatforming” issues for YNAP, for example, Solca says that Richemont’s efforts to reach a deal with Farfetch likely diverted attention away from YNAP. Likely faced with the reality that it could not make the YNAP venture work and under the assumption that Farfetch boasted superior e-commerce technological prowess and resources, Richemont set its sights on a merger with the London-based e-commerce platform.

The first big culmination of reports that something was brewing between Richemont and Farfetch came in November 2020 when Richemont and Alibaba announced that they would each invest $550 million in Farfetch and a new Farfetch China joint venture. All the while, rumors began circulating that Richemont had set its sights on selling off a hefty stake in YNAP to Farfetch.

After dedicating an estimated two years to negotiating with Farfetch and its founder José Neves, the parties reached a deal that would have seen Richemont sell 47.5 percent of YNAP to Farfetch in exchange for a 10 to 11 percent stake in Farfetch and a €2.7 billion write-down for YNAP. The terms of the transaction also paved the way for a second phase, which would have ultimately enabled Richemont to offload the rest of YNAP to Farfetch.

Seemingly convinced that Richemont had found the perfect partner, Rupert touted the strength of Farfetch and its tech expertise, including in a statement several months after the announcement of the deal, saying in November 2023, “Everything we expected in terms of technology from our Farfetch friends, they’ve delivered … we believe that it’s going to enhance our business model.” Yet, that perfect pairing swiftly fell apart when Farfetch announced just days later that it would not release Q3 results as planned and in light of mounting debt, needed a bailout in order to avoid bankruptcy. Shortly thereafter, Farfetch revealed that its assets would be acquired by Korean e-commerce giant Coupang, thereby, taking its deal with Richemont – which said it would not provide any further investment in Farfetch – off the table.

What Now?

The fall of YNAP leaves the future of the former e-commerce darling as a looming question. Solca suspects that it “will not be easy for Richemont to dispose of YNAP considering the company produces significant losses.” The “most likely scenario,” he contends, is a merger between YNAP and another digital retail player. Cereda says that MyTheresa may be the most logical option. Meanwhile, TFL sources expect that Richemont will have trouble selling off YNAP as a whole and may need to break up the company into various parts, including its Net-a-Porter arm, its off-price Yoox venture, etc., which could prove to be both time consuming and costly for Richemont.

And, of course, none of this will be made any easier by the fact that “selling fashion online from a multi-brand platform is a bad business, as the disastrous experience of Farfetch demonstrates,” Solca claims. Part of this is the unavoidable fact that luxury groups are becoming staunchly less willing to play ball and relinquish control over their brands, including the conditions in which – and prices at which – their goods are sold, and as a result, are actively reining in wholesale and bringing e-commerce operations in-house. This is an increasingly obvious thorn in the side of all “neutral” luxury goods platforms and may ultimately be a key reason why “even insider Rupert’s bid to build a cross-brand platform failed,” according to Neev Capital managing director Rahul Sharma.

Looking beyond the future of YNAP, there may be deeper issues to consider here. Richemont’s sizable investments in Farfetch and Rupert’s enduring praise for the company and its technology – which appears to have gone largely unopposed by Richemont’s board – suggests that the group may have failed to do enough due diligence before putting all of its e-commerce eggs in Farfetch’s basket. Richemont’s “infatuation with Farfetch in spite of mounting evidence of a dubious business model raised questions as to [the group’s] due diligence process,” per Cereda, who says that Farfetch “dominated the conversation, which was a very odd own-goal and did little to enhance [Richemont leadership’s] credibility when it comes to strategy.”

Ultimately, sources say that the strategy behind its YNAP acquisition/operations and the failed Farfetch ventures, particularly when considered together, have prompted at least some investors to question Richemont’s leadership and in particular, what succession at the group will look like. This means that the biggest issues at play here are less about the next steps for YNAP and more about what the future holds for Richemont.