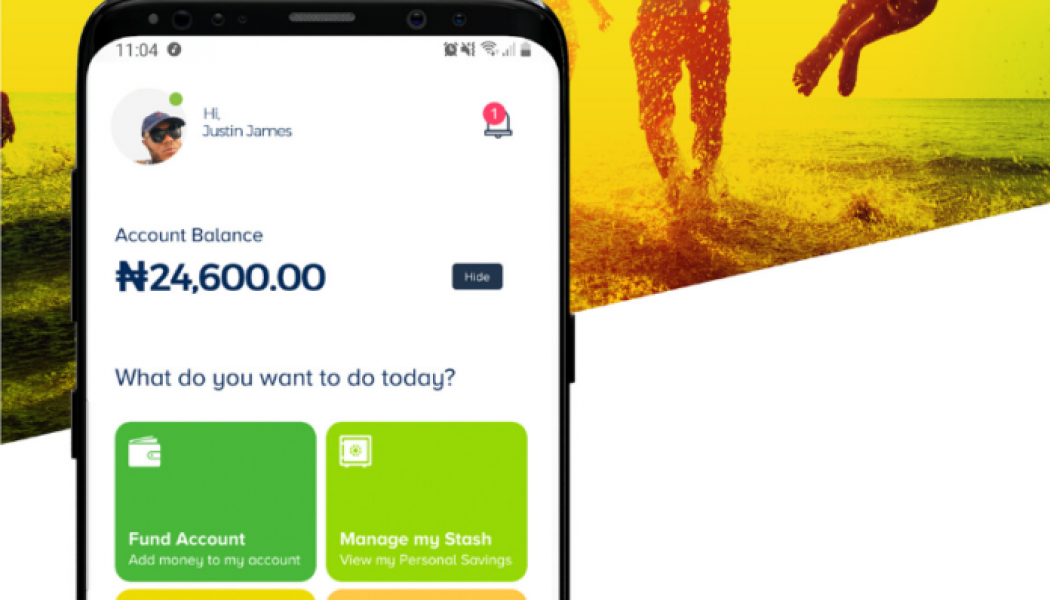

Nigerian entrepreneur and former Diamond Bank CEO, Uzoma Dozie has launched a digital ecosystem – called Sparkle – that provides financial, lifestyle and business support services to Nigerians across the globe.

Sparkle, which has been granted a banking license from the Central Bank of Nigeria (CBN), has been built to help Nigerians fulfil their potential. It offers comprehensive support for individuals including flexible payments, savings and analytics to provide greater freedom, flexibility and control over finances and lifestyle once and for all.

Powered by data and technology, Sparkle is available for iOS and Android – giving customers full and free access to one account that offers multiple services and different wallets.

According to the company, Sparkle users will be provided with visibility over spending patterns, with a detailed breakdown of payments by category. Tools such as Sparkle Stash, a savings tool aimed towards specific goals, are included.

/* custom css */

.tdi_3_4ee.td-a-rec-img{ text-align: left; }.tdi_3_4ee.td-a-rec-img img{ margin: 0 auto 0 0; }

Users will also have the ability to split payments and bills, make utilities and bill payments, as well as send and receive money in the Sparkle network and with other local banks. Customers will also have access to Indy – a 24/7 financial buddy and customer services chatbot.

“Sparkle will be transformational for Nigerians across the globe and I am hugely excited to be launching it. Sparkle is redefining Nigerian commerce by merging financial services with a seamless lifestyle solution. We are removing barriers using technology and data, driving inclusion at scale. In doing so, we are empowering Nigerians to fulfil their potential, democratizing access to valuable solutions for both business and personal needs,” Dozie.

“We are working with global partners to unleash freedom, flexibility and transparency in Nigeria. We are helping to drive forward the growth of Nigeria’s budding entrepreneurs and individuals.”

Sparkle is partnering with VISA, Microsoft and PwC Nigeria.

/* custom css */

.tdi_4_fc5.td-a-rec-img{ text-align: left; }.tdi_4_fc5.td-a-rec-img img{ margin: 0 auto 0 0; }