Henrik Fisker has abandoned his electric vehicle startup’s effort to create a solid-state battery, the Fisker Inc. founder told The Verge in a recent interview.

“It’s the kind of technology where, when you feel like you’re 90 percent there, you’re almost there, until you realize the last 10 percent is much more difficult than the first 90,” he said. “So we have completely dropped solid-state batteries at this point in time because we just don’t see it materializing.”

Fisker spoke with The Verge in late January, though a lot has happened since then — most notably, the startup announced a partnership with iPhone-maker Foxconn. The two companies plan to make an electric vehicle that Fisker says will cost much less than the $37,500 base price tag of its first EV, the Ocean SUV. Fisker told The Wall Street Journal that the vehicle may even be built at Foxconn’s troublesome Wisconsin facility.

Fisker’s decision to axe the solid-state program comes after his startup spent its first few years working to develop the technology. In 2018, he said the company had solved some of the problems related to making solid-state batteries, and that it was just a few months away from a final design. By early 2019, though, the startup postponed a planned sports car that was based on the solid-state technology and pivoted to the Ocean, which uses a more common lithium-ion battery.

Around that time, Fisker Inc. settled a trade secret lawsuit with Volkswagen-backed battery startup QuantumScape in 2020, as The Verge first reported this week. QuantumScape discovered one of its employees brought thousands of documents with her to a new job at Fisker Inc. in late 2018 and early 2019, though the EV startup argued that it never used the information and swiftly fired the researcher. Fisker Inc. ultimately paid $750,000 to settle the case. The man who ran the project is also no longer with the company and is suing Fisker Inc. over his departure.

Solid-state batteries haven’t been much of a focus during Fisker’s many media appearances in the time since he unveiled the Ocean. But he’s never been more clear. “I think personally, they’re at least seven years out, if not more, in terms of any sort of high-volume format,” he said.

Fisker Inc.’s trouble with solid-state batteries hasn’t stopped its momentum. It was one of the first EV startups to ride the wave of special purpose acquisition company (or SPAC) mergers into becoming publicly traded — and it raised around $1 billion in cash in the process. It struck a deal with leading automotive supplier Magna to build the Ocean. And while a deal to use Volkswagen’s electric vehicle platform has fallen through, Fisker Inc. shared this week that it’s still in talks with the German automaker on a parts supply agreement.

Deals like those are crucial for Fisker Inc.’s survival, which is trying to make it as a truly asset-light automaker. The startup plans to outsource nearly everything with its cars and will instead focus on design and customer relations.

In the interview, Fisker spoke about his reasoning behind that business model, as well as why merging with a SPAC was an easy decision, before explaining why he walked away from solid-state batteries.

This interview has been lightly condensed and edited for clarity.

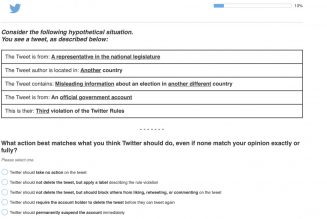

What was it that drew you to wanting to go through one of these mergers, and what did you like about it as a tool to bring Fisker to the public markets

Basically, I’m pretty much one of the few people [taking an EV startup public via SPAC], maybe the only one, who’s started a car company before. And that was, of course, in the early days. But one of the big hindrances in the path toward your first production vehicle and getting revenue is financing. And you know if you remember both Fisker [Automotive, Fisker’s first startup] and Tesla back in the day had many private financing rounds, and there was always delays. So we decided really to wait for the right moment where we could get enough money in one go to finance our entire program all the way to production.

So when the SPAC opportunity emerged and we saw we could raise over a billion dollars in cash, which was enough to get our vehicle on the road, this was just the perfect opportunity because now I don’t have to worry about going out and raising money every three months, and how the markets will look, if there’s going to be delays.

So we are on time, on budget on our vehicle, and that’s because we have already raised all the money.

Was there ever sort of commiseration or conversations among the people in the industry that you’re in, particularly executives at EV startups trying to make a name for themselves, about the difficulty, or the process in general, of trying to raise money? And how that changed so quickly with this SPAC stuff? I would imagine that it must have felt like a very strange moment but a very great opportunity at the same time.

Yeah, talking to just a few people in the industry, I think everybody’s aware that what’s unique about the automotive industry is that you need several hundred million dollars every time you move a certain milestone. It’s just very, very difficult to convince private investors to go through all of these milestones, all hundreds of millions. And I think in the meantime, what SPACs have really done is replaced Silicon Valley as a funding tool for capital-intensive industries like automotive, EVs.

So I think when this opportunity happened, it was just a clear decision right from the go. We didn’t have any doubt. We were obviously one of the early ones that came out, but now there’s been a ton of other SPACs and EV companies [merging]. Obviously, it doesn’t change the fact that you still have to develop and deliver a vehicle, and you still have to be as tight with the money as you can because in the automotive industry, you can burn through hundreds of millions very fast. Those fundamentals are changing, but if you start out with a billion dollars, it’s a lot better than starting out with maybe $50 or $100 million in private funding because that doesn’t get you very far.

I’d imagine one way you try to prevent burning through that money really fast is by architecting this asset-light business model that you have. And one thing I’m really curious about, because I know I’ve spoken to you a little bit about it before, is: what was the reception as you started trying to find the right SPAC to merge with, and then also working with additional follow-on investors? What were their reactions to that business model?

Well, I think that was really what attracted a lot of the investors. Specifically, I think we have maybe slightly more sophisticated investors than some other SPACs. You know if you TK613 outside the car industry, it’s very easy to say “Why don’t you just do that?” I have people on Twitter saying, “Why don’t you just make the car next month? You have a prototype.” Most people don’t understand that it takes 18 months to do long-lead body tooling for high-volume vehicles. Most people don’t understand it takes two years to do durability tests and do all the engineering certification and everything else.

What our business plan is really based on is the philosophy that the automotive industry has not fundamentally changed its way of doing business for the last 100 years. And we took this opportunity to say, “Okay, it’s not just about making an electric car.” You want to look at two other fundamentals. One is, what if we were to create an automotive company today from scratch and think about what’s the right business model rather than just following the old one. That was one. And the second part was how would we truly interact with the customer, and what is the customer’s expectation, and what does the future customer look like? How would we create the real commercial side of it as the vehicle gets delivered to the customer even before? So that became that whole digital model, which started before COVID and has now accelerated during COVID.

And on the business model itself, I believe that there is nobody in the near future or the next couple of years that’s going to make a million EVs on one model. Today, there’s nobody doing it. Tesla probably has the highest volume of one single model, a couple hundred thousand. But even the big giant established carmakers are not making, right now, a couple hundred thousand vehicles of one model. So the way you get volume, in my view, is if you partner up with other OEMs and share some of the expensive parts of the platform, which in my view is not anymore something that is unique IP or something that is a unique experience to the customer. An aluminum stamped floor or a steel stamped floor really doesn’t have any brand value anymore.

So therefore, we’ve decided to follow this way of looking for partners for platform sharing, and we’re not only looking for one partner; we’re talking to many different groups because we’re looking at making different vehicles. So we are not necessarily just going to have one partner. And of course, we announced our first partner, which is the world’s third-largest supplier, which is Magna. We’re co-developing a platform with them that is being used also by another OEM, so we immediately have the volume.

And we also decided to have Magna manufacture our vehicle because we didn’t feel like taking a risk and going through what other people are calling “manufacturing hell,” as you know. And I think it’s very, maybe a little bit ignorant if you think you can build a factory in the desert, hire people, develop the car, and build a brand-new vehicle, and think you’re going to build it as good as Volkswagen or Toyota.

So we did that deal with Magna, which has already built Toyotas and BMWs, so we know we’re going to get a high-quality car right out of the gate, so we took that risk out. And I think our investors really appreciate that because they’ve seen other EV companies fail when they got to that point, or they’re seeing them spend much more money than they thought, so I think that fundamental de-risking really attracted our investors.

And obviously, as we move forward, we always start to do some of the things ourselves. But it was really about de-risking in our first vehicle to market. So we’re going to do another three vehicles, which we can do because we don’t have to spend all our money and effort on learning how to manufacture a car, for instance.

What are the trade-offs of this business model? Is there something you just have to give up in the name of going after this partnership / asset-light business model that you could have if you tried to do more of it yourself?

I don’t think at this point as a startup there is any trade-off. Now obviously, we will look different in five or seven years from now when we have revenue and we have several vehicles on the road. At that point, we can decide to do more of the stuff for ourself.

But it’s just like asking a 10-year-old kid “What is the trade-off of living at home versus getting your own apartment?” Well, if you don’t have any money for your own apartment, and you’re not a certain age, you probably can’t even get the apartment, and you’re not going to be able to pay for it. So we’re kind of taking the approach that, as a startup, we are in growth mode and we have no revenue, so therefore we are taking what we believe is the absolute correct approach to get our first vehicle to market.

Let’s see what happens after that. We have a whole bunch of plans that we are maybe not ready to discuss right now. But for sure we’re going to evolve as a business. And certain things are going to change and adapt to the conditions of the market, the conditions of where we are as a company.

You spoke about the deal with Magna, and it sounds like you are having, or are at least happy with conversations with other potential partners on the platform side of things. What happened with the talks with Volkswagen in the middle of last year?

Well, you know we’re constantly in talks with many different partners, and we don’t really want to comment on any of these talks until they materialize. And there’s a common understanding between the partners. So at this point, I don’t want to comment on any potential talks that we have with any partners.

One thing I think is interesting about SPAC mergers is that, while they’re a great tool for going public faster, one quirk about them is they’re not regulated in quite the same way as if you were just going public in the traditional way, and one of the consequences of that is that startups have a little bit more freedom in their projections. They can tell what they think is probably a better story to investors than if they were going [public] the more traditional route. I’m curious, do you feel you were overly optimistic in the pitch you were making to investors? Or do you feel like what you presented is a really reasonable case for your business moving forward?

My view is that when you present a projection that is two or three years out, you have a group of people who are trying to make the absolutely best projection, and it is at the end of the day a projection. I don’t think there’s any difference, at least for Fisker — I have no idea what other SPACs and other companies are doing, and I know there’s been some exciting stories out there about some other SPACs — but I’d say from Fisker’s point of view, and what we’re doing in our company, there would be no difference whether we would do a normal IPO or a SPAC or a private financing. We are making the same projections, and those are projections, at this point, we stand by.

Of course, you never know what’s going to happen in the future. Nobody could have predicted COVID. There were a lot of established car companies that were going to launch a whole bunch of cars last year and were all postponed, and had projected they were going to launch these cars and sell a certain amount of cars. So I don’t think it matters what type of company you are. Everybody can run into certain unforeseen things that you simply cannot plan for. But our projections were not different whether we would have done a normal IPO, private financing, or what we’re doing here as a SPAC. And by the way, now we are public, and we are now set to the same standards of any other public company, no matter how they became public.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/10001155/jbareham_180108_2235_0026.jpg)

One of the things I know you were working on in the early days of the company, and especially when you were working on the sports car, was trying to get solid-state batteries into the vehicle. And I know that when you turned your attention to the Ocean that was something that changed as far as a company priority. When you talk about these subsequent vehicles you have planned now and potential different platform partners, is solid-state technology what you are considering? And if so, is it coming from the same technological path that you were already on, or is it something you would have to start anew in those vehicles?

So we spent a lot of time, several years, doing research in solid-state batteries. And it’s kind of a technology where when you feel like you’re 90 percent there, you’re almost there, until you realize the last 10 percent is much more difficult than the first 90. But you don’t really know that until you get up to the 90 percent. So as we got toward the end of this — or let’s put it, as we got close to understanding fully this technology, we realized that it was much more difficult than we had predicted and expected in the beginning as we were very excited about some of the early things we were doing.

But we eventually came to the conclusion, I think it was probably end of 2019, beginning of ‘20, I forget exactly, that solid-state batteries are still very, very far out, they’re not around the corner. I think personally, they’re at least seven years out, if not more, in terms of any sort of high-volume format. Because you need to … once you have a breakthrough in that technology, you need probably three years to set up high-volume manufacturing, and then you need another three years to do durability testing. So even if somebody invented it today, it would be at least probably six years out.

So we have completely dropped solid-state batteries at this point in time because we just don’t see it materializing. Would we do something in the future? If we do, it would be something completely new, and we obviously have a battery team that’s looking at the current technology that’s here. But the solid-state battery that we worked on, that just doesn’t have a future at this point in time in the near future. And I don’t see us continuing with that particular development at all.

I know there was a lawsuit that was settled with QuantumScape, and I know settlements usually preclude talking about any of that, but is there anything you can say as to whether whatever dispute you may have had with that company was something that played into this walkaway from solid-state batteries? Or was it really just a technological decision?

So as you just mentioned, a settlement precludes you from speaking about it. Sorry.

Let’s talk about something that you probably would like to talk about. One of the things I thought was pretty funny in the S-1 you filed with the SEC is that it says outright that you want to really be an engaging presence on Twitter, and you want to make potential customers feel that they’re hearing from you and your voice — as opposed to how like, Mary Barra uses it at GM. And I’m wondering how you see yourself as a person who is running this company who is also engaging with potential customers in this particular way? Because Elon Musk aside, it’s not something we really see all that often.

Yeah, I love this personal interaction. I think it’s something unique. And it gives me the opportunity to answer people directly from my heart because I run the company, and they get the real answer. I think there’s sort of a great dual conversation. I can obviously not answer everybody’s question, but for instance, we went a step further, and we have this sort of program for referrals. And what we did was we said the two people with the most leads, I’ll do a half-hour zoom with them.

And the interesting thing was the number two guy was a guy from Kentucky, just a really nice person that I would never ever have met. And there was no preselection or anything. He just happened to have the most referrals, which surprised me as well because I would have thought it would’ve been somebody from California because that’s where we have most of the reservations from. But the long story short was he had all of these questions and interesting things to talk about that I would never have heard from anybody unless you just truly sit down and talk with a real customer. And I think that’s an advantage we have that I would never give up. Because normal car companies, they have to go through the dealers and do all kinds of other things where they never really get to talk to the customers.

There’s some good with it. Of course, you also get the bad. You get hammered on Twitter, people don’t like you. But hey, that’s life, and I think there’s more of an upside than a downside. And I really like to be able to interact with the people and get their straightforward questions, and I give them straightforward answers.

One of the things I remember talking to you at length about at CES last year is how you’re approaching this goal of wanting to make the car really sustainable. I’m curious what the progress has been on that. Has anything changed in how you’re approaching those goals of using particular materials for different parts of the car that you view as sustainable?

So we have programmed a lot. We have hired a head of ESG, environmental and social governance, and he is really spearheading developing specific… we kind of put out some goals that we would like to reach with suppliers, and we at least try to bring them in that direction. They are not reaching those goals right now, but they may reach them later. And then we have goals for ourselves. So for instance, we look at transport. Are we choosing a supplier that’s closer to the plant, or are we choosing a supplier that’s on the other side of the planet that way we have to then transport all that stuff. So those are the types of things that we’re really thinking about now as we’re nominating suppliers. And finally, materials as well, looking at sustainable materials. We’ve actually picked up a lot of knowledge on that side as well, where we are adding more sustainable materials to our vehicle. So we are actually looking across everything — supply chain, where the suppliers are located, what the suppliers are doing for sustainability, and also then of course in the vehicle itself — in terms of the type of materials there.

The last thing I want to ask you about is, going back to the business goals and your optimism for where the company is going, one of the things I noticed in the language presenting the business in your financial filings is that Fisker believes the Ocean is going to be a “primary alternative” to the Tesla Model 3 and Model Y. What is it that makes you confident you can find the kind of audience to exploit that midrange market that doesn’t have a lot of competition right now?

I think you answered part of it yourself by saying there really isn’t any alternative. I mean Tesla made a great car, and what makes us confident that we can be an alternative for when somebody gets out of a gasoline car and into an electric car is, first of all, we have a completely different design. We haven’t designed a “me too” crossover hatchback like the other EV companies have done.

That’s number one. And we already have a lot of our customers in our surveys saying they picked our vehicle first because of the design, because we haven’t released a lot of technical information. But we also believe we will have some technical advancements, which we obviously don’t want to announce for competitive reasons yet, that will set us apart not only from Tesla but from our other competitors. And then finally, we have some other features in software and hardware like our California Mode, which no other competitor has, where all the windows roll down at the push of one button, which is both kind of fun and a utility feature. And then finally, when you look at our base price, we think we’re really competitive in that base price, so we think we can attract a lot of first-time EV buyers because of that base price as well. And on the high end, I think the sustainability aspect, I believe after COVID, is going to be even more powerful as a brand pillar for us. Because people care about the environment, they care about buying sustainable products, they just haven’t had the choice or they’ve had to buy a product they didn’t like. If you now have the choice to buy a cool vehicle that you actually like and is also super sustainable, I think that’s an added point in our direction.