The National Assembly’s Finance Committee has bowed to pressure from different stakeholders and dropped a number of contentious clauses in the Finance Bill, 2024, even as Kenyans took to the streets in Nairobi on Tuesday morning to protest against the proposed laws.

The committee is today afternoon expected to table its report, with recommendations, in the House.

This comes as ruling Kenya Kwanza and opposition Azimio MPs were summoned by their respective leaderships to meetings Tuesday to firm up positions on the Bill.

Kenya Kwanza’s Parliamentary Group, which was chaired by President William Ruto at State House on Tuesday, comes as his emboldened deputy, Rigathi Gachagua, has been accused of inciting MPs associated with him to shoot down the Bill over its punitive proposals.

Azimio has also urged its members to shoot it down, but with the committee recommending the deletion of the punitive taxes, it remains to be seen how the MPs will approach the debate on the Bill.

It was running battles Tuesday as police arrested dozens of protesters on the streets of Nairobi opposing the Finance Bill 2024. Earlier, police had declared the demonstrations illegal.

The protests dubbed ‘Occupy Parliament’, are aimed at pressuring lawmakers not to pass the Bill.

Kenyan activist Ojiro Odhiambo protests against the Finance Bill, 2024 at Kimathi Street, Nairobi on June 18, 2024.

Photo credit: Steve Otieno | Nation Media Group

Tax changes

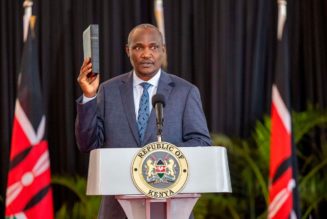

In an address to the nation, the Kimani Kuria-led committee announced the proposed changes, noting that they were informed by the inflationary pressures confronting a lot of Kenyans.

Excise duty on M-Pesa transactions

Excise duty on mobile money transfers is to be retained at 15 percent, not 20 percent as proposed by the National Treasury.

VAT on banking services

The 16 percent VAT on financial services and foreign exchange transactions has been removed.

The eco levy tax will only be subjected to imported finished products. Locally manufactured products such as sanitary towels, diapers, phones, computers, wheelchair tyres and motorcycles, will not be subject to eco levy. The move is aimed at protecting local manufacturing and safeguarding jobs.

Removal of excise duty on imported eggs

The committee proposed to impose excise duty on onions, eggs, potatoes and onions in a move aimed at protecting local producers. However, it was not clear whether this applies to onions, potatoes and eggs from the East African Community countries.

VAT on Bread

The 16 percent value-added tax has been scrapped. However, it is not clear whether it will remain under the zero-rated schedule or be moved to the exempt schedule. Moving it to the exempt schedule means that manufacturers will not be able to claim input tax thus passing it to the final consumers.

2.5 percent motor vehicle tax

The committee has deleted the 2.5 percent tax on motor vehicles, arguing it will cripple the insurance sector. The committee also noted the tax should not be applied under the Income Tax.

E-Tims for farmers

Farmers with a turnover of less than Sh1 million are exempt from the requirement of generating a tax invoice through the Electronic Tax Invoice Management System (e-Tims).

Proposal to allow KRA to spy on Kenyans

The committee has dropped the proposal to amend data protection laws to exempt the processing of data relating to the assessment, enforcement or collection of any tax/duty.