The Federal Reserve said Wednesday it will begin to slow its massive bond purchases later this month, the first step in removing its extraordinary pandemic-era support for the economy.

The long-awaited move signals both optimism about the pace of job growth and wariness about price surges that have pushed inflation up to its highest level in decades. The central bank has been buying $120 billion a month in U.S. government debt and mortgage-backed securities, a process designed to supercharge its efforts to keep borrowing costs low for households and businesses.

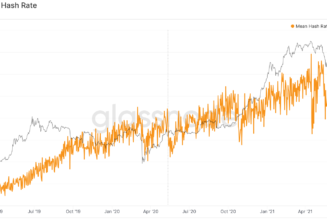

But some investors and lawmakers have warned that the central bank’s vast purchases are feeding financial bubbles in the housing, stock and even cryptocurrency markets, and stoking higher consumer prices.