The European Union wants to double its chip manufacturing output to 20 percent of the global market by 2030. The goal is part of its new Digital Compass plan, announced yesterday, which aims to boost “digital sovereignty” by funding various high-tech initiatives.

As well as doubling chip output, the EU also wants all households to have 5G access and gigabit internet connectivity by 2030; for “all key public services” to be available online in every member state; and for the bloc to have its first quantum computer. Funding for these and other projects will come from the EU’s €672.5 billion ($800 billion) coronavirus response fund, with 20 percent of this money ($160 billion) earmarked for tech investment.

The EU’s ambition to produce more semiconductor chips is particularly notable. Maintaining a steady supply of these chips has become a pressing concern for nations around the world as supply chain disruptions caused by the pandemic and the US-China trade war have affected global supplies. As with the flow of key resources like oil, access to cutting-edge chips is essential for many industries and products, from iPhones to cars. Currently, the bulk of production is concentrated in Asia, particularly in Taiwan and Korea.

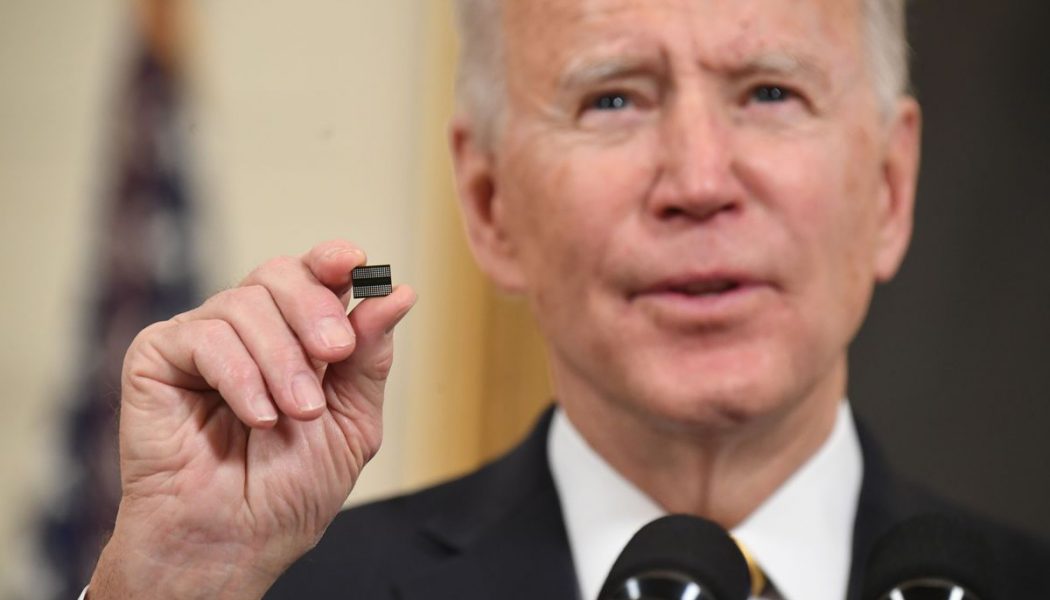

In February, President Joe Biden signed an executive order to investigate how the US can further support its own chip manufacturing industry. “This is about making sure the United States can meet every challenge we face in this new era of pandemics, but also in defense cybersecurity, climate change, and so much more,” said Biden at a press conference.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22358937/1231364830.jpg)

The EU’s worries mirror those of America’s. “We need to become less dependent on others when it comes to key technologies,” vice president of the European Commission, Margrethe Vestager, said at the launch of the Digital Compass plans, reports The Wall Street Journal.

This dependency extends beyond chip supply, too. The last few years have seen the EU grapple with its relationship with Chinese tech giant Huawei, which supplies essential 5G components but has been hamstrung by US sanctions introduced over national security concerns. In related news, Apple announced this week that it will invest more than €1 billion ($1.2 billion) in a silicon design center in Germany. Its employees will focus on “5G and future wireless technologies.”

Building up the EU’s chip production, though, will be a difficult task. Manufacturing semiconductors is an extremely expensive business, and the main success of European companies has been creating machinery used in this process rather than the chips themselves. Dutch firm ASML, for example, has a majority market share in the production of equipment known as “photolithographic machines” that are essential for chipmaking.

“As China has shown, throwing money at chips does not guarantee success,” Dan Wang, a technology analyst at Gavekal Dragonomics, told the WSJ. “For the last few decades, Europe has seen its number of semiconductor companies shrink, and it will require a mighty effort to wrest leadership from the US and Asia, which are also investing heavily.”