As the world grapples with the COVID-19 health crisis, the desire for mobile money and contactless payments is on the rise to avoid infections and disease transmission.

With mobile money, customers can make payments anywhere at any time with their mobile devices connected to the Internet which decreases exposure to physical money, Point of Sales (PoS) terminals and Automated Teller Machines (ATM)– especially with high volumes of micropayments.

The freedom to send, spend and receive money with a mobile phone is quickly becoming an essential part of life for billions of people. It is said that more money remains digital – promoting further digital transactions circulating in the system – rather than being cashed-out – which is great progress towards a cashless society.

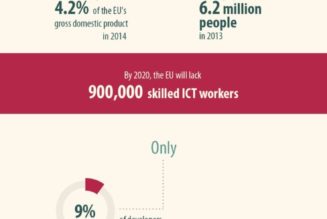

In 2019, GSMA recorded over a billion registered accounts and close to $2 billion in daily transactions. Mobile money has been a contributor to shaping the lives of low-income users by allowing easier, secure and cheaper exchange of micropayments. It is also enabling entrepreneurs and small businesses to become more productive and helping governments develop and better manage economies.

/* custom css */

.tdi_3_ec5.td-a-rec-img{ text-align: left; }.tdi_3_ec5.td-a-rec-img img{ margin: 0 auto 0 0; }

A large portion of the population in Africa needs to be brought into the folds of financial inclusion in order to generate sustainable economic growth. However, the unbanked are the ones who are least involved in the formal financial system, due to factors such as distance to banks, education, and the inability to authenticate their identity, according to data from Ericsson Consumer Lab.

Additional challenges are related to lengthy queues, processing time, high service charges while receiving payments are also common.

Moreover, the amount of time taken to process money transfers, the distance from the place of transacting for international transfers can be frustrating – as can long processing and waiting times during bill payment provide opportunities.

Integration and interoperability between banks, telecom/mobile money operators and money transfer providers is critical for mobile money growth. Getting all relevant parties to connect and create a new type of ecosystem that is open for everyone to join to make mobile money transactions as easy as sending a digital message can be a challenge.

That’s why Ericsson is creating a more secure, flexible, transparent and open financial ecosystem that helps key stakeholders speed the launch of mobile financial services to drive financial inclusion.

There are so many possibilities in the FinTech market to tap into – with innovative services and solutions. With four times as many mobile subscribers in the world than people with bank accounts, Ericsson Wallet Platform provides advanced mobile financial services to people and businesses across the globe.

By Hossam Kandeel, Country Manager of Ericsson Angola