Leading CFD broker Eightcap has launched more than 250 cryptocurrency derivatives, specifically targeting retail investors.

Eightcap, an award-winning CFD broker, has announced the launch of more than 250 cryptocurrency derivative products. This latest development makes the broker the largest cryptocurrency offering available for retail clients.

According to the broker, the crypto derivative will allow its clients to diversify their crypto portfolios via the MT4 and MT5 platforms. Thus, making it easier for thousands of cryptocurrency traders and investors to gain exposure to the crypto space.

Joel Murphy, the CEO, Eightcap, said, “Our vision at Eightcap is to provide a new home for Crypto derivative traders by providing an unparalleled offering that includes the largest crypto derivative library paired with ultra-low spreads and fast withdrawal options. The regulatory issues crypto exchanges such as Binance are facing means traders are left with unnecessary worries about their funds and if they can withdraw them. With us, Crypto derivative traders can have a seamless experience from the moment they open an account to when they want to withdraw their funds.”

Eightcap solves some of the issues traders and investors face when using cryptocurrency exchanges. With crypto exchanges, users have to deal with reduced withdrawal limits due to regulatory issues. Eightcap allows its clients to buy and sell a wide range of Cryptocurrency CFDs, including crypto-crosses and crypto indices. It also allows them to have multiple funding options and enjoy instant withdrawals.

Eightcap is a Melbourne-based online financial trading company that provides CFD trading solutions in various countries globally. With Eightcap, cryptocurrency traders can choose from a wide range of crypto offerings, enjoy tight spreads, and also deposit and withdraw funds with ease. As a regulated broker, it offers services that are within the purviews of the law.

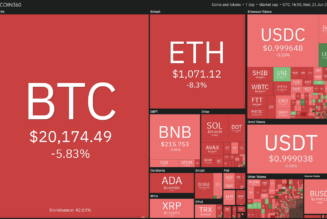

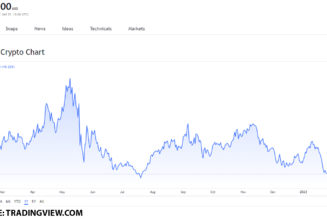

The cryptocurrency market has experienced tremendous growth over the past few years, and there are now more ways for people to gain access to cryptos. In the past, centralised exchanges were the primary ways people bought cryptos.

However, decentralised exchanges and CFD brokers have also made it possible for people to gain access to the cryptocurrency market. With a market cap of nearly $2 trillion, the crypto market is estimated to get even bigger over the coming years.