Companies

EABL cuts dividend as profit drops 22pc to Sh6.7 billion

Thursday January 25 2024

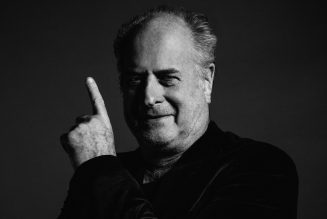

EABL chief executive Jane Karuku. FILE PHOTO | NMG

East African Breweries Plc (EABL) cut its interim dividend by 73.3 percent to Sh1 per share after posting lower earnings in the half year to December 2023.

The company had paid an interim dividend of Sh3.75 per share a year earlier. The new dividend will be paid on April 26 to shareholders on record as of February 16.

EABL’s dividend has been trending down since the year ended June 2022 when it made a peak distribution of Sh11 per share after registering a strong recovery from the impact of the Covid-19 pandemic.

The brewer’s net profit dropped 22 percent to Sh6.7 billion in the review period as high operating costs, increased debt service expenses and weakening of the shilling eroded the benefits of increased sales.

The company had posted a net income of Sh8.7 billion the year before. EABL’s net revenue –after indirect taxes— grew to Sh66.5 billion from Sh57.2 billion on what it attributed to improved sales across its markets.

“EABL Group’s volumes increased by 2 percent, lifted by resilient consumer demand as markets leveraged a strong and expanding portfolio with brilliant commercial execution,” the company said in a statement.

“The Group reported net sales growth across the three markets: Kenya at 10 per cent, Uganda at 31 at per cent and Tanzania at 9 percent. Additionally, beer and spirits categories grew at 18 percent and 13 percent respectively.”

The higher operating costs and the devaluation of the local currency however cancelled the sales gain, leading to the decline in net earnings.

EABL booked a foreign exchange loss of Sh2.3 billion due to the weakening of the Kenya shilling.

The currency loss increased from Sh209 million the year before.

The company’s net finance costs also jumped to Sh3.9 billion from Sh2.3 billion despite a decline in borrowings, underlining the impact of rising interest rates.

“We have achieved a resilient set of results in the half-year period. Our great brand building, brilliant commercial execution, as well as consumer insight led innovation, has allowed us to continue our revenue growth momentum,” EABL’s chief executive Jane Karuku said in a statement.

“However, our bottom line has been impacted by increased costs of inputs, currency devaluation and rising interest rates.”

EABL’s cost of sales surged to Sh37 billion from Sh30.7 billion, contributing to the reduced margins. The company said its expenses increased amid the general high inflation in the economy.

Ms Karuku said the company will in this second half focus on cutting costs to grow margins besides making selective investments in its brands and businesses.

EABL had already spent Sh6.1 billion on marketing in the review period when its microbrewery, built at a cost of Sh1.2 billion, also started production.