Gary McCormick, Tulsa’s senior special projects engineer, said most people remain resistant to a buyout unless they actually experience a flood.

Yet the city still notifies homeowners of their flood risks and offers buyouts. New federal funding will help them do more. McCormick walks homeowners through the flood maps and the risks, spelling out the costs for damage. Some take the city up on the offer. Most don’t.

“They’re still just resistant,” McCormick said. “That’s frustrating. Just being one who wants to help people, keep them out of harm’s way, keep them from flooding, and experiencing all that goes with that.

“The optimum solution is just to move people out of harm’s way,” he added.

No clear signal

But there’s a major divide between experts like McCormick and elected leaders. In Florida, elected officials are pledging to rebuild. Many want to restore communities right in Ian’s footprint. It’s only natural: People have to live somewhere, and these somewheres were people’s homes.

Given how many people elected to stay put in Sand Springs, many people will also likely choose to return to Florida’s Gulf Coast — even if the federal government is growing more assertive about the perils people face by remaining in place.

“The signal from the federal government is that we’re taking resilience seriously,” said Natalie Enclade, executive director at BuildStrong Coalition.

But the view on the ground from places like Tulsa reveals major faults in the execution, which Enclade said boils down to: “Throw money at it, hold our nose and close our eyes — and hope it gets better.”

The federal grant that Joe Kralicek is using for the buyouts in Graham’s old Town and Country neighborhood is over-subscribed — 180 people in the county have signed up, but Kralicek only has funding for 60.

It’s a Department of Housing and Urban Development grant. That means it comes with income restrictions: At least 70 percent of the state’s $36.4 million HUD Community Development Block Grant must benefit low- and middle-income people. Many who are interested, whose homes are decimated, are ineligible for income reasons. The HUD program is so complicated that most governments fail to spend the money it offers.

So Kralicek, who is the emergency manager for Tulsa and Tulsa County, is looking at another program through FEMA. But the county is struggling to come up with the money to cover the 25 percent federal match FEMA requires. Instead, Kralicek is using some of the HUD grant as the match for the FEMA award.

That means people like Barb Jackson are left in limbo as local officials juggle the complicated buyout process.

The 79-year-old Jackson officially retired from teaching in Tulsa Public Schools in 2016 after earning enough to redo the kitchen and pay for other renovations to the home. But the floods ravaged it — and contaminated the land, fouling the air.

The county said she would have to elevate the home to prevent future flooding. Jackson moved out instead. Living on a fixed income, she’s making mortgage payments for the first time in her life. She said she worries nonstop about money and grieves the loss of her home. The result has been anxiety, depression and three hospital visits since the flood.

The buyout would bring peace of mind and stability, even if it won’t bring Jackson’s home back. “It gave me hope,” she said. But she’s still waiting.

“I’m devastated. And even though people say get over it, you can’t get over it. So it’s like losing a family member,” she said. “Everything was paid off. And at my age, starting over again, I feel like I’m in a pit and can’t climb my way out.”

Making people pay

One way to push people to make rational decisions is to force them to pay more if they don’t.

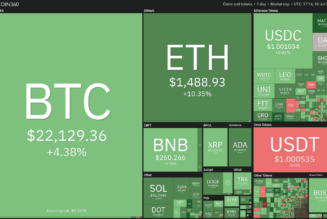

In October 2021, FEMA rolled out its long-awaited revamp to the federal flood insurance program, known as Risk Rating 2.0. The effort aims to align insurance premium pricing with the actual flood risk homes face. FEMA hopes doing so will limit losses to the chronically indebted, taxpayer-funded federal flood insurance program and also signal to would-be homeowners that some places face significant danger.

“There is no greater risk-communication tool than a pricing signal. When we distort the price, we distort their understanding of risk,” said Wright, the former FEMA flood insurance chief.

FEMA is also weighing new regulations that would expand the federal floodplain, which could include increasing minimum requirements for elevating homes to reduce flood risk. Those rules could be a “game changer” by requiring stricter building standards to reduce flood risk for hundreds of local governments, said Berginnis of the Association of State Flood Plain Managers. The rules have remained largely unchanged since 1976, before the broader public even heard of global warming.

The White House also has convened an interagency effort to update building codes. The Biden administration hopes it can entice local and state governments to adopt the types of measures that kept many Ian-whacked Florida buildings upright.

Meanwhile, Reps. Sean Casten (D-Ill.) and Earl Blumenauer (D-Ore.) have sponsored legislation that would more quickly purchase severe repetitive loss properties to lessen the taxpayer burden on bailing out those homeowners. The bipartisan infrastructure law also gave FEMA authority to start a new pilot program in flood-ravaged states that connects flood victims more quickly with federal dollars.

But such modest steps aren’t nearly enough to overcome the many pitfalls.

While the federal government encourages new building codes, they’re merely voluntary. Roughly 30 percent of construction in the U.S. today occurs in places with outdated building codes, said Gabriel Maser, vice president of government relations with the International Code Council, which develops model codes. Only one federal agency — FEMA — includes minimum standards for building codes, though a federal government-wide standard “is certainly something we’ve raised” with the administration, Maser said.

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]