The promoters of investment firm Cytonn have sued Superior Homes over the planned sale of their 12.5 percent stake in the real estate developer as part of plans to raise funds to compensate investors who lost Sh14 billion in the various Cytonn entities.

Cytonn Investment Partners Fifteen LLP says the property firm has conspired to sell the stake in contravention of an existing court injunction preserving the shareholding for the benefit of creditors.

The entity acquired 25 million shares, representing a 12.5 percent stake in Superior Homes in 2017, for Sh250 million using funds raised from Cytonn High Yield Solutions (CHYS), a special purpose vehicle that is now being wound up after investors obtained court orders to recover their funds from assets that were purchased with their capital.

The LLP is seeking orders from the High Court to block the alleged sale of the shares to Ian Henderson, a Scottish national, managing director and majority shareholder of Superior Homes.

The firm is additionally seeking orders to prevent Superior Homes from selling its assets and accessing funds from its bank accounts at Equity Bank Kenya and Gulf African Bank.

“The sale of the 1st defendant/respondent’s (Superior Homes) assets in effect weakens the applicant’s (Cytonn) shares, occasioning loss to not only the applicant but also to over 25,000 creditors and investors that the applicant owns shares in trust for,” Cytonn said in a sworn affidavit.

Cytonn acquired the Superior Homes stake from Ian Henderson and Ann Henderson, who are co-shareholders of the real estate developer.

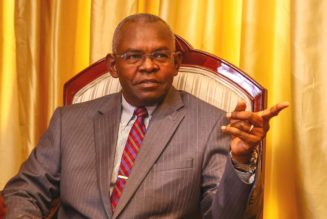

Ian Henderson, Edwin Dande (the CEO of Cytonn Investment Management Plc) and Shiv Arora (the CEO of Superior Homes) are directors of the real estate firm by virtue of their respective roles as shareholders and executives of the company.

Superior Homes has rejected Cytonn’s prayers to the court, stating that the existing preservation orders only cover the firm’s shareholding in the company and not its assets.

The realtor further argues that the freezing of the sale of its assets and bank accounts would directly impact its day-to-day operations.

Superior Homes, however, acknowledges the existence of a share purchase deal between CYHS official receiver Mark Gakuru and Ian Henderson.

“The allegations of fraud and conniving are denied. The 1st defendant (Superior Homes) has no intention of entering into any transaction for the purchase of the 25 million shares until the matter before the Court of Appeal has been determined,” Superior Home states in its response to Cytonn’s application.

“Holding shares in the 1st defendants’ company does not entitle the plaintiff to the 1st defendants’ assets, and more importantly, any right to interfere in the normal running and business operations of the 1st defendant.”

Superior Homes assets include a real estate development firm, the Lake Elementaita Mountain Lodge in Nakuru County, Sundowner Hotel located inside Green Park estate, Barizi –a hotel facility in Pazuri Vipingo estate and Arcadia Rental— a unit that collects rent and electricity bills at Arcadia Mall (Green Park estate).

The realtor also controls other special-purpose vehicle entities, including Supastop Management, Superior Ridge Limited and the SHK Foundation.

In October 2021, CHYS applied to be placed in administration with at least Sh14 billion investments by 3,116 creditors as it sought breathing space to restructure its balance sheet and preserve the value of assets in the company.

Creditors later accused the appointed administrator Kereto Marima of being complacent and not taking control of CYHS, forcing the court to terminate the administration and send the fund into liquidation.

CYHS sunk funds from its investors in other real estate projects, including the Alma, Cysuites and Taraji Heights.

The fund’s investment in Superior Homes shareholding was valued at Sh383.9 million as at February 28, 2022, according to disclosures made by Mr Marima.

The High Court gave orders to preserve all the assets of CYHS, including shares held by Cytonn Investment Partners Fifteen LLP in Superior Homes (Kenya) Plc in a ruling made on January 6, 2023.

Proceeds from the sale of Cytonn’s shares in Superior Homes are expected to offset the firm’s arrears to its creditors.