The CSA might examine marketing material during the review process for an exchange’s registration

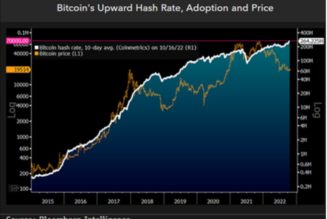

The Canadian Securities Administrators (CSA) and the Investment Industry Organization of Canada (IIROC) have issued warnings against crypto trading platforms in the country, accusing them of using gambling-like marketing practices. The warnings come amid multiple regulatory bodies expressing concern over consumer protection while trading digital assets and the increased risk of losses due to emotional buying and volatile prices of cryptocurrencies.

The guidance published by the CSA and IIROC details regulations that crypto trading platforms must keep in mind to meet their marketing, advertising and social media compliance requirements under securities law and IIROC rules. The recent surge in aggressive marketing campaigns that encourage excessive and risky trading behaviour among retail investors led to the intervention, IIROC President and CEO Andrew Kriegler said.

“Crypto trading platforms should consider their advertising and marketing strategies in the context of their obligations to treat investors fairly and honestly,” he added.

Questionable statements such as “Your crypto assets are safe with us because we meet all regulatory requirements as a fully licensed Money Services Business under Canadian legislation”, or “Important Update! BTC skyrockets! Don’t get left behind!” were recently seen being used to promote crypto platforms in Canada.

While the first statement implies that investors must feel a false sense of protection just because a platform is registered as a Money Services Business, the second statement can be constituted as investment advice.

Addressing both registered exchanges and those exchanges seeking registration, the guidelines advise crypto platforms to refrain from advertising and marketing material like the examples above that could be considered misleading or false. They also point out that contests, promotions and schemes designed to entice risky behaviours are a violation of the trading platforms’ good faith obligations.

Specific regulatory and compliance guidelines for social media posts and marketing were also issued by the authorities.

“Not respecting the requirements under the securities law and IIROC rules may raise concerns about a crypto trading platform’s fitness for registration,” CSA Chair Louis Morisset stated, adding that the regulatory body may examine advertising practices of trading platforms as part of the registration review process going ahead.