Stablecoins are a controversial subject in crypto. Questioning the legitimacy and backing of Tether (USDT) is a right of passage for many entering the crypto market for the first time. The meltdown of the Terra (LUNC; or the old LUNA) ecosystem left little doubt that algorithmic stablecoins don’t have a future beyond Do Kwon’s fantasies. Pesky regulators are constantly poking and prodding at dollar-pegged assets to carve out firmer rules on their usage.

But, if you look beyond all the fear, uncertainty and doubt, stablecoins are providing liquidity to millions of people who don’t have access to dollars because of capital controls or sanctions, or because hyperinflation is destroying their local currency. This week’s Crypto Biz newsletter looks at the role of stablecoins in fueling e-commerce. We also do some prodding of our own to see if a major payment platform is prepping its own stable asset.

Checkout.com launches 24/7 stablecoin settlement in partnership with Fireblocks

If crypto is ever going to achieve mainstream success as a payment system, stablecoins will likely play a major role. This week, global payment processor Checkout.com announced that it was launching a new stablecoin settlement system centered around Circle’s USD Coin (USDC). Now, merchants who use Checkout.com will be able to receive USDC payments and convert them into fiat instantly. As it turns out, Checkout.com already settled more than $300 million in USDC transactions during its beta testing phase. Regardless of what you think of them, stablecoins continue to deliver real-world utility.

[embedded content]

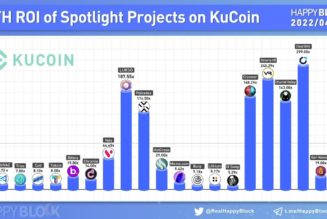

Crypto.com’s Cronos launches $100M accelerator for DeFi and Web3

On Tuesday, digital asset exchange Crypto.com announced that its Cronos blockchain ecosystem had launched a $100 million accelerator program to fast-track decentralized finance, Web3 and metaverse projects. The new fund aims to help up-and-coming crypto projects earn seed and pre-seed investments as they get their concepts and business models off the ground. You may have heard that venture capital funding into crypto has slowed somewhat from its torrid pace. That may be true, but 2022 is already shaping up to be a record-breaking year for VC funding — and we’re not even halfway through.

FTX will not freeze hiring amid layoffs at other crypto firms, CEO states

The bear market has been brutal on crypto exchanges and other blockchain-focused companies. Amid heartbreaking stories of people accepting jobs at Coinbase only to have their offers rescinded due to a hiring freeze, derivatives exchange FTX clarified this week that its HR department will continue to add personnel. CEO Sam Bankman-Fried explained that his exchange will “keep growing” despite the so-called crypto winter. In fact, the CEO said he has no plans to scale back. “We’re going to keep pushing forward,” he tweeted. Maybe it’s time to consider a career in crypto derivatives?

12) And because we hired carefully, we can keep growing regardless of market conditions.

Because we exponentially scaled our revenue and productivity, not our expenses.

But more importantly, because each person we add takes on a huge opportunity, and a huge responsibility.

— SBF (@SBF_FTX) June 6, 2022

PayPal enables transfer of digital currencies to external wallets

When PayPal launched its crypto services in October 2020, the company provided a huge market catalyst by sucking up the available supply of newly minted Bitcoin (BTC). Now, finally, the global payment provider is allowing users to natively transfer, send and receive crypto between PayPal and external wallets and exchanges. Of course, the service is currently available only to United States residents. You may also be intrigued to know that PayPal is still actively exploring the creation of its own stablecoin — at least, according to the source code on the company’s iPhone app.

Before you go! Can the Merge save Ethereum from the ETH Killers?

There’s a lot riding on the successful rollout of Ethereum 2.0. On this week’s Market Report, I sat down with fellow analysts Jordan Finneseth, Marcel Pechman and Benton Yuan to explain what exactly Eth2 entails and whether competitors such as Solana (SOL), BNB, Cardano (ADA) and Avalanche (AVAX) can actually de-throne Ethereum as the largest smart contract platform. What do you think — do they stand a chance? Catch a recording of the discussion below and tell us what you think.

[embedded content]

Crypto Biz is your weekly pulse of the business behind blockchain and crypto delivered directly to your inbox every Thursday.

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

Tagged: crypto blog, Crypto news, cryptocurrencies, Funding, Stablecoin, Venture Capital