The monumental collapse of FTX will go down as one of the biggest corporate scandals of all time. But, at least Sam Bankman-Fried, or SBF, is sorry. On Nov. 22, the disgraced founder of FTX penned a letter to his former employees describing his role in the company’s bankruptcy. “I never intended this to happen,” he wrote. “I did not realize the full extent of the margin position, nor did I realize the magnitude of the risk posed by a hyper-correlated crash.” Get this: SBF still thinks the company can be saved because “there are billion of dollars of genuine interest from new investors.” Shouldn’t he be preoccupied with trying to avoid jail right now?

Bitcoin (BTC) and the broader crypto market have been reeling in the wake of the scandal. While this has allowed many diamond handed hodlers to accumulate more BTC on the cheap, institutional investors are using this opportunity to short the market. We may finally get that final capitulation to round out the current four-year cycle.

As always, this week’s Crypto Biz newsletter delivers all of the latest high-profile business news from our industry.

Sam Bankman-Fried says he is ‘deeply sorry’ for collapse in letter to FTX team

SBF’s letter to former FTX employees painted the picture of a deeply remorseful founder who managed to squander billions because of excessive margins and poor oversight. He also blamed the “run on the bank” for FTX’s ultimate demise. For those of you keeping track, the bank run that SBF mentioned was triggered by Binance CEO Changpeng Zhao who, on Nov. 6, disclosed on Twitter — of all places — that he would be selling $500 million worth of FTX tokens. That announcement triggered a tidal wave of redemptions on FTX as users rushed for the exit. Within 48 hours, FTX was shown to be insolvent.

FTX owes over $3 billion to its 50 biggest creditors: Bankruptcy filing

The hole in FTX’s balance sheet is estimated to be worth around $8 billion — and a huge portion of that is owed to just 50 people. New bankruptcy filings in the state of Delaware confirmed this week that FTX’s top 50 creditors are owed a combined $3.1 billion. One individual is owed more than $226 million, while the rest of the top 50 had anywhere between $21 million and $203 million on the failed derivatives exchange. So, when can FTX creditors expect to get some of their money back? It could take years or even decades, according to insolvency lawyer Stephen Earel.

FTX discloses its top 50 creditors are owed $3.1 billion.

The largest creditor is owed $226 million.

All names were redacted. pic.twitter.com/JGeddvMB7w

— Tom Dunleavy (@dunleavy89) November 20, 2022

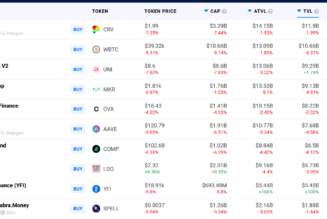

FTX crisis leads to record inflows into short-investment products

Believers in Bitcoin as a sound money alternative to the current monetary regime have used the latest market collapse to accumulate more BTC. But, for some institutional investors, the FTX collapse has triggered a new shorting opportunity. According to CoinShares, 75% of institutional crypto investments last week went to short investment products. In other words, they’re betting that Bitcoin and other crypto assets will see a further decline in price. BTC has already plunged to around $15,500, marking a new low for the cycle. Although Bitcoin can go much lower, we are nearing the end of the current four-year cycle. So, the bottom could be close.

US senators urge Fidelity to reconsider its Bitcoin offerings after FTX blow-up

Fidelity Investments, one of the earliest institutional backers of digital assets, is being strongly urged by members of Congress to limit its Bitcoin investment offerings. This week, Senators Elizabeth Warren, Tina Smith and Richard Durbin once again called on Fidelity to reconsider its Bitcoin 401(k) product offering in the wake of the FTX disaster. “Since our previous letter [from July 26, 2022], the digital asset industry has only grown more volatile, tumultuous, and chaotic—all features of an asset class no plan sponsor or person saving for retirement should want to go anywhere near,” the senators wrote. The crypto skeptics can take their victory lap for now, but Bitcoin will get the last laugh.

The implosion of FTX has made it clear that the digital asset industry has serious problems. I joined @SenWarren & @SenTinaSmith to urge Fidelity to do what is best & reconsider its decision to expose retirement accounts & employer-sponsored plans to these volatile assets. pic.twitter.com/qQn4PF80AP

— Senator Dick Durbin (@SenatorDurbin) November 21, 2022

Before you go: Could Grayscale trigger the next Bitcoin price collapse?

Concerns around Grayscale’s Bitcoin Investment Trust (GBTC) began to mount last week after the company refused to provide on-chain proof of its reserves. Now, investors are worried about whether Grayscale’s parent company, Digital Currency Group (DCG), could be forced to liquidate a portion of its GBTC to cover a massive hold in Genesis Global Trading’s balance sheet. What’s the relationship between DCG, GBTC and Genesis? In this week’s Market Report, Marcel Pechman and I discuss this relationship and why it matters to Bitcoin investors. You can watch the full replay below.

[embedded content]

Crypto Biz is your weekly pulse of the business behind blockchain and crypto delivered directly to your inbox every Thursday.

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

Tagged: crypto blog, Crypto news, ftx, Grayscale, investments, Sam Bankman-Fried, Senate