In an intriguing turn of events, Credit Suisse AG has made a notable decision to reduce its stake in Capri Holdings Limited. According to the recent 13F filing with the Securities and Exchange Commission (SEC), Credit Suisse AG cut its stake by a staggering 34.5% during the first quarter of this year. This move has undeniably captured the attention of investors and financial analysts alike.

Prior to this adjustment, Credit Suisse AG held 128,026 shares of Capri Holdings Limited. However, as a result of selling 67,519 shares during the period under review, their ownership now stands at a diminished figure. Nonetheless, it is worth noting that even after this significant reduction, Credit Suisse AG still retains ownership of approximately 0.10% of Capri’s stock. Impressively enough, their stake is valued at a remarkable $6,017,000 as per their most recent SEC filing.

Capri Holdings Limited has been making headlines recently due to its compelling quarterly earnings results announced on May 31st. Despite prevailing market expectations, Capri exceeded consensus estimates by delivering an impressive earnings per share (EPS) figure of $0.97 for the quarter. This surpassed the predicted EPS by an impressive margin of $0.03.

Furthermore, Capri generated revenues amounting to $1.34 billion during the same period—an achievement that surpassed analysts’ projections of $1.28 billion. Although there was a decline in revenue compared to the previous year (approximately 10.5% down on a year-over-year basis), Capri’s ability to outperform expectations cannot be understated.

The impressive accomplishments did not end there for Capri Holdings Limited during this reporting period though—the company also boasted an outstanding return on equity (ROE) figure of 38.22%. Additionally, it demonstrated commendable operational efficiency with a net margin of 10.96%. These robust financial indicators are indicative of Capri’s adeptness at managing its resources and maximizing profitability.

Market experts are cautiously optimistic about Capri Holdings Limited’s future prospects as well. Sell-side analysts, in their collective wisdom, forecast that the company will post an EPS figure of 6.12 for the current fiscal year. This projection reflects a positive outlook regarding Capri’s ability to sustain its performance and generate further value for investors.

For those keen on exploring the investment landscape surrounding Capri Holdings Limited, it is recommended to visit HoldingsChannel.com. This platform provides comprehensive insights into hedge funds’ positions, including detailed 13F filings and insider trades related to Capri stock.

In conclusion, Credit Suisse AG’s decision to reduce its stake in Capri Holdings Limited has undoubtedly piqued interest within the investment community. Against the backdrop of remarkable quarterly earnings results and with sell-side analysts predicting continued growth, the future trajectory of this luxury fashion group appears promising. As investors navigate through these perplexing market dynamics, it becomes imperative to stay abreast of the latest developments via platforms such as HoldingsChannel.com for informed decision-making purposes.

Investor Interest and Financial Analysis of Capri Holdings Limited: A Mark of Growth and Profitability in the Fashion Industry

Capri Holdings Limited, a renowned fashion conglomerate, has recently made headlines with its notable investments and business activities. However, it is not just the big players in the investment world who have shown interest in this company; many institutional investors have also bought and sold shares of Capri Holdings Limited.

One such investor is Ellevest Inc., which significantly increased its position in shares of Capri during the fourth quarter. Ellevest Inc. now owns 492 shares of the company’s stock, valued at $28,000, after purchasing an additional 214 shares last quarter. TCI Wealth Advisors Inc. also joined this bandwagon by increasing their holdings in Capri by a staggering 123.5% during the same period. TCI Wealth Advisors now owns 590 shares of the luxury fashion company’s stock, worth $34,000.

Another noteworthy investor is Capital Analysts LLC, which purchased a new stake in Capri worth about $80,000 during the fourth quarter. Kistler Tiffany Companies LLC followed suit by increasing its holdings in Capri by an impressive 80.5%, bringing their ownership to 1,531 shares valued at $88,000.

Moreover, Belpointe Asset Management LLC joined the league of investors purchasing stakes in Capri during the fourth quarter with an investment worth approximately $96,000. Currently, these institutional investors own approximately 90.12% of the company’s stock.

Despite these significant developments amongst investors in Capri Holdings Limited business activities over time remain vital indicators that influence share value and investor perception. On July 15th ,the company experienced a decrease in share price as CPRI traded down $0.84 during mid-day trading on Friday and hit a value of $35.34 per share. A total volume of approximately 767,518 shares were traded on that day alone compared to its average volume of 2,539,

In evaluating the financial stability of the company, we need to consider various financial metrics. Capri Holdings Limited has a quick ratio of 0.56, a current ratio of 1.29, and a debt-to-equity ratio of 0.99, indicating the company’s efficiency in meeting short-term obligations and managing its debts effectively.

The luxury fashion giant boasts an impressive market capitalization of $4.15 billion and a favorable P/E ratio of 7.97, signifying that investors have recognized the growth potential and profitability of Capri Holdings Limited. Additionally, with a PEG ratio of 1.88 and a beta value of 2.26, it suggests that the stock may be undervalued for its projected earnings growth rate.

It is essential to note that there are several equities research analysts who have taken notice of these developments within Capri Holdings Limited as well. BMO Capital Markets, for instance, recently decreased their price objective on Capri from $70.00 to $68.00 in their report on June 5th.

Other leading financial institutions such as Barclays also cut their target price on Capri from $46.00 to $38.00 in their research note published on June 1st, while Wells Fargo & Company adjusted their target price from $65.00 to $55.00 on May 10th.

Over time, TheStreet downgraded Capri’s rating from “b” to “c” in their research note released on May 31st; this change reflects revised market sentiments towards the company’s performance during that period.

Despite these mixed reviews by analysts, Bloomberg.com reports that Capri presently holds a consensus rating of “Moderate Buy,” alongside a consensus price target of $55.13 among industry experts.

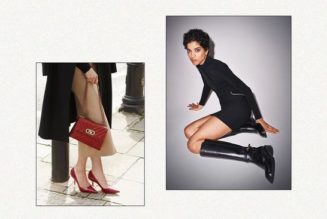

To fully understand the scope and impact generated by Capri Holdings Limited within the fashion industry today requires taking an in-depth look at its brand offerings and global distribution channels. Capri Holdings Limited operates through three distinct segments: Versace, Jimmy Choo, and Michael Kors.

These renowned fashion brands provide a wide range of products for both men and women, including apparel, footwear, accessories, handbags, scarves and belts, small leather goods, eyewear, watches, jewelry, fragrances, and home furnishings.

Capri Holdings Limited serves its diverse customer base through an extensive network of boutiques, department stores, specialty stores worldwide. Additionally , their offerings are made available via e-commerce sites to ensure accessibility across various geographical locations.

In conclusion, Capri Holdings Limited’s recent investment activities from institutional investors showcase the market’s belief in the company’s potential for growth and profitability. These activities have had a notable impact on the company’s share value.

While fluctuations in stock prices are expected within a dynamic market environment , Capri Holdings Limited consistently demonstrates strong financial performance and market presence through its diverse brand portfolio that caters to the preferences of global consumers.