BY PAUL NJOKI

Investing is a deeply personal journey, shaped by each individual’s financial goals and risk tolerance. In the quest for financial gains, many investors are drawn to high-income strategies for their immediate cash flow. Yet, this focus may not be optimal for long-term growth. Income portfolios, rich in bonds and dividend yielding stocks, offer consistent cash flow which is appreciated by retirees and those seeking income stability. However, for investors aiming to grow their assets, having a balanced allocation of stocks, bonds and alternative assets, including a good amount of growth-oriented assets is crucial. In this piece, we explore the merits of income and balanced allocation strategies and the optimal income level for a long-term sustainable withdrawal rate for investors.

Understanding income portfolios

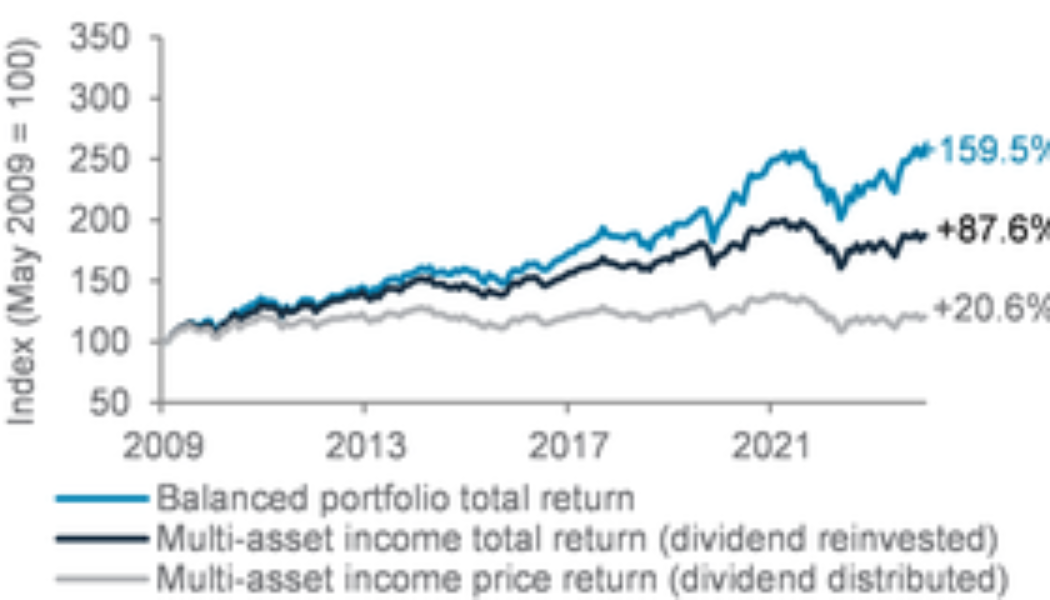

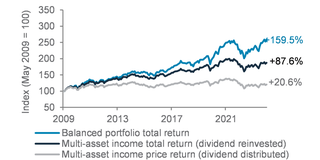

Income portfolios, traditionally bond-heavy with a sprinkle of dividend-yielding stocks, are designed to deliver a steady cash flow to investors. Their popularity is undeniable among those in need of income. However, they often lag behind balanced portfolios that marry income generation with growth potential. Without substantial growth, income portfolios struggle to beat inflation and maintain purchasing power. Historical data since 2009 shows that a balanced 55/35/5/5 equity/bond/cash/gold (Fig.1) handily outperformed an income portfolio from a total return perspective, highlighting the importance of including growth assets into the investment mix to capitalise on market upswings and compound wealth over time.

Fig. 1 Total return key for long-term wealth accumulation; for Income strategies, reinvesting income is imperative. Not reinvesting income will result in lower total returns long-term

Cumulative returns of total return and price return of a diversified income allocation* vs total returns of a balanced allocation** (May 2008 to May 2024)

* Income allocation is proxied by 40% global bonds, 20% EM bonds and 40% dividend equities

** Balanced allocation is proxied 55% Global Equities, 35% Global Bonds, 5% Gold, 5% Cash

Photo credit: Source: Standard Chartered Chief Investment Office

The hidden cost of not reinvesting income

An often neglected facet of income investing is the long-term repercussions of not reinvesting income. While income portfolios provide regular cash flow, they can suffer in terms of compound growth if dividends and interests are regularly withdrawn instead of being reinvested. This factor can significantly curtail the portfolio’s growth trajectory over time. While income portfolio caters to immediate financial needs, investors need to weigh the opportunity cost of forgoing the powerful effects of compounding, which are central to long-term wealth accumulation.

Total returns: A key measure of success

Total return, which encompasses interest, dividends, and capital gains, is an important measure of financial success. Focusing solely on income can be misleading as it does not consider the potential for losses in asset value. Thus, having a holistic view of portfolio performance, considering both income and growth when evaluating success is key.

This concept of total return is not only crucial for investment performance but also plays a crucial role in retirement planning. As investors approach retirement, the focus often shifts from accumulation to preservation and distribution of wealth. In this phase, understanding the interplay between total returns and withdrawal strategies become paramount.

Fig. 2 Balanced and equity Investors have greater odds of success with below 4% withdrawal rate

Success rate** of simulated portfolio with varying withdrawal rates

Success rate: the proportion of simulated portfolios with a positive value post a 30-year rolling retirement period since 1871

*Balanced allocation refers to 55% US Equities, 35% US Bonds, 5% Gold, 5% Cash

Photo credit: Source: Standard Chartered Chief Investment Office

The 4% Rule: A guideline for sustainable withdrawals

A balanced portfolio provides a robust foundation for implementing sustainable withdrawal. The ‘4% rule’ is a time-tested principle that offers a benchmark for sustainable withdrawal. It is based on the premise that an investor can withdraw 4% of their portfolio in the first year of retirement, and then subsequently adjust the amount for inflation each year, without facing a significant risk of depleting their retirement funds over a typical 30-year period.

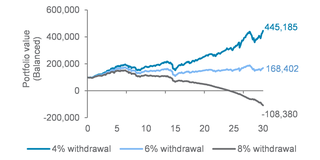

Fig. 3 Withdrawal rates over 6% could be hazardous given potential inflation risks and in the event of a longer-than-expected retirement period

*Balanced portfolio value at varying withdrawal rates over a rolling 30-year retirement period since 1871; starting with USD100,000

*Balanced allocation refers to 55% US Equities, 35% US Bonds, 5% Gold, 5% Cash

Photo credit: Source: Standard Chartered Chief Investment Office

At higher rates of withdrawal, the risk of depleting the portfolio prematurely increases significantly. For example, if a retiree withdraws at a higher rate, say at 8%, they may initially have a more comfortable standard of living. However, this comfort could be short-lived if the market experiences a downturn, or if inflation rises unexpectedly. A higher withdrawal rate would accelerate the depletion of the portfolio’s principle, potentially leading to a situation where the portfolio may run out earlier than expected. Moreover, higher withdrawal rates also limit a portfolio’s growth potential. Since a large portion of the assets is being used for current expenses, less is left to invest and compound over time. This can be particularly detrimental during the early years, as the effects of compounding are most potent over the longer term.

Striking for balance in our stock-bond mix

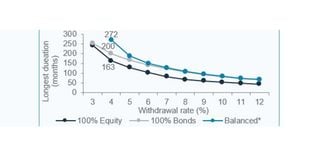

A portfolio that is entirely allocated to either stocks or bonds is rarely optimal. Figure 2 suggests a higher allocation to equities typically provides better growth, while a 100% bond portfolio fared the worst due to lower returns. However, a 100% equity portfolio carries higher risk due to greater volatility. Given the following two options for investors: 1) a 90% chance of living another 30 years, but a chance of running out of money after 7 years, and 2) a 90% chance of living for 30 years, but a chance of running out of money after 25 years, the latter is clearly better. Stocks increase the odds of success here but are subject to the vagaries of return risks and market cycles, while bonds will significantly reduce the chance of portfolio failing too early. Hence, balance is key.

Fig. 4 Historically, balanced strategies have better safeguarded against premature failure and helped in preserving long-term value

Number of months before the first dip into negative value by simulated portfolios

*Balanced allocation refers to 55% US Equities, 35% US Bonds, 5% Gold, 5% Cash

Photo credit: Source: Standard Chartered Chief Investment Office

Navigating market volatility with a balanced portfolio

Achieving financial success involves more than simply choosing between income and growth. It requires a thoughtful blend of both, tailored to an individual’s needs and goals. Income portfolios have their merits, especially for retirees who value predictable cash flow. For those with no immediate income needs and a substantial investing horizon, a balanced portfolio, consisting of a judicious mix of income and growth assets, is essential to charting a course towards substantial long-term wealth accumulation.

Standard Chartered have released the H2 2024 Global Market Outlook. This report brings together in depth research to highlight investment opportunities that investors can tap into over the next 6 months. Get it here: https://bit.ly/3WGLeSj.

Paul Njoki is the Head of Affluent Banking & Wealth Management, Kenya & East Africa, Standard Chartered.