Typically there are macroeconomic factors that a country is looking to manage through the adoption of a currency as legal tender. In order to make Bitcoin legal tender, these factors should coincide with visionary leadership.

Despite that, central banks are getting into digital currencies. There are countries with more fundamental problems that just a digital version of a fiat currency may not solve. For instance, countries like Argentina and Venezuela have suffered from hyperinflation for years and can do with a form of currency that derives value from much beyond their own economies. There are also countries like El Salvador, Panama, Guatemala and Honduras, where a big percentage of the GDP is contributed by remittances. This paves the way for a form of value exchange that is not restricted by national borders. For instance, 24.07% of El Salvador’s GDP in 2020 came from remittances.

One more consideration for countries is the extent of financial inclusion in their economies. While the customer journey around cryptocurrencies is by no means user-friendly, it must be said that hyperlocal experiments in creating an ecosystem on bitcoin in countries like El Salvador have seen some success. With remittances contributing to the economy in a big way, digital currencies can not only help financial inclusion but also achieve cost savings on remittance fees.

It should also be noted that regimes that roll out Bitcoin as legal tender have claimed to be bringing financial inclusion to its population. Yet, financial inclusion often must be preceded by mobile and internet penetration. Without the digital infrastructure, a digital currency will not be able to solve the problem of financial inclusion all by itself.

So, which countries have adopted Bitcoin as legal tender and how have they done it? El Salvador is the first country to adopt Bitcoin as legal tender. Apart from macroeconomic factors described above, the country had a leader who was willing to experiment with bitcoin. He has since been a loyal ambassador of the cryptocurrency.

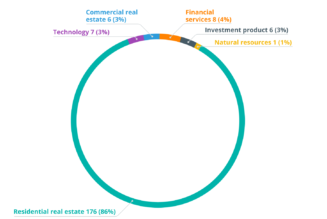

The second country to adopt Bitcoin as legal tender is the Central African Republic (CAR). The CAR is rich in natural resources like gold and diamond and has a $2.3 billion sized economy. Yet, financial inclusion is pretty low and they rely on remittances. Apart from embracing Bitcoin, the country also revealed that 20% of their treasury will hold Sango Coin (SANGO), a digital currency that will reflect the health of natural resources in the country.

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

Tagged: Bitcoin, crypto blog, Crypto news