On this week’s The Market Report show, Cointelegraph’s resident experts discuss what the ramifications would be if Grayscale Bitcoin Trust were to collapse.

We start off this week’s show with the latest news in the markets:

GBTC next BTC price black swan? — 5 things to know in Bitcoin this week

Bitcoin (BTC), the largest cryptocurrency, just like the rest of the crypto industry, remains highly susceptible to downside risk as it continues to deal with the fallout from the implosion of exchange FTX.

Contagion is the word on everyone’s lips as November grinds on — just like the Terra collapse earlier this year — and fears are that new victims of FTX’s giant liquidity vortex will continue to surface. Grayscale Bitcoin Trust (GBTC) seems to be on everyone’s radar this week for all the wrong reasons. Will it be the next black swan event? We break down all the details surrounding GBTC to keep you up-to-date.

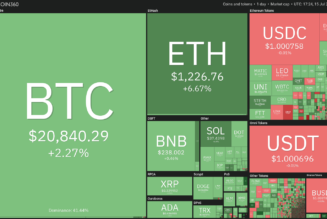

Data shows traders are slightly bullish even as crypto’s total market cap falls under $800B

The total crypto market capitalization has dropped under $800 billion, but data highlights a few reasons why some traders are bullish. Our very own Marcel Pechman breaks down why some traders are actually bullish, a sentiment that seems highly counter-intuitive. Marcel has some very good reasons for this, so make sure you tune in to find out.

Cardano to launch new algorithmic stablecoin in 2023

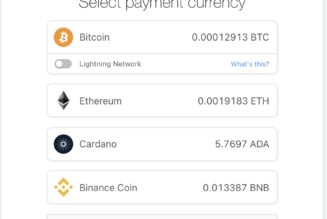

Proof-of-stake blockchain platform Cardano has partnered with Coti, a directed acyclic graph-based layer-1 protocol, to launch what it refers to as an overcollateralized algorithmic stablecoin. The project said in an announcement provided to Cointelegraph that the stablecoin would be backed by excess collateral in the form of cryptocurrency stored in a reserve. Do we need another stablecoin? How will this one be different from the existing stablecoins already in circulation?

CoinMarketCap launches proof-of-reserve tracker for crypto exchanges

CoinMarketCap, a leading market researcher and tracker in the crypto industry, announced the launch of a new feature on its platform that gives users updated financial insights on exchanges.

The proof of reserves (PoR) tracker audits active cryptocurrency exchanges in the industry for transparency on liquidity at a given moment. According to the announcement, the tracker details the total assets of the company, and its affiliated public wallet addresses, along with the balances, current price and values of the wallets. Our experts break down the need for such a tool and how it helps the industry.

Do you have a question about a coin or topic not covered here? Don’t worry. Join the YouTube chat room and write your questions there, and we’ll make sure to get you your answers.

The Market Report streams live every Tuesday at 12:00 pm ET (4:00 pm UTC), so be sure to head on over to Cointelegraph’s YouTube page and smash those Like and Subscribe buttons for all our future videos and updates.

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

Tagged: crypto blog, Crypto news, Grayscale, Market Analysis, Market Update