In 2018, the two main ways video game players can earn a living were through e-sports and live streaming — or perhaps a successful YouTube channel. But, thanks to the rise of blockchain technology, the financial aspect has never been more interwoven with the gaming industry. While most users are acquainted with one or two facets of financialization in gaming such as earning and cashing out rewards from completing game quests a la Axie Infinity, there are several other methods exist that have yet to be explored by most users in the cryptocurrency market’s flourishing new vertical called GameFi.

CryptoKitties in 2017 is the first known game to use blockchain technology, introduce nonfungible tokens (NFTs) and enable players to have a verifiable claim on their virtual assets. Then, in 2019, the introduction of an in-game currency called Smooth Love Potion (SLP) boosted Axie Infinity’s popularity and paved the way for other decentralized finance (DeFi) components to penetrate blockchain gaming. Such parallels that GameFi has with DeFi include staking, liquidity mining, NFT trading and NFT fractionalization.

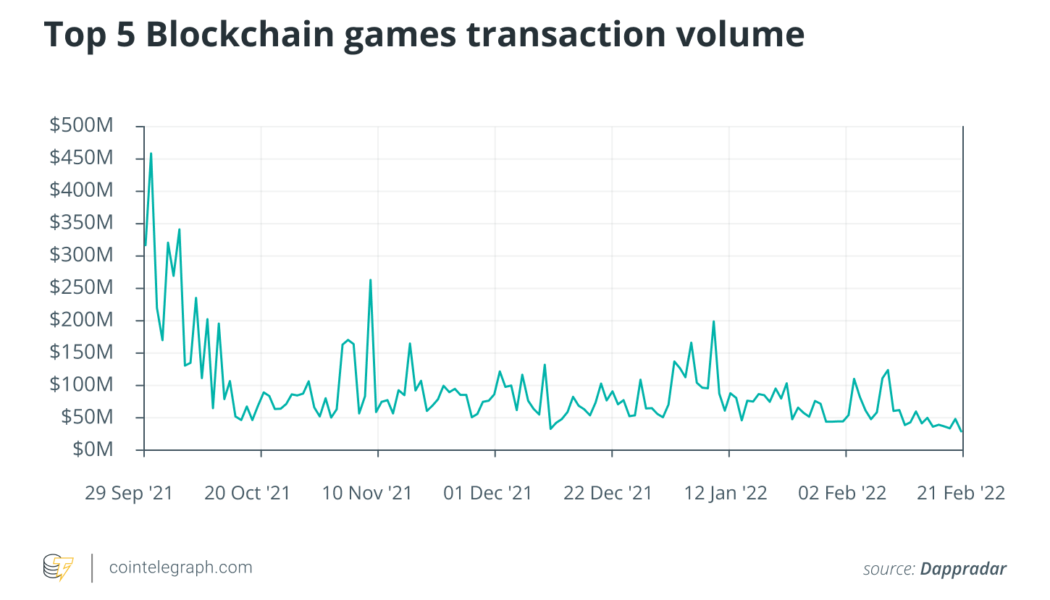

Last year, the gaming subsector of the cryptocurrency market exploded which came on the heels of the NFT market boom. It even outperformed Bitcoin (BTC) and the DeFi sector back in December. While the uptrend has fizzled out in recent months, popular games like Axie Infinity, DeFi Kingdoms, Pegaxy, MOBOX and Bomb Crypto continue to rake millions per day in transaction volume.

Much of the excitement around gaming in 2021 also stems from an increase in venture capital interest. For instance, Solana Ventures and Lightspeed Venture Partners launched a $100 million GameFi ecosystem fund in November 2021. A month later, BNB Chain, formerly known as Binance Smart Chain (BSC), and Animoca Brands also established a $200 million fund dedicated to GameFi projects built on BSC.

There are elements of DeFi in gaming that have attracted investors and players alike and these are discussed below.

The NFT component

As mentioned above, NFTs were initiated by CryptoKitties, which has provided players a way to ascribe value and ownership to certain assets in a game. Take Axie Infinity, for example. NFTs on this Ethereum-based video game serve as the game’s entry cost. To begin playing, users must have three “Axies,” which are the game’s characters acquired from other players through Axie Infinity’s marketplace.

Axies are NFTs and their prices vary depending on their rarity and utility. Players can earn from Axies by finding buyers to whom they can be sold at a profit. With other games such as Splinterlands, NFTs take on the form of trading cards whose market value is also determined by their rarity.

Fractionalization

The concept of NFTs and fractionalization are intertwined but fractional NFTs make games more accessible to everyone. Fractionalization is essentially a whole NFT divided into smaller fractions, providing claims of ownership to several people such as the case of Gustav Klimt’s painting The Kiss, whose digital version was sold as 10,000 fractional NFTs. Owners of fractionalized NFTs can then trade their assets on secondary markets and make money.

It is similar to real estate crowdfunding which, incidentally, is another growing use case of NFTs. With gaming, on the other hand, rare and expensive in-game assets could best be sold under a fractionalized NFT as it democratizes the ownership process.

For example, Waves Ducks, another play-to-earn game, have integrated fractionalization via its “Collective Farms” that intends to lower entry costs. One “duck” would cost 3.3 Waves Duck (EGG) to hatch and at EGG’s price at the time of writing, that would be nearly $700. By joining a farm, however, a player can play the game with as little as 0.01 EGG and receive tokens representing their stakes in the farms.

Staking

The staking function is a common theme in DeFi and has also entered the realm of blockchain gaming. Staking support for Axie, where users can lock in AXS tokens to secure the network and get paid rewards, went live in September 2021. Mobox also offers users to earn MBox tokens through staking.

Aside from this, staking rewards can also be used to purchase in-game items or upgrades or even generate keys to unlock new NFTs. Staking with Mobox requires users to add to a liquidity pool and earn tokens based on the pool’s APY. Several smaller GameFi projects have introduced staking to their games as well.

Ostensibly, staking benefits users by earning more tokens, but some tokens earned through staking are also used for governance, enabling holders to vote on specific directions for the game and the community. But, most importantly, it incentivizes users to hold on to their tokens which, in turn, promotes a real and active economy.

Liquidity Mining

The liquidity mining component can also play an important role in GameFi, as is the example of the game DeFi Kingdom. Built on the Harmony blockchain, DeFi Kingdom offers a suite of DeFi aspects to its game right from its inception, appealing to DeFi fans and putting the game aspect as a secondary feature.

The liquidity mining pools in the DeFi Kingdom come in the form of in-game “gardens.” LP shares are represented as a plot filled with blooming plants, which grow in accordance with their yields. Users earn JEWEL tokens, the game’s main token used for purchasing in-game NFTs or liquidity mining outside the game.

These are just some of the inclusions of DeFi technology in gaming but innovations in this sector are not ceasing. Some even believe that GameFi is also fueling the materialization of Web3 since it’s migrating a once centralized form of entertainment to a more decentralized domain, with communities more connected or in control of the game ecosystem. In actuality, this is already taking place as the DeFi features of gaming is already a prelude to what Web3 is.

Cointelegraph Research’s upcoming report is all about GameFi. Stay tuned.

Cointelegraph’s Market Insights Newsletter shares our knowledge on the fundamentals that move the digital asset market. The newsletter dives into the latest data on social media sentiment, on-chain metrics and derivatives.

We also review the industry’s most important news, including mergers and acquisitions, changes in the regulatory landscape, and enterprise blockchain integrations. Sign up now to be the first to receive these insights. All past editions of Market Insights are also available on Cointelegraph.com.

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

Tagged: crypto blog, Crypto news