The Capital Markets Authority (CMA) has fined several directors of listed companies including an auditor more than Sh8 million for flouting trading rules in the financial year ended June 30, 2023, new disclosures showed.

While the regulator did not disclose the firms or individuals affected by the sanctions, it said that most of them settled the fines.

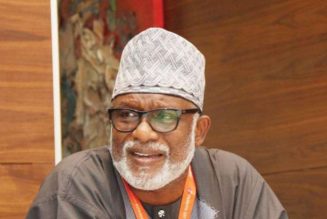

“For the period in question, the Authority undertook enforcement actions on various persons or entities who had contravened the legal and regulatory framework,” CMA Chief Executive Officer Wycliffe Shamiah said in an interview.

“In particular, the Authority imposed penalties on various directors of listed companies and an auditor for contravening the legal and regulatory framework. As a result, most of them opted to settle the fine/penalty as imposed,” he added.

Disclosures contained in CMA’s latest annual report for 2022/2023 show the regulator’s earnings from fines penalties and levies increased more than eight-fold to Sh10 million from Sh1.1 2 million in the previous year.

“The Authority undertook investor protection initiatives aimed at boosting investor confidence including capital market investigation and enforcement processes, the online whistleblower portal and reporting via email and issuance of investor alerts and market arbitration,” the regulator said.

The disclosures come in the wake of a decision by the Capital Markets Tribunal that allowed CMA to sanction four ex-directors and a serving director of micro-lender Real People Kenya Ltd (RPKL) for their roles in the illegal diversion of proceeds of a Sh1.6billion bond to South Africa about nine years ago.

The lender raised Sh1.6 billion in 2015 from Kenyan investors to issue loans to local customers but the bulk of the money was wired to its parent company in South Africa to pay an internal loan.

The CMA Tribunal on June 5 dismissed an appeal by the four ex-directors—Norman Ambunya, Daniel Ohonde, Nthenya Mule and Charl Kocks— who had sought to block CMA’s Ad Hoc committee from proceedings with the hearings on the matter.

Ms Yvonne Godo, who still serves on the RPKL board, is one of those facing CMA sanctions over her role in the scandal.

CMA’s investigations in 2015 disclosed that the directors allegedly violated certain provisions of the Code of Corporate Governance Practices for issuers of securities to the public (2015) and the Capital Markets Act.

The regulator had fined four other former directors of Real People, a combined Sh15 million for their roles in diverting proceeds of a Sh1.6 billion bond to South Africa.

This landed nine former bosses and directors-four Kenyans and five South Africans, in trouble with the regulator who ordered an inquiry into the company.

Five of the nine executives opposed the regulatory action and moved to the CMA tribunal, while the other four were fined between Sh2.5 million and Sh5 million.

Besides, the sanctions against the RPKL officials, a former acting chief finance officer (CFO) at the National Bank of Kenya (NBK) Wycliffe Lindong’a Kivunira is also facing a Sh1 million sanction by CMA for impropriety.

The ex-CFO had sought to block a disciplinary hearing against him over financial irregularities at the State-owned lender before its takeover by KCB in September 2019. The Capital Markets Tribunal on June 5, 2024, however, rejected the attempt.

CMA issued a notice to show cause to Mr Kivunira in August 2017 following investigations into the affairs of NBK that revealed that the then-acting CFO willfully prepared and published false and misleading financial statements for NBK by reporting a gain on disposal of assets of Sh847,920,000 for the quarter ended June 30 to September 30, 2015.

The investigations also found Mr Kivunira to have been potentially involved in the embezzlement of NBK’s funds through commissioning a deposit mobilisation exercise in 2014 and 2015 and irregularly restructuring and rebooking loans without the approval of the NBK board to save the bank from incurring obligations on loan provisions for non-performing loans amounting to Sh2,595,303,848.

According to CMA, Mr Kivunira also recognised and subsequently wrote off interest on the non-performing loans amounting to Sh680 million contrary to provisions of the Guidelines on corporate governance practices by publicly listed companies.

Mr Kivunira who was sacked by NBK in April 2016 failed to supply the CMA board with relevant, accurate, and timely information to enable the Board to discharge its duties resulting in a financial penalty of Sh1 million.