The International Monetary Fund (IMF) has warned Kenya against a larger rate cut despite the fall in inflation to a 17-year low and the recent stability of the shilling, saying that easing monetary policy risks price stability.

The IMF caution clashes with recent pronouncements by the Treasury and the Central Bank of Kenya (CBK) that rates should be brought down in order to stimulate economic growth and tame the rising non-performing loans in the banking sector.

In a country report on Kenya following the seventh and eight reviews of its medium-term funding programme, the IMF says it sees lingering inflationary risk in a low-rate environment.

The multilateral lender warns that Kenya also risks losing the ability to attract external investment flows if it lowers the returns available from its financial assets.

It says the differential between Kenya’s real policy rate and the US nominal rate (the global benchmark for risk-free investment) remains narrower than the pre-Covid-19 level.

This marks the second time that the IMF has cautioned against a rush to cut rates. In October 2023, the Bretton Woods institution told African countries that were experiencing falling inflation that cuts would lead to a risk of a sharp rise in the cost of living once economic activity rebounded on availability of cheap credit.

“The tight monetary policy stance remains appropriate given risks to price stability and external sustainability,” said the IMF in the country report.

“While headline inflation reached the target earlier than expected, benefitting from lower food prices and a stronger shilling, core inflation remains sticky above the level that the CBK considers appropriate for its price stability objective.”

Treasury Cabinet Secretary John Mbadi said last month that the CBK ought to lower the lending rate in the wake of falling inflation, in order to encourage the private sector to take up loans and create jobs.

Headline inflation fell to a 17-year low of 2.7 percent in October, due to lower prices of fuel and selected food items. Core inflation, also known as non-food-non-fuel inflation, stood at 3.3 percent, slightly lower than September’s 3.4 percent and August’s 3.5 percent.

While the CBK has a target of five percent plus or minus 2.5 percentage points for overall inflation, it doesn’t have an official target for core inflation, even though it is said to prefer that this inflation goes no higher than three percent.

The CBK cut its base rate by 0.75 percentage points to 12 percent in its October 8 monetary policy committee (MPC) meeting, saying that it expected inflation to remain below the mid-point target range in the near term. In the previous meeting in August, the CBK had cut the rate by 0.25 percentage points, which marked the first such action since 2020.

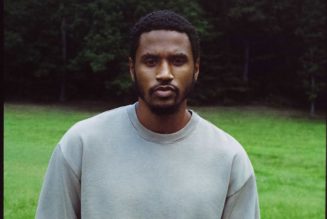

Following the October MPC meeting, CBK governor Kamau Thugge said that there was scope for further easing of monetary stance, citing the deceleration in lending to the private sector and slowing economic growth as reasons to do so.

Kenya’s GDP expanded by 4.6 percent in the second quarter of this year, down from 5.6 percent in the corresponding period in 2023, partly reflecting difficulties faced by businesses and households to access credit in a high-interest rate environment.

Annualised private sector credit growth fell to 1.3 percent in August, down from 13.9 percent at the beginning of 2024.

Banks have also seen rising defaults on loans on account of the tough economy, with their ratio of non-performing loans (NPLs) to total loan book (NPL ratio) going up to an 18-year high of 16.7 percent in August.

The shilling’s recent stability in the forex market has also given the CBK more room to ease monetary policy. It has gained to currently exchange at an average of Sh129.19 to the dollar, down from Sh160 in February.

In December 2023, the CBK’s concerns about a rapidly depreciating shilling and the potential knock-on effect on the cost of living prompted the MPC into a 2.5 percentage rate hike to 12.5 percent, followed by another increase to 13 percent in February 2024.

The move was meant to make Kenya’s financial assets attractive to foreign investors, in the process attracting dollar inflows, which would support the currency in the forex market. These are the inflows that the IMF reckons are under threat if the country lowers its interest rates.