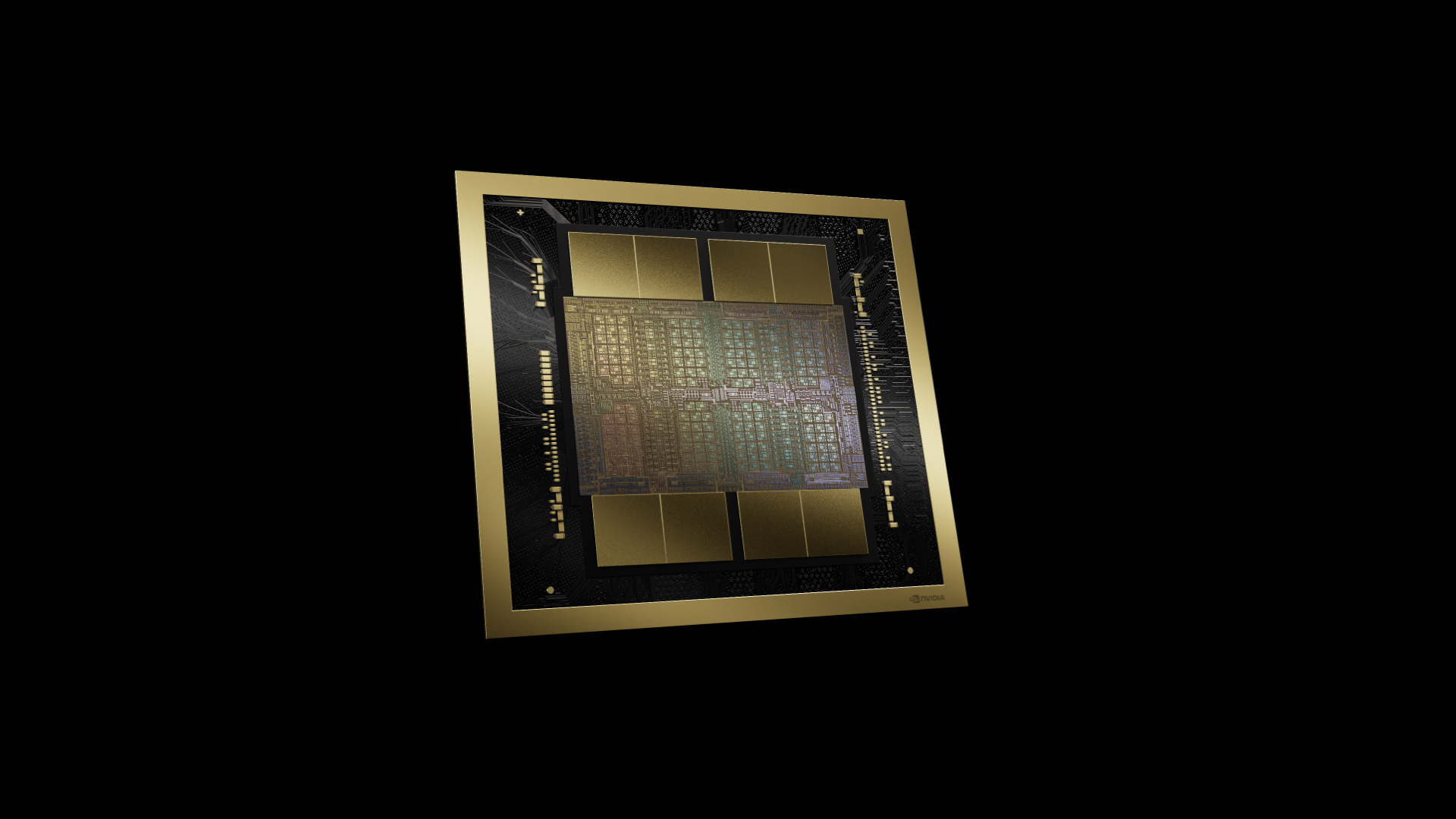

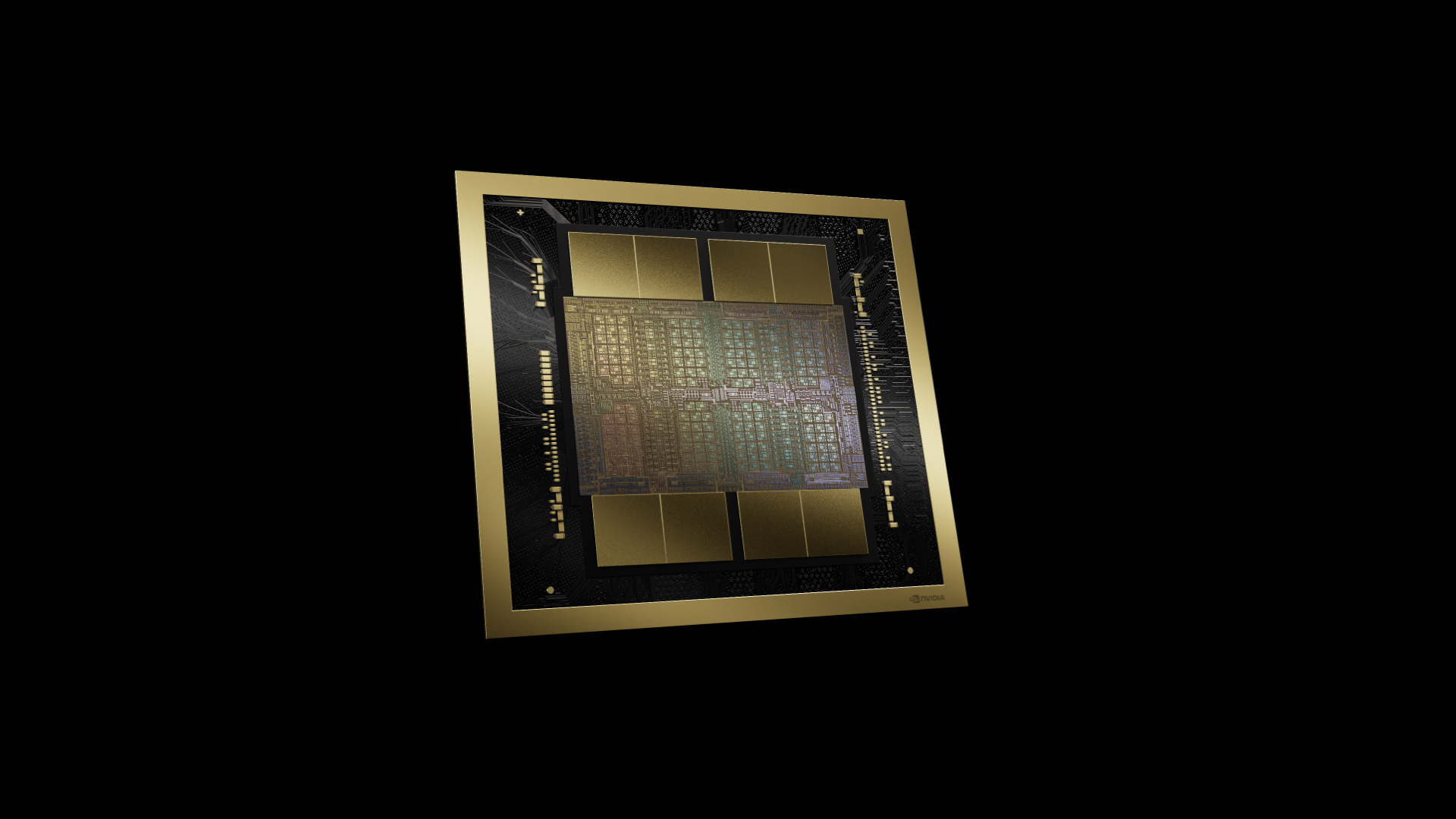

The rise of generative AI has been powered by Nvidia and its advanced GPUs. As demand far outstrips supply, the H100 has become highly sought after and extremely expensive, making Nvidia a trillion-dollar company for the first time.

It’s also prompting customers, like Microsoft, Meta, OpenAI, Amazon, and Google to start working on their own AI processors. Meanwhile, Nvidia and other chip makers like AMD and Intel are now locked in an arms race to release newer, more efficient, and more powerful AI chips.

As demand for generative AI services continues to grow, it’s evident that chips will be the next big battleground for AI supremacy.

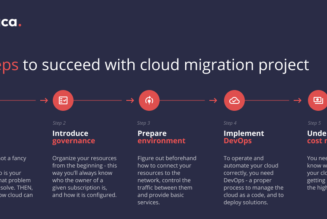

-

Nvidia’s next AI chip, Blackwell Ultra, will be unveiled next month.

Nvidia’s next AI chip, Blackwell Ultra, will be unveiled next month.Nvidia is hosting its GTC keynote on March 18th, and its keynote speaker has just revealed his talk. “Come to GTC and I’ll talk to you about Blackwell Ultra, Vera Rubin, and then show you the one click after that,” Nvidia CEO Jensen Huang told analysts on the fiscal Q4 2025 earnings call.

He says Blackwell Ultra will come in the second half of next year, with new networking, new memory, new processors, but on the same system architecture as Blackwell.

-

OpenAI remains on track to start producing its in-house AI chip next year, according to a report from Reuters. Sources tell the outlet that OpenAI plans to finalize its design over the next few months before sending it to the Taiwan Semiconductor Manufacturing Co (TSMC) for fabrication.

By making a chip of its own, OpenAI won’t have to use Nvidia’s chips as much to train and run AI models. TSMC will produce the chip using the more efficient 3-nanometer technology, with “high-bandwidth memory” and “extensive networking capabilities,” according to Reuters.

-

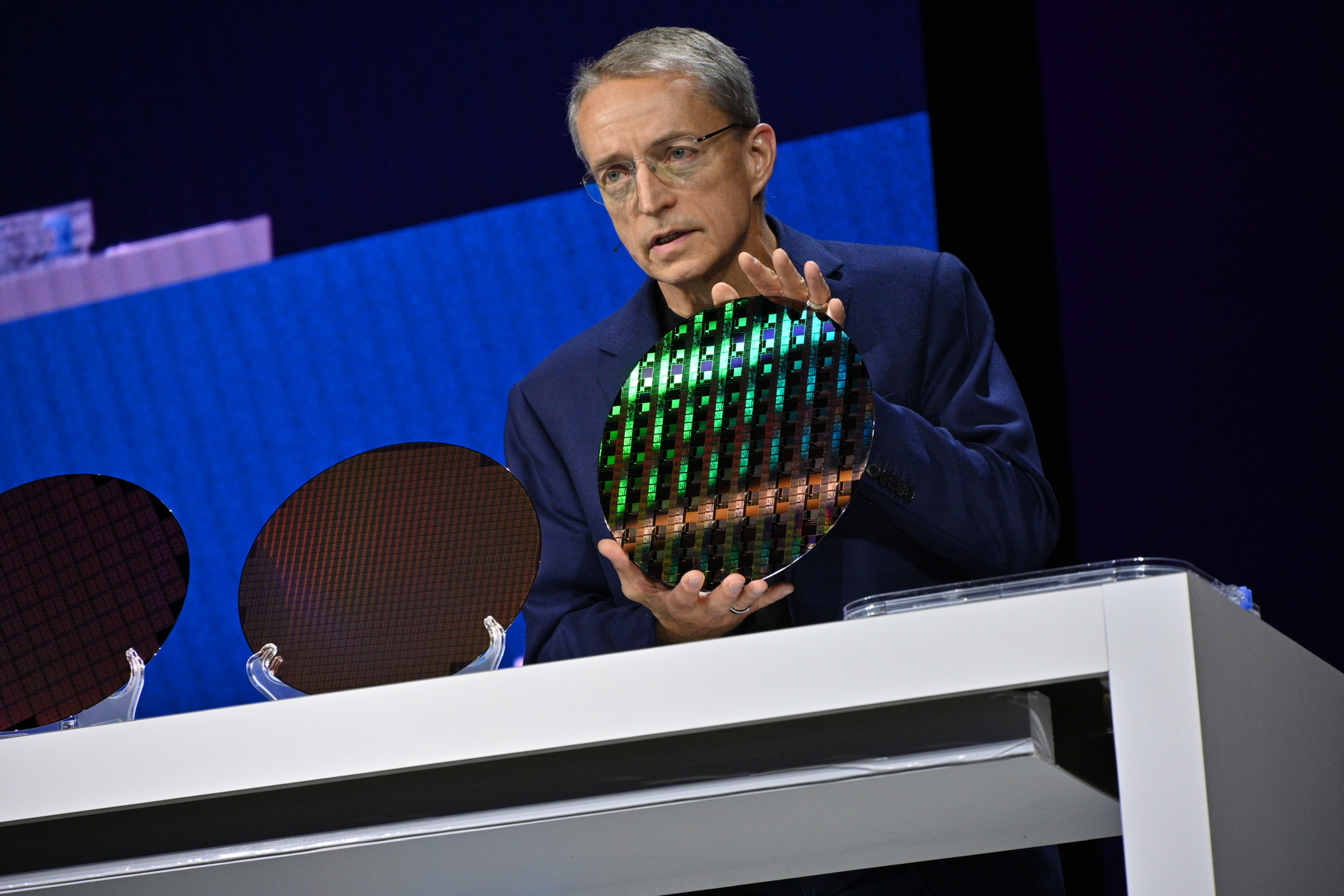

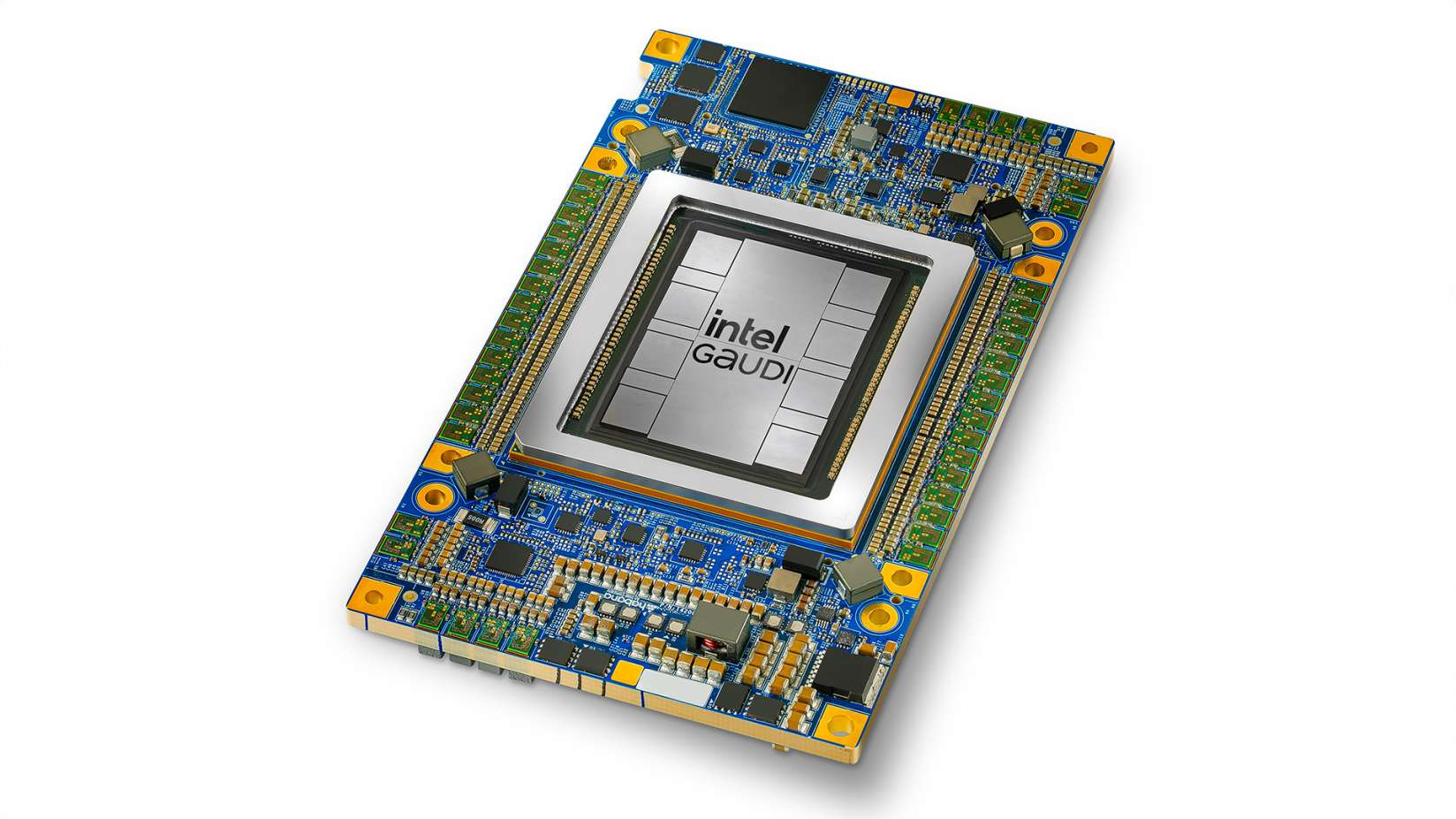

Intel is canceling Falcon Shores, its next big AI chip.

Intel is canceling Falcon Shores, its next big AI chip.So, says Holthaus, Intel will “simplify our roadmap and concentrate our resources” by canceling Falcon Shores. We plan to leverage Falcon Shores as an internal test chip only without bringing it to market.” It’ll focus on Jaguar Shores, a “system-level solution at rack scale,” instead.

Sean Hollister -

Last quarter, amid turmoil and restructuring, chipmaker Intel announced one of the largest corporate quarterly losses of all time — $16.6 billion, ten times worse than its $1.6B loss the quarter before. But in today’s Q4 2024 and full-year earnings release, Intel’s not hurting as badly: the company just announced a mere $126 million quarterly loss on $14.3 billion in revenue, and its executives are talking about simplifying the company so it can win in the future.

The company isn’t in great shape despite the staunched bleeding, as its primary businesses were all down this quarter and barely up over the full year (see table below). And if you thought its chipmaking foundries were spending too much back when they lost $7 billion in 2023, well, Intel just revealed the foundries lost nearly double that — $13.4 billion — across 2024.

-

Nvidia’s market cap drops by almost $600 billion amid DeepSeek R1 hype.

Nvidia’s market cap drops by almost $600 billion amid DeepSeek R1 hype.As Chinese AI startup DeepSeek draws attention for open-source AI models that it says are cheaper than the competition while providing similar or better performance, AI chip king Nvidia’s stock price dropped today.

CNBC said that after closing at $118.58, down 17 percent, this was “the biggest drop ever for a U.S. company.”

-

Elon Musk doesn’t miss an opportunity to take a dig at OpenAI — even when the news item in question is supposed to be favorable to President Trump. Just a few hours after yesterday’s White House presser on The Stargate Project wrapped up, Musk posted on X that “they don’t actually have the money.”

Softbank, OpenAI, Oracle, and MGX have committed to “deploy” $100 billion now and $500 billion toward the AI data center company over the next four years.

-

An AI supercomputer you can carry around.

An AI supercomputer you can carry around.This is Nvidia CEO Jensen Huang’s introduction of Project Digits, a GB10 Grace Blackwell Superchip-powered system with 128GB of RAM that costs about $3,000 and can run sophisticated AI models in a package small enough to sit on your desk.

-

Sony is furthering its partnership with AMD so they can create more AI-powered technology to make games look and play better — and not just on PlayStation hardware. The two companies are establishing a “deeper collaboration” to work on “Machine Learning-based technology for graphics and gameplay,” lead architect of the PS5 and PS5 Pro Mark Cerny announced on Wednesday.

The two already partner on the PS5 and PS5 Pro’s GPUs, which are based on AMD’s RDNA 2 architecture, and the PS5 Pro uses a feature called PSSR (PlayStation Spectral Super Resolution) to improve image clarity and frame rates.

-

China is investigating Nvidia over antitrust violations, reportedly over claims the chipmaker failed to follow conditions set during China’s approval for its $6.9 billion acquisition of Israeli network hardware company Mellanox in 2020.

While announcing the DGX A100 GPU after acquiring Mellanox, Nvidia CEO Jensen Huang said this while explaining its importance to his company:

-

On Monday, Intel CEO Pat Gelsinger abruptly decided to retire after less than four years on the job. That was the official story, anyhow. Within hours, Reuters, Bloomberg, and The New York Times had a different one: the board of directors pushed him out.

Three and a half years ago, Gelsinger announced an ambitious plan to turn around the troubled chipmaker within four years — now, he’s reportedly been kicked out of the company before he could see it through. It happened so abruptly that Intel doesn’t have a planned successor in mind, and so completely that Gelsinger won’t even stick around as an adviser. He’s gone.

-

-

Nvidia has become the world’s most valuable company on the back of AI chips, passing Microsoft and Apple along the way, and in today’s Q3 2025 earnings, the company suggested its record AI revenue and profits are only the beginning.

While The Information recently reported that its new flagship Blackwell AI servers might have cooling issues, the company didn’t address that on today’s call — instead, Nvidia assured investors that Blackwell is in “full production,” is “full steam” ahead, and that the company would continue to deliver more of the chips each quarter from here on out.

-

Nvidia just made nearly $20 billion in pure profit in a single quarter.

Nvidia just made nearly $20 billion in pure profit in a single quarter.$14.8 billion profit in Q1, $16.6 billion in Q2, and now $19.3 billion in Q3 of fiscal 2025 — that’s profit, not earnings. (Earnings were $35.08 billion, up from $30.04 billion last quarter.)

The vast majority is from AI data center, of course — but gaming did have a 14 percent bump. It’s a $3B-a-quarter business, while data center is a $30B one.

-

Nvidia made a fortune on the AI boom. AMD’s rival AI chip became the fastest ramping product in its history, already pulling in $1 billion per quarter and inspiring AMD to remake itself as an AI company too. But Intel, which suggested it would pull in $1 billion, even $2 billion on the back of AI in 2024, now says it won’t even meet its more modest $500 million goal for its Gaudi AI accelerator this year.

“We will not achieve our target of $500 million in revenue for Gaudi in 2024,” CEO Pat Gelsinger just said on the company’s Q3 2024 earnings call today.

-

OpenAI is reportedly working with Broadcom to develop new custom silicon designed to handle its large AI workloads for inference and secured manufacturing capacity with TSMC, according to sources speaking to Reuters. OpenAI has reportedly built a chip development team of about 20 people, including lead engineers who previously worked on Google’s Tensor processors for AI.

Still, on its current timeline, the custom-designed hardware may not start production until 2026.

-

“We had a design flaw in Blackwell,” admits Nvidia CEO.

“We had a design flaw in Blackwell,” admits Nvidia CEO.“It was functional, but the design flaw caused the yield to be low. It was 100% Nvidia’s fault,” Nvidia’s Jensen Huang tells Reuters, effectively confirming The Information’s report from August about why its new flagship AI chips won’t ship in large amounts right away.

He says it’s now fixed, but the timeline stays the same: Q4 for first shipments.

-

AMD’s AI chips are coming for Nvidia — but how quickly?

AMD’s AI chips are coming for Nvidia — but how quickly?AMD says the MI325X, shipping Q4, will beat Nvidia’s H200. But Nvidia seems a step ahead; it’ll ship “several billion dollars” of its next-gen Blackwell B200 GPU in Q4, too. AMD says its Blackwell competitor, the MI355X, won’t arrive till 2H 2025.

AMD isn’t talking price, but told us it’ll undercut Nvidia when it comes to total cost of ownership.

-

Samsung and TSMC have reportedly discussed building AI chip “megafactories” in the UAE.

Samsung and TSMC have reportedly discussed building AI chip “megafactories” in the UAE.We’ve heard rumors about AI chip manufacturing projects in the Middle East linked to OpenAI Sam Altman and Elon Musk.

Now, the WSJ says Samsung and TSMC execs have visited the United Arab Emirates “recently,” discussing projects worth up to $100 billion despite concerns about water sources and building up local engineering talent.

-

On Friday afternoon, The Wall Street Journal reported Intel had been approached by fellow chip giant Qualcomm about a possible takeover. While any deal is described as “far from certain,” according to the paper’s unnamed sources, it would represent a tremendous fall for a company that had been the most valuable chip company in the world, based largely on its x86 processor technology that for years had triumphed over Qualcomm’s Arm chips outside of the phone space.

The New York Times corroborated the report on Friday evening, adding that “Qualcomm has not yet made an official offer for Intel.”

-

Apple A16 chips are reportedly being made in America.

Apple A16 chips are reportedly being made in America.Former Bloomberg reporter Tim Culpan writes on Substack:

Apple’s A16 SoC, which first debuted two years ago in the iPhone 14 Pro, is currently being manufactured at Phase 1 of TSMC’s Fab 21 in Arizona in small, but significant, numbers, my sources tell me.

They’re only used in the iPhone 14 Pro and standard iPhone 15 right now, but maybe the American-made chips Apple signed up for will end up in a future iPhone SE someday. The question is if it’s worth the costs.

-

Intel is spinning off its chipmaking business as part of its plans to reverse billions in losses and a tumbling stock price. In an announcement on Monday, Intel CEO Pat Gelsinger said the Intel Foundry will become an independent subsidiary with “clearer separation and independence” from Intel.

With the change, the Intel Foundry will have its own operating board and report its financial earnings separately from Intel. Intel will also stop work on the factories it’s building in Poland and Germany for two years “based on anticipated market demand.” The company is still moving forward with its plants in Arizona, Oregon, New Mexico, and Ohio, however.

-

What’s next after the PS5 Pro? A report from Reuters focuses on Sony’s plans beyond this fall’s new $700 system, saying that the battle to win a contract for the chip powering a future PlayStation 6 came down to AMD vs. Intel, with others like Broadcom eliminated earlier, with AMD eventually winning out.

According to Reuters, since AMD makes the chip in the PS5 and PS5 Pro, maintaining backward compatibility in a possible move was part of “months” of discussions in 2022 between executives and engineers at Sony and Intel. However, Intel’s bid was blocked because they couldn’t agree on how much profit Intel would make from each chip it would design as Taiwan Semiconductor Manufacturing Co (TSMC) handled the manufacturing process.

-

TikTok’s parent company reportedly gets closer to making its own AI chips.

TikTok’s parent company reportedly gets closer to making its own AI chips.A report from The Information details the China-based ByteDance’s plans to mass produce two new AI chips by 2026 with Taiwan Semiconductor Manufacturing Company (TSMC). The move would help ByteDance save “billions of dollars” as opposed to buying chips from Nvidia.

-

AMD is saying the quiet part out loud: it’s now prioritizing AI chips ahead of flagship GPUs for gamers. The company’s just laid out a new business strategy, where it will merge its RDNA gaming graphics and CNDA data center efforts into a single universal “UDNA” that’s aimed at AI first.

In two interviews with Tom’s Hardware (you’ll definitely want to read both), AMD computing and graphics boss Jack Huynh doesn’t beat around the bush. With gaming graphics, he explains, the goal is now building scale and market share at lower price points — not the “King of the Hill” flagship GPUs that haven’t convinced enough buyers to leave Nvidia behind.

-

An antitrust investigation by the Department of Justice focusing on Nvidia’s AI dominance as the hardware company of choice is escalating, reports Bloomberg. The outlet reports that Nvidia and other companies have received legally binding requests for information as its sources say regulators are investigating whether Nvidia is “making it harder to switch to other suppliers and penalizes buyers that don’t exclusively use its artificial intelligence chips.”

“Nvidia wins on merit, as reflected in our benchmark results and value to customers, and customers can choose whatever solution is best for them. We have inquired with the U.S. Department of Justice and have not been subpoenaed. Nonetheless, we are happy to answer any questions regulators may have about our business,” said Nvidia spokesperson John Rizzo, as reported previously by CNBC.