Centum Investment Company has bought out a UK renewable energy fund from Akiira Geothermal Limited, doubling its stake to 75 per cent, as it holds talks with potential investors to build a green power plant.

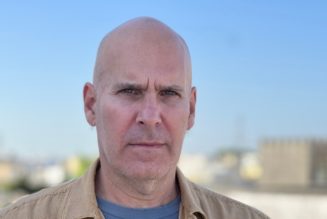

Centum chief executive James Mworia said the firm had acquired the entire 37.5 per cent stake in the DI Frontier Market & Carbon Fund last month, adding to a similar-sized stake it already held in Akiira.

He said the deal would help Centum drive value creation in the significant and growing demand for green energy in Kenya and beyond.

“At 37.5 per cent, we felt we could not do much even in terms of raising money for the company. At 75 per cent, we will be able to drive value and maximise on the existing market opportunity in the geothermal industry,” Mr Mworia said in a phone interview, declining to give details of the value of the deal.

Centum invested Sh1.97 billion in Akiira Power in 2016 for a 37.5 per cent stake. The book value of the investment at the end of March 2024 was Sh1 billion.

This indicates that Centum spent hundreds of millions of shillings to acquire the additional stake in Akiira, whose other shareholders are Marine Power Generation (15 per cent) and RAM Energy Inc (10 per cent).

Mr Mworia added that there were discussions with potential investors to inject money into Akiira to help build a 140 megawatt (MW) geothermal plant. He did not disclose the amount of money being sought, saying it was market sensitive.

“We are in advanced discussions with a number of investors to enable us to close the equity round for development of a 140MW power plant. I cannot divulge further details before this closes,” he said.

Centum holds its stake in Akiira through Investpool Holdings Limited, a Mauritius-based company that wholly owns Mvuke Limited – a special purpose vehicle for the exploration of geothermal opportunities in Africa.

The investment company said last year that it had received all approvals and contracts for the geothermal plant. However, it said the project had been delayed by challenges in the process of developing and drilling the geothermal resource.

As a result of the challenges, Centum partnered with a utility company with the necessary experience in developing geothermal fields to help it complete the contracting phase and resume drilling activities.

In the same year of 2016, Centum invested Sh2 billion in Amu Power – a joint venture between Centum and Gulf Energy. However, the project suffered several setbacks, including the revocation of an environmental permit, delays in raising funds from banks and the announcement by technical partner General Electric that it was exiting the coal business.

Centum has written off its Sh2 billion investment in the project due to uncertainties surrounding government approvals and funding.

The diversified investment firm on Tuesday proposed a dividend of Sh210 million after results for the year ended March 2024 showed it had returned to profit, helped by a rise in the valuation of investment properties in the Two Rivers Special Economic Zone.

The latest dividend, equivalent to Sh0.32 per share, is a 46 per cent drop from the Sh0.60 per share totalling Sh400 million paid by the investment firm in the previous period.