The lack of crypto regulation in the United States has long complicated the lives of users and service providers, and now a judge has acknowledged the pain the judiciary also feels from its absence. Chief United States Bankruptcy Judge Martin Glenn, the judge who is leading the Celsius case, said the court will look abroad for guidance in the case.

Glenn wrote in an Oct. 17 filing in the Celsius case:

“Many, or pe[r]haps most, cases involving cryptocurrency may raise legal issues for which there are no controlling legal precedents in this Circuit or elsewhere in the United States or in other countries in which cases arise.”

However, the court may consider the 529-page “Digital Assets: Consultation Paper” published by the Law Commission of England and Wales in the Celsius case in the future, as the document addresses “many legal issues arising in cases involving digital assets.”

Judge Glenn, who oversees #Celsiusbankruptcy, filed a letter saying because there is often no legal precedence for crypto in the US, the court may refer to the UK’s “Digital Assets Consultation Paper” for guidance.

Letter: https://t.co/jqcGfWFYhg

Paper: https://t.co/1n380Rh0u8 pic.twitter.com/WhkO8p4Id7— Amy Castor (@ahcastor) October 17, 2022

The judge noted: “Legal principles that are applicable in the United Kingdom are not binding on courts in the United States,” but said those principles “may be persuasive in addressing legal issues that may arise in this case.”

The paper was released on July 28 and is not legally binding in the United Kingdom. It contains provisional law reform proposals and it is open to comments through Nov. 4. It suggests looking at crypto assets as a new “category of personal property.”

Related: Celsius bankruptcy proceedings show complexities amid declining hope of recovery

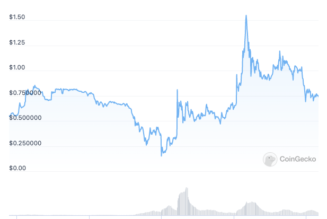

Crypto lending platform Celsius filed for bankruptcy on July 13 after halting withdrawals on June 13. Due to the complexity of the case, the United States trustee handling the case asked for an independent examiner to “untangle” Celsius’ finances and business operations and assess accusations against Celsius of incompetence and mismanagement.

FTX head Sam Bankman-Fried, who earned the moniker of “banker of last resort” during the recent crypto market meltdown, has promised to “take a look” at Celsius but has not taken any other action.

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

Tagged: bankruptcy, crypto blog, Crypto news, Lending