Crypto

Wazupnaija – Naija Entertainment blogs & Forums – Business – Crypto

Central African Republic eyes legal framework for crypto adoption

A 15-member committee is tasked with working on a legal framework that will allow cryptocurrencies to operate in Central African Republic and expedite the development of the national economy. News Own this piece of history Collect this article as an NFT Central African Republic (CAR), a developing country in Central Africa, set up a 15-member committee responsible for drafting a bill on the use of cryptocurrencies and tokenization in the region. According to Faustin-Archange Touadéra, the president of CAR, cryptocurrencies can potentially help eradicate the country’s financial barriers. He believed in creating a business-friendly environment supported by a legal framework for cryptocurrency usage. A rough translation of the official press release reads: “With access to cryptocurrencies, th...

Crypto Biz: SBF’s newest Excel spreadsheet reveals all

Large enterprise businesses spend tons of money keeping track of their financial dealings — think accountants, financial analysts, consultants and enterprise-grade accounting software. Sam Bankman-Fried, meanwhile, used Microsoft Excel. On Jan. 17, in another sloppy Excel spreadsheet, SBF revealed that FTX US was solvent. The Excel file purportedly showed customer balances, bank deposits and assets held in cold storage. “S&C forgot to include bank balances” of roughly $428 million, SBF said, referring to FTX’s former legal counsel Sullivan & Cromwell. “Once you add those back in, you get in the neighborhood of my prior balance sheet” of around $350 million, he said. This week’s Crypto Biz explores the “Herculean investigative effort” to identify billions in liquid FTX assets....

Going cashless: Norway’s digital currency project raises privacy questions

The small Nordic country of Norway may not be particularly notable on the global crypto map. With its 22 blockchain solution providers, the nation doesn’t stand out even at the regional level. However, as the race to test and implement central bank digital currencies (CBDCs) accelerates every day, the Scandinavian nation is taking an active stance on its own national digital currency. In fact, it was among the first countries to begin the work on a CBDC back in 2016. Dropping cash In recent years, amid a rise in cashless payment methods and concern over cash-enabled illicit transactions, some Norwegian banks have moved to remove cash options altogether. In 2016, Trond Bentestuen, then an executive at major Norwegian bank DNB, proposed to stop using cash as a means of payment in the c...

Bitcoin due new ‘big rally’ as RSI copies 2018 bear market recovery

Bitcoin (BTC) is in for a new “big rally” as market strength copies conditions from after the 2018 bear market. According to the latest analysis, BTC/USD will continue to head higher “after some consolidation” thanks to key signals from its relative strength index (RSI). Bitcoin prints never-before-seen bullish divergence With the BTC price gains still coming, Bitcoin bulls are feeling increasingly confident despite widespread mistrust of the longevity of the current rally. For popular trader Crypto Wolf, a key phenomenon now underway sets Bitcoin’s latest recovery apart from all others. RSI, he noted on Jan. 18, had printed a long-awaited bullish divergence on weekly timeframes — something which has never happened before. “BTC printed a rare weekly RSI bullish divergence. Never happened i...

Crypto to play ‘major role’ in UAE trade: foreign trade Minister

Crypto will play a “major role” in the United Arab Emirates’ global trade moving forward, says the UAE’s minister of state for foreign trade Thani Al-Zeyoudi. Speaking with Bloomberg on Jan. 20 in Davos Switzerland — where world leaders are currently gathered for the 2023 World Economic Forum — Al-Zeyoudi provided a host of updates regarding the UAE’s trade partnerships and policies heading into 2023. Minister Thani Al-Zeyoudi: Bloomberg Commenting on the crypto sector, the minister stated that “crypto will play a major role for UAE trade going forward,” as he outlined that “the most important thing is that we ensure global governance when it comes to cryptocurrencies and crypto companies.” Al-Zeyoudi went on to suggest that as the UAE works on its crypto regulatory regime, the...

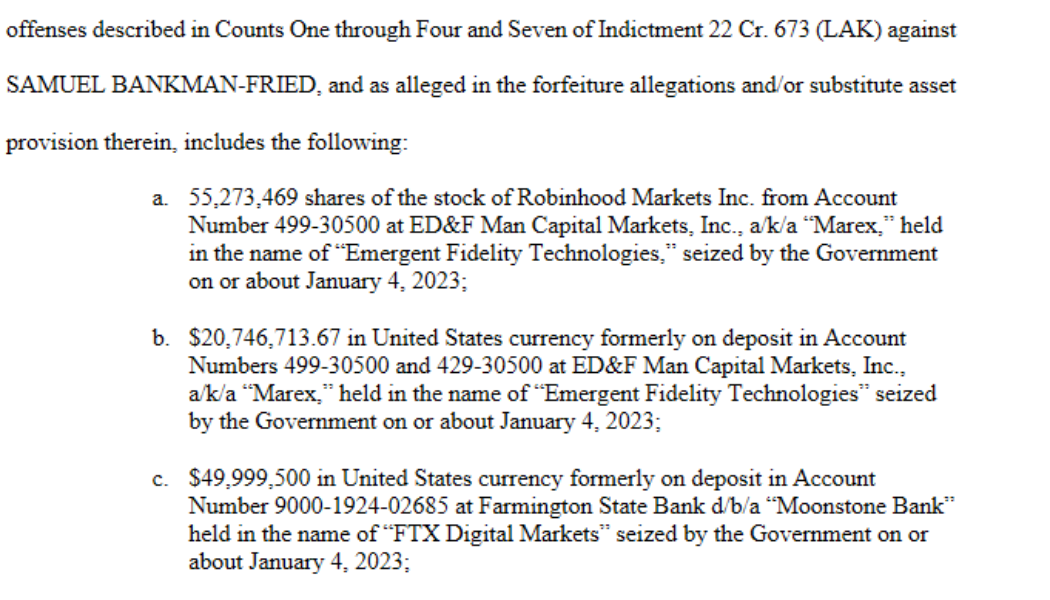

SBF to forfeit $700M worth of assets if found guilty of fraud

According to new court filings, disgraced FTX founder Sam Bankman-Fried (SBF) will be subject to the forfeiture of roughly $700 million worth of assets if he were to be found guilty of fraud. In a court document filed on Jan 20, U.S. federal prosecutor Damian Williams outlined that the “government respectfully gives notice that the property subject to forfeiture” covers a long list of assets across fiat, shares and crypto. The filings state that most of the assets were seized by the government between Jan.4 and Jan. 19, while it is also looking to lay claim to “all monies and assets” belonging to three separate Binance accounts. Looking at the list of seized assets, the biggest allocations include 55,273,469 Robinhood (HOOD) shares worth roughly $525.5 million at the time of writing, $94.5...

FTX VCs liable to ‘serious questions’ around due diligence — CFTC Commissioner

Amid ongoing investigations around the defunct crypto exchange FTX, the Commodity Futures Trading Commission (CFTC) questions the due diligence conducted by institutional investors and their accountability regarding the loss of users’ funds. CFTC Commissioner Christy Goldsmith Romero stated that VCs that had to write down their investments in millions of dollars to nearly zero raises “serious questions” about the due diligence conducted over the last year, speaking to Bloomberg. CFTC Commissioner Christy Goldsmith Romero questioning the VCs that once backed FTX. Source: Bloomberg She raised concerns about FTX CEO John Ray’s revelations in court about not having any records and controls over the exchange’s financials. I’m glad Mr. Ray is finally paying lip service to turning the excha...

Dead cat bounce? Bitcoin price nears $23,000 in fresh 5-month high

Bitcoin (BTC) took a swing at $23,000 into Jan. 21 as Asia buyers drove fresh market strength. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bid liquidity causes suspicion Data from Cointelegraph Markets Pro and TradingView showed BTC/USD battling bears to reach $22,790 on Bitstamp overnight — its highest since August. With new multi-month peaks coming in quick succession despite fears of a major correction, Bitcoin continued to surprise as traders cleared the way for more upside. As noted by intraday trader Skew, Asia was leading the way into the weekend, with sellside pressure from market makers being absorbed on exchanges. “Another rally driven by asia bid. TWAP buyers absorbing the sell pressure from MMs. Large spot bid lifting offers & ask wall pulled prior to anothe...

DeFi should complement TradFi, not attack it: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week. Following FTX’s demise, the DeFi space is up for a complete remodel as crypto users demand better security and compliance practices. SushiSwap’s roadmap for the coming year includes the development of a decentralized exchange (DEX) aggregator, a decentralized incubator and “several stealth projects.” All these projects combined can grow its market share 10x, said the CEO. The co-founder and CEO of Ava Labs spoke with Cointelegraph at the World Economic Forum in Davos, Switzerland, on the future of DeFi and traditional finance (TradFi) and said DeFi should complement TradFi, not attack it. Another DeFi report sugge...

Stellar joins CFTC’s Global Markets Advisory Committee as one of four crypto orgs

The Stellar Development Foundation (SDF) has become the newest member of the United States Commodity Futures Trading Commission (CFTC) Global Markets Advisory Committee (GMAC), the blockchain announced on its blog. The committee is preparing to meet on Feb. 13 for the first time in over a year. SDF supports the Stellar blockchain, which is used for crypto-fiat transfers. The foundation will be represented on the committee by chief operating officer Jason Chlipala. He wrote in the company blog that “we hope to bring the unique perspective of Layer 1 protocols” to the GMAC and: “As part of the Committee, SDF will highlight the role of stablecoins in the digital asset markets and real-world use cases, including leveraging stablecoins in the delivery of humanitarian aid.” Stellar is the issuer...