Crypto

Wazupnaija – Naija Entertainment blogs & Forums – Business – Crypto

Mining Bitcoin at home — Is it time to start? Market Talks

On this week’s episode of Market Talks, Cointelegraph welcomes Justin Kramer, CEO of Badgerland Home Crypto Mining — a home-based crypto mining equipment business. This week, to kick things off, we get to know a little bit about Kramer and his mining business. What are his expertise and experience with crypto mining, and how did he gravitate toward it? We also get his take on the current market conditions and the price of Bitcoin (BTC). Doing anything from your house, whether it’s working from home or mining cryptocurrencies, comes with its own set of challenges, especially when you’re first starting out. We find out what some of those challenges are and how to overcome them. This is especially useful for anyone looking to set up their own mining rig at home. We discuss the five major thin...

Congress may be ‘ungovernable,’ but US could see crypto legislation in 2023

The United States House of Representatives finally elected a speaker last week, concluding a four-day, 15-ballot ordeal that left many wondering if political gridlock was now the new normal in the U.S., and if so, what the consequences would be. For example, were the concessions made by Republican Kevin McCarthy to secure his election as speaker ultimately going to make it difficult to achieve any sort of legislative consensus, making it impossible for the U.S. to raise its debt ceiling and fund the government later this year? Not all were optimistic. The House of Representatives will be largely “ungovernable” in 2023, Representative Ritchie Torres, a Democrat from New York, told Cointelegraph on Jan. 6, shortly before joining colleagues for that day’s series of ballots — which final...

Orange Financial To Launch Innovative Yield Farming Treasury – Stablecoin Rewards for NFT Holders

Geneva, Switzerland, 12th January, 2023, Chainwire Orange Financial, a multi-chain yield farming treasury, is excited to announce its public mint date on February 1st, 2023. As the only NFT project to offer stablecoin rewards through yield farming to its holders, Orange Financial will revolutionize the world of yield farming and NFTs. Through its innovative approach, Orange Financial has created a basket of DeFi assets and farming opportunities to provide yield for its NFT holders. The Treasury takes care of all the compounding and harvesting on behalf of its holders and routes the returns back through USDC, making it a convenient and secure choice for hands-off diversification. One of the key features of Orange Financial is that the Treasury rewards users in stablecoins as opposed to usin...

Gary Gensler finds new audience for his crypto skepticism: the US Army

United States Securities and Exchange Commission (SEC) chair Gary Gensler has found a new audience for his crypto-skeptical pep talks — the United States Army. On Jan. 11, the U.S. Army hosted its first Twitter Spaces event of 2023, with Gensler and SEC commissioner Caroline Crenshaw joining the discussion to provide financial advice on how and where U.S. soldiers should invest their money. https://t.co/oRjE3pDc8C — U.S. Army (@USArmy) January 11, 2023 Sergeant Lawrence Holmes noted “there are soldiers that look for those alternative investments [such as] crypto assets,” asking the pair what risks there were to crypto investing. “It’s the Wild West,” Gensler answered, adding that “most of these 10,000 or 15,000 tokens will fail.” “History tells us there’s not much room for micro currencies...

Nifty News: ‘Degen’ season returns with feet NFTs, disappointing Game of Thrones NFTs and more

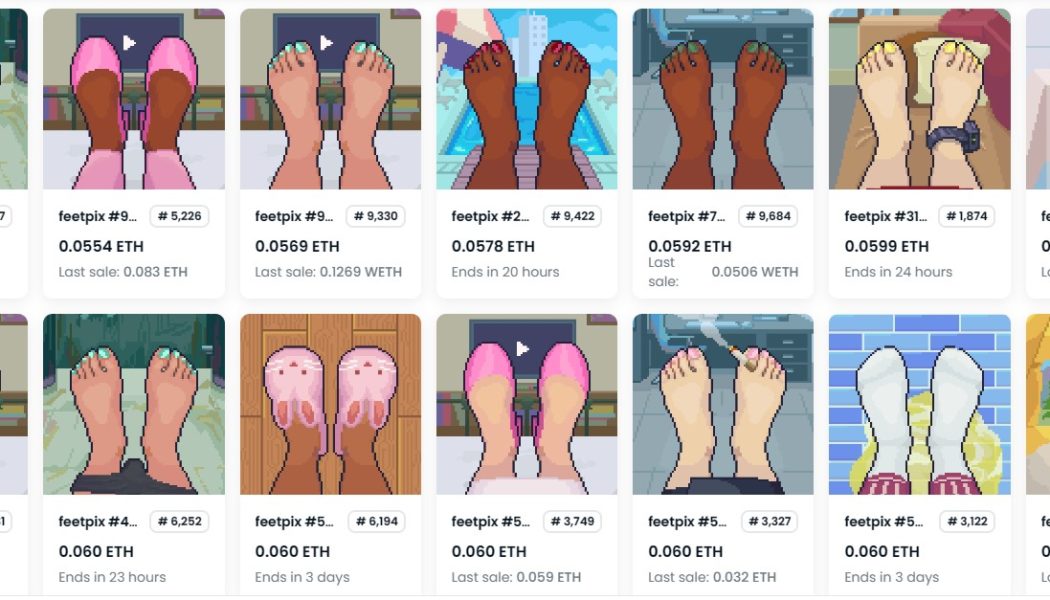

‘Degen’ season smells like pixelated feet Feetpix.wtf’s newly launched nonfungible token (NFT) collection, “Feetpix,” has seemingly taken the NFT community by storm with surging trading volumes, prompting some to suggest the return of “degen” season. Feetpix.wtf’s collection soared ahead of Bored Ape Yacht Club (BAYC) on Jan. 11 with the fifth-highest trading volume recorded on NFT marketplace OpenSea. Feetpix NFTs come in different skin tones, nail colors, shoes and backgrounds. Image: OpenSea. The project — which released 10,000 Feetpix NFTs — has traded over 825 Ether (ETH) ($1,157,000) across nearly 18,000 transactions since its release on Jan. 8. Crypto Twitter is still split on what inspired the surge in foot fetish-NFT trading volumes. However, Feetpix noted the absence of a roadmap...

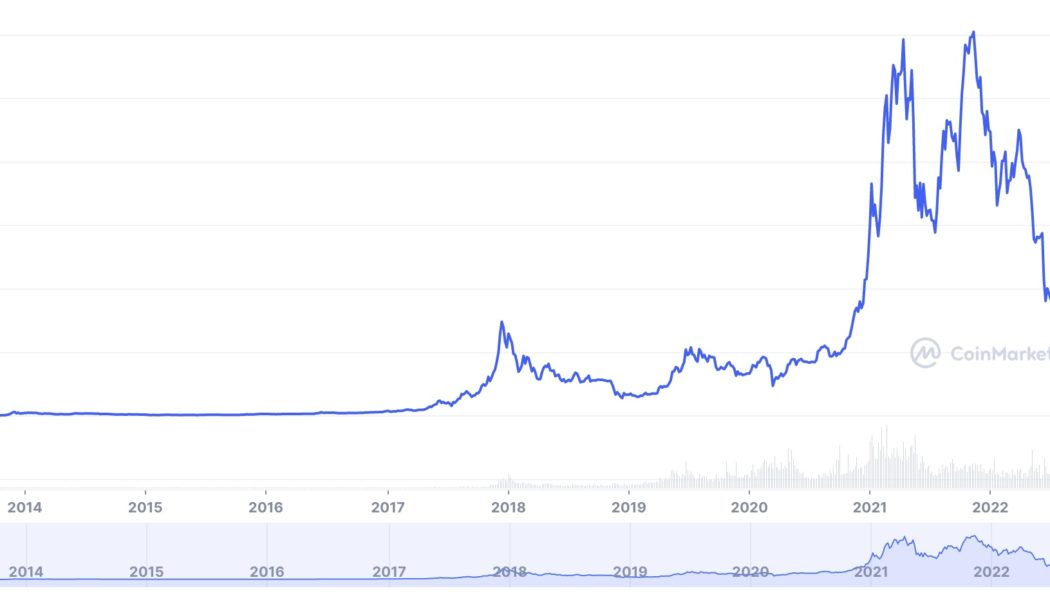

Bitcoin mining ETF tops equity ETF market in new year’s performance charts

Bitcoin (BTC) and other altcoins started the new year on a bullish note, with most cryptocurrencies surging to multi-month highs. Apart from the spot market, the equity exchange-traded fund (ETF) market is also dominated by BTC, wherein Valkyrie’s Bitcoin Miners ETF (WGMI) is the leading equity ETF market and is up by 40% year to date. The Bitcoin mining ETF is leading the traditional equity ETF market and the leveraged equity ETFs, which is considered a rare occurrence. Bloomberg senior ETF analyst Eric Balchunas pointed out that the Valkyrie Bitcoin mining ETF is highly “concentrated,” with investment in only 20 firms, including Argo Blockchain, Bitfarm and Intel, among other notable names. Cast your vote now! The WGMI ETF was listed on the Nasdaq in February 2022 but...

Ava Labs partners with AWS to offer one-click node deployment

Ava Labs, the developer of the Avalanche network (AVAX), has partnered with Amazon Web Services (AWS) to implement new features intended to make running a node easier, according to a Jan. 11 blog post from Ava Labs. The new features include one-click node deployment through the AWS Marketplace, AWS GovCloud integration for decentralized app (DApp) developers concerned about compliance, and the ability to create Avalanche subnets with just a few clicks. It’s official! @Amazon #ChoseAvalanche to bring scalable blockchain solutions to enterprises and governments #AWS fully supports Avalanche’s infrastructure and dApp ecosystem, including one-click node deployment, offering the best tooling for these high compliance use cases. pic.twitter.com/syInSrU9XD — Avalanche (@avalancheavax) January 11,...

Miami-Dade gains right to remove FTX name from Heat arena

Miami-Dade County will soon start to remove FTX’s advertising brand from the NBA’s Miami Heat arena, after granting the right from a United States bankruptcy judge in Delaware on Jan. 11, the Associated Press reports. County officials negotiated in 2021 a $135 million deal with the crypto exchange for renaming rights to the Miami Heat’s arena as FTX Arena until 2040. A number of entrances, the roof of the arena, the basketball court, the security polo shirts, as well as many of the cards employees use to access the facility are branded with FTX logos. Following FTX’s bankruptcy filing, officials in Miami-Dade filed on Nov. 22 a motion to terminate the naming rights agreement. As part of that deal, the Heat were to receive $2 million annually beginning in June 2021. ...

Ooki DAO misses lawsuit response deadline, default judgment on the cards

The Commodity Futures Trading Commission (CFTC) has begun the process of getting a default judgment in its case against Ooki DAO after the latter missed the deadline to respond to the lawsuit. According to a Jan. 11 court filing, the regulator has requested the court for an “entry of default” against the decentralized autonomous organization (DAO), stating it had missed the deadline to “answer or otherwise defend” as instructed by the summons. If approved, the entry of default will establish Ooki DAO has failed to plead or defend itself in court and will no longer be able to answer or respond to the suit. An “entry of default” is the first step in the process of gaining a default judgment — a ruling handed down by the court when the defe...

From Bernie Madoff to Bankman-Fried: Bitcoin maximalists have been validated

Long before Bitcoin (BTC), Bernie Madoff sat atop the longest-running, largest fraud in history. The rise and real-time fall of Sam “SBF” Bankman-Fried, former CEO of crypto exchange FTX, were expedited in comparison. While the similarities are profound, the storyline is not: Create organizations under false pretenses, develop relationships with people in authority positions, defraud clients, survive as long as possible, and try not to get caught. Madoff advisers experienced a “liquidity” problem in 2008, around late November into early December, where the fund was unable to meet client redemption requests. On its surface, the fourth-quarter timing of the Madoff collapse more than a decade ago appears eerily similar to FTX’s 2022 implosion. Bitcoiners who hold their keys will never experie...

Venom Foundation in Partnership With Iceberg Capital Launches $1 Billion Venom Ventures Fund

Abu Dhabi, Abu Dhabi, 11th January, 2023, Chainwire Venom Foundation, the first Layer-1 blockchain licensed and regulated by the Abu Dhabi Global Market (ADGM), and Iceberg Capital, an ADGM regulated investment manager, officially announce that they have partnered to launch a $1 billion venture fund called Venom Ventures Fund (VVF). The blockchain-agnostic fund will invest in innovative protocols and Web3 dApps, focusing on long-term trends such as payments, asset management, DeFi, banking services, and GameFi. It aims to become the leading supporter of the next-generation digital technologies and entrepreneurs. Venom Ventures Fund (VVF) will leverage Iceberg Capital’s network, expertise, and capabilities to offer incubation programs and access to an extensive industry network. Furthermore...