Crypto

Wazupnaija – Naija Entertainment blogs & Forums – Business – Crypto

Bank of Thailand to allow first virtual banks by 2025

Bank of Thailand has disclosed plans to allow virtual banks to operate in the country for the first time. Financial firms will be able to provide services by 2025, a Bloomberg report shows. The “Consultation Paper on Virtual Bank Licensing Framework” published by the central bank says that applications will be available later in 2023 allowing virtual banks to act as financial services providers. The move focuses on increasing competition and boosting Thailand’s economic growth. The Bank of Thailand will issue three different licenses for interested companies by 2024. There are at least 10 parties interested in granting permissions, the report states. Regulations and supervision for virtual banks will be the same as those for traditional commercial banks under the licensing framework....

Scaramucci to invest in crypto firm founded by former FTX US boss

SkyBridge Capital founder Anthony Scaramucci is investing in a crypto company founded by the former president of FTX US. According to an email to Bloomberg, Scaramucci said he would be investing his own personal funds to support ex-FTX US president Brett Harrison’s new venture, which became known just three weeks after the collapse of crypto exchange FTX. It is understood that the crypto software company — which doesn’t yet have a name — will enable crypto traders to create algorithmic-based strategies to access different markets — both centralized and decentralized. It is also understood that Harrison has been seeking a fundraising target as high as $10 million for a $100 million valuation. In a Jan. 14 tweet responding to Harrison’s lengthy thread on Sam Bankman-Fried and his ...

3 blockchain use cases that extend beyond crypto

Blockchain use cases have expanded far beyond cryptocurrency in recent years, with multiple industries embracing the technology in a wide range of fields, including healthcare, logistics and financial services. There are many factors behind the hype. Blockchains are decentralized, transparent and increase the capacity of a whole network, opening a window for solutions that require significant computational power. More importantly, they give users the capacity to control their assets, including their data, without relying on third parties. As blockchain evolves, companies across the world are working to find the best ways to implement the technology for a range of applications. To gain further insight, Cointelegraph reached out to projects disrupting industries and bringing blockchain...

The aftermath of LBRY: Consequences of crypto’s ongoing regulatory process

The case of LBRY highlights a wave of renewed regulatory pressure that could affect both blockchain token-issuing companies and their investors. In November, an over year-long court battle between the United States Securities and Exchange Commission (SEC) and blockchain development company LBRY and its LBRY Credits (LBC) token culminated in the ruling of the token as an unregistered security, despite the company’s argument of its use as a commodity within the platform. The court’s decision in this case sets a precedent that could influence not only the regulatory perception of blockchain-based platforms, but cryptocurrencies as well. The old Howey Old standards don’t always apply when it comes to the regulation of new technologies. The LBRY case was mostly centered on the basis of th...

Navigating the World of Crypto: Tips for Avoiding Scams

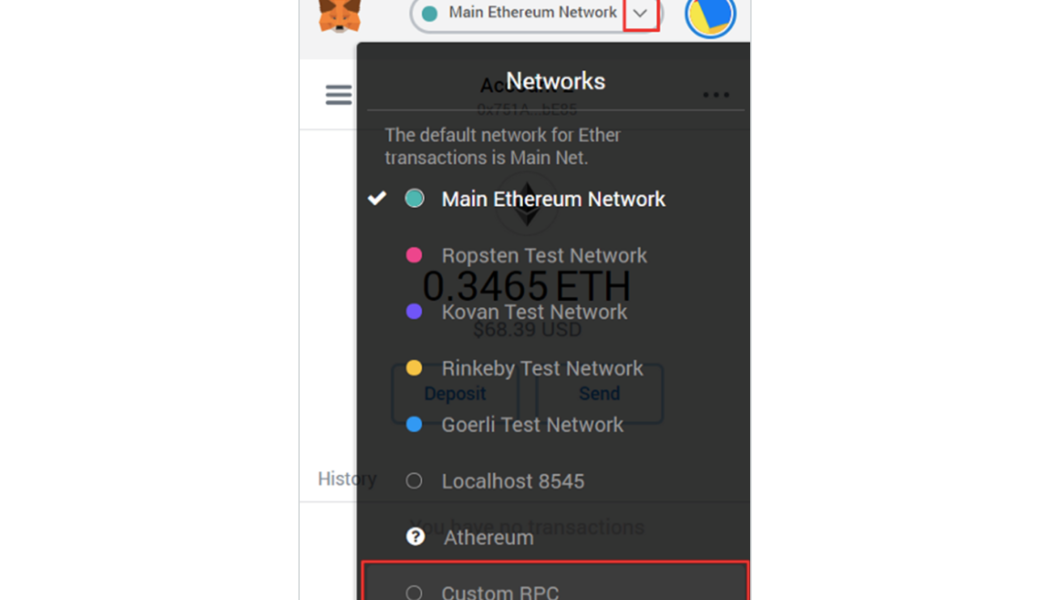

Despite the belief of many crypto enthusiasts that centralized exchanges (CEXs) are safer, history has often shown them to be rather vulnerable to attacks. Because these exchanges centralize the storage of users’ assets, they can be attractive targets for cybercriminals. If an exchange’s security measures are inadequate or successfully compromised, user assets may be stolen or lost. Another risk of centralized exchanges is the potential for fraud or mismanagement by their operators. Since CEXs may have a single point of control, they may be more susceptible to insider fraud or other forms of misconduct — which can lead to the loss of funds or other negative consequences for users. Over the last year, with the collapse of major centralized cryptocurrency platforms like FTX and Celsius, more...

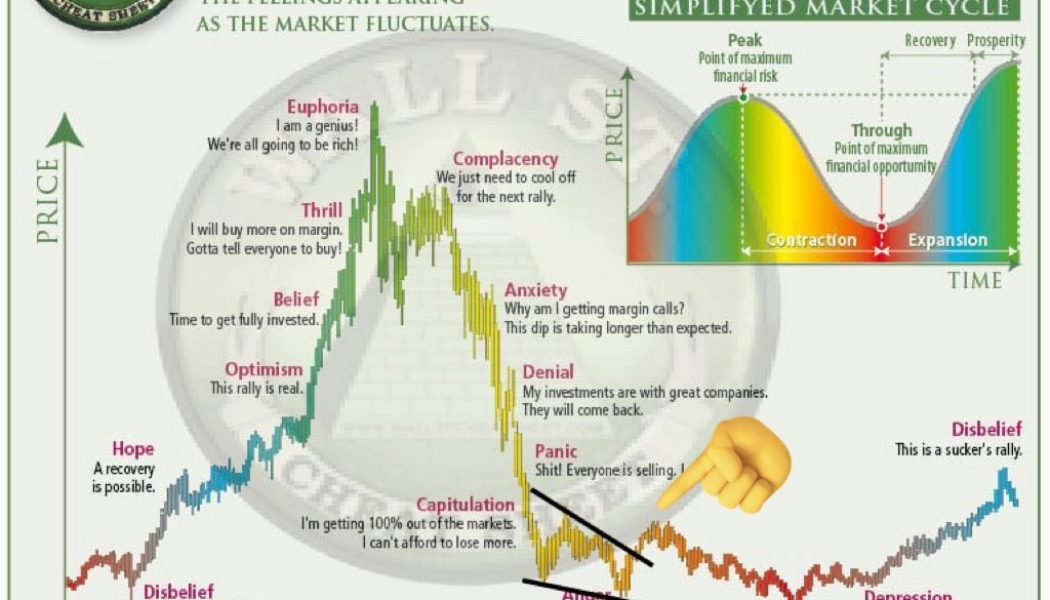

Bitcoin fails to convince that bottom is in with $12K ‘still likely’

Bitcoin (BTC) may be circling its highest levels in months, but few are convinced that the bull market is back. Ahead of a key weekly close, BTC/USD remains near $21,000, data from Cointelegraph Markets Pro and TradingView shows, with analysts nervous about the good times ending all too soon. Bitcoin to see new “depression” before bull run resumes Bitcoin is dividing opinion after its week of brisk gains. Warnings over a potential pullback abound, while others are already commiserating bears ahead of time. “Now bears will be caught in the vicious cycle of praying for pullbacks to go lower, not realizing the tides have shifted for a time and we’re going higher,” Chris Burniske, former head of crypto at ARK Invest, summarized. Even more optimistic takes such as that of Burniske, however, do ...

Can Canada stay a crypto mining hub after Manitoba’s moratorium?

Canada has remained a peculiar regulatory alternative to the neighboring United States in regard to cryptocurrency. While its licensing process has become more stringent than in some countries, Canada was the first to approve direct crypto exchange-traded funds. State pension funds have invested in digital assets, and crypto mining firms have moved to the country to take advantage of the cool temperatures and cheap energy prices. But the gold rush for miners in Canada may be slowing down. In early December, the province of Manitoba — rich in hydroelectric resources — enacted an 18-month moratorium on new mining projects. This move resembled a recent initiative in the U.S. state of New York that stopped the renewal of licenses for existing mining operations and required any new proof-of-wor...

Polygon primed for hard fork aimed at reducing gas fee spikes: New details revealed

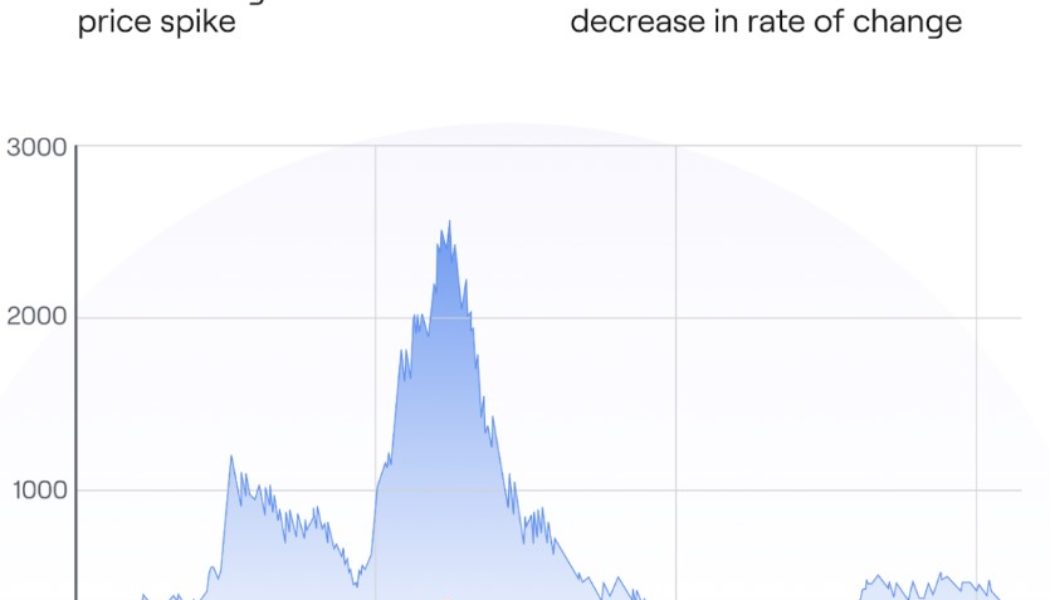

Ethereum layer-2 scaling solution Polygon will undergo a hard fork on Jan. 17 in order to address gas spikes and chain reorganizations issues that has affected user experience on the Polygon proof-of-stake (POS) chain. Polygon officially confirmed the hard fork event in Jan. 12 a blog post, which came after weeks of preliminary discussion on Polygon Improvement Proposal (PIP) forum page in late December. GET READY FOR THE HARDFORK The proposed hardfork for the #Polygon PoS chain will make key upgrades to the network on Jan 17th. This is good news for devs & users — & will make for better UX. You will NOT need to do anything differently. Details:https://t.co/RaBWDjEGrI pic.twitter.com/nipa15YQdZ — Polygon (@0xPolygon) January 12, 2023 A Polygon spokesperson also provided...

Former FTX US President lashes out at ‘insecure’ SBF in 49-part Twitter thread rant

Former FTX US President Brett Harrison has lashed out at Sam Bankman-Fried for manipulating and threatening colleagues who proposed solutions to reorganize FTX US’ management structure. Harrison shared his experiences with Bankman-Fried and FTX US on Dec. 14, explaining how he was hired “casually over text” in Mar. 2021 after working together at New York-based trading firm Jane Street for a few years. But six months into Harrison’s tenure at FTX US, “cracks began to form” between the two, he said. Despite recalling Bankman-Fried to be a “sensitive and intellectually curious person” at first, Harrison said he saw “total insecurity and intransigence” in Bankman-Fried when confronted with conflict, particularly when Harrison suggested FTX US establish separate branches for i...

Alameda Research had a $65B secret line of credit with FTX: Report

Former FTX CEO Sam Bankman-Fried (SBF) reportedly ordered Gary Wang, co-founder of the crypto exchange, to open a $65 billion “secret backdoor line of credit” for Alameda Research, according to FTX attorney Andrew Dietderich. The attorney disclosed the information during a Delaware bankruptcy court hearing on Jan. 11, the New York Post reported. The alleged line of credit was financed with FTX customers’ funds. As per Dietderich testimony, the “backdoor was a secret way for Alameda to borrow from customers on the exchange without permission.” “Mr. Wang created this backdoor by inserting a single number into millions of lines of code for the exchange, creating a line of credit from FTX to Alameda, to which customers did not consent,” Dietderich told the court, adding...

Alameda Research had a $65B secret line of credit with FTX: Report

Former FTX CEO Sam Bankman-Fried (SBF) reportedly ordered Gary Wang, co-founder of the crypto exchange, to open a $65 billion “secret backdoor line of credit” for Alameda Research, according to FTX attorney Andrew Dietderich. The attorney disclosed the information during a Delaware bankruptcy court hearing on Jan. 11, the New York Post reported. The alleged line of credit was financed with FTX customers’ funds. As per Dietderich testimony, the “backdoor was a secret way for Alameda to borrow from customers on the exchange without permission.” “Mr. Wang created this backdoor by inserting a single number into millions of lines of code for the exchange, creating a line of credit from FTX to Alameda, to which customers did not consent,” Dietderich told the court, adding...