Crypto

Wazupnaija – Naija Entertainment blogs & Forums – Business – Crypto

Samsung’s Bitcoin ETF, $700M bust, Coinbase exits Japan: Asia Express

Our weekly roundup of news from East Asia curates the industry’s most important developments. Samsung’s new Bitcoin ETF On Jan. 13, Samsung Asset Management, a wholly-owned subsidiary of the namesake South Korean conglomerate, successfully listed the Samsung Bitcoin Futures Active ETF on the Hong Kong Stock Exchange. According to local news outlet Edaily, the ETF debuted under the ticker 3135:HK and seeks to replicate the performance of spot Bitcoin by investing in Bitcoin futures listed on the Chicago Mercantile Exchange (CME). The ETF will also simplify the procedures for investors seeking exposure to regulated Bitcoin products in the Asia-Pacific time zone. Park Seong-jin, head of Samsung Asset Management’s Hong Kong office, commented: “Hong Kong is the only market in Asia where B...

Opinion: Bots are a critical tool for retail investors

The thing about the future, where robotic super traders battle over micromovements in stock price, is that it’s already here. With access to algorithmic trading bots a click away, we could be seeing the fall of human investors and the triumph of artificial intelligence. Algorithmic trading bots are programmed to buy and sell when they detect preprogrammed conditions and can execute pretty much any trading strategy. They have been used by professional traders for two decades, and these firms have taken them into the crypto markets too. Now, a new crop of accessible crypto trading tools has hit the market, made with retail clients in mind. I know — I have built several of them. Currently, I’m working on a system that helps neophyte investors find their own risk preferences based on the...

Binance tightens rules on NFT listings

According to a Jan. 19 announcement by Binance, the cryptocurrency exchange has tightened its rules for nonfungible tokens, or NFT, listings. Starting Feb. 02, 2023, all NFTs listed on Binance before Oct. 2, 2022, and have an average daily trading volume lower than $1,000 between Nov. 1, 2022, and Jan. 31, 2023, will be delisted. In addition, after Jan. 21, 2023, NFT artists can only mint up to five digital collectibles per day. Binance NFT requires sellers to complete know-your-customer (KYC) verification and have at least two followers before listing on its platform. In addition to the revised rules, Binance said it would forthwith “periodically review” NFT listings that do not “meet its standards” and recommend them for delisting. “Users can repo...

DeFi problems and opportunities in 2023: Market Talks

On this week’s episode of Market Talks, Cointelegraph welcomes Grant Shears, founder of Blocmates — an educational and consultancy company that aims to create crypto, decentralized finance (DeFi) and Web3 content that anyone can understand. This week, to kick things off, the show takes a look at the emerging trends of 2023 and what people should look forward to. What industries could really take off this year, and which sector could have the most potential to grow? It’s no secret that 2022 was not a great year for DeFi, an industry that arguably imploded on itself by offering unsustainable high yields that eventually caused the model to collapse. Host Ray Salmond, Cointelegraph’s head of markets, asks Shears if there are any projects this year that plan to fix this problem, and what that f...

FTX CEO says he is exploring rebooting the exchange: Report

John Ray, who took over as CEO of cryptocurrency exchange FTX prior to bankruptcy proceedings, has reportedly set up a task force to consider restarting FTX.com. According to a Jan. 19 report from the Wall Street Journal, Ray said everything was “on the table” when it came to the future of FTX.com, including a potential path forward with rebooting the exchange. FTX Trading, doing business as FTX.com, was one of roughly 130 companies under FTX Group that filed for Chapter 11 bankruptcy in November 2022. Ray reportedly was considering reviving the crypto exchange as part of efforts to make users whole. FTX reported on Jan. 17 that it had identified roughly $5.5 billion of liquid assets in its investigations, with more than $3 billion owed to its top 50 creditors. According to the FTX CEO, he...

Bitcoin Suisse explains why Swiss is a crypto pivot point: Davos 2023

Switzerland is a “pivot point” for crypto adoption in Europe and continues to be the “center point of the next stage of institutionalization,” said Dr. Dirk Klee, CEO of Bitcoin Suisse. Klee divulged why Switzerland is still the top spot for crypto in Europe and will continue to attract institutional investors in an exclusive Cointelegraph interview in Davos, Switzerland. We have boots on the ground in Davos! Our reporter @gazza_jenks speaks to Dr. Dirk Klee, CEO of @BitcoinSuisseAG about Switzerland and the adoption of cryptocurrency at the @wef. #CTWEF23 pic.twitter.com/ka00dvWpVz — Cointelegraph (@Cointelegraph) January 18, 2023 In discussion with Cointelegraph reporter Gareth Jenkinson, Klee explained: “A lot of trust has been destroyed and eroded in the last year and...

FinCEN lists Binance among the top Bitcoin counterparties of Bitzlato

The United States Financial Crimes Enforcement Network (FinCEN), a bureau of the Treasury Department, has argued that Binance is linked to the illegal cryptocurrency platform Bitzlato. In an order published on Jan. 18, FinCEN stated that Binance cryptocurrency exchange was among the “top three receiving counterparties” of Bitzlato in terms of Bitcoin (BTC) transactions. According to the authority, Binance was among the biggest counterparties that received Bitcoin from Bitzlato between May 2018 and September 2022. Other such counterparties included Russia-connected darknet market Hydra and the alleged Russia-based Ponzi scheme known as “TheFiniko,” FinCEN noted. On the other hand, FinCEN did not mention Binance as the top three sending counterparties in the order. According to the document,...

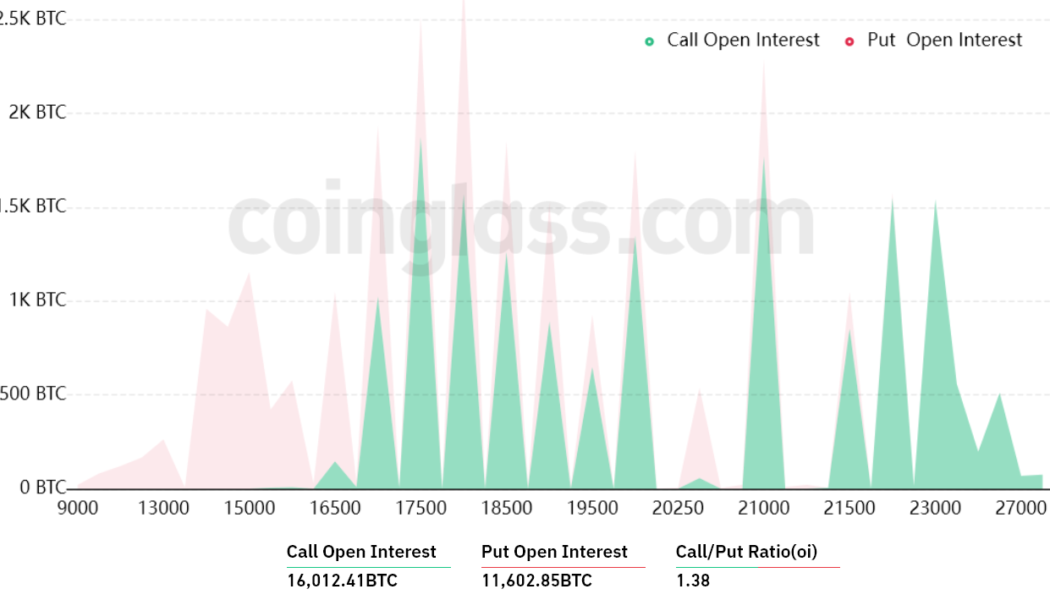

Bitcoin crowd sentiment hit multi-month high as BTC price touches $21K

Bitcoin (BTC) price climbed to a four-month high above $21,000 in the third week of January, relishing trader’s hope. The market has seen the most substantial investor optimism since July due to the January BTC price rebound. According to data shared by crypto analytic firm Santiment, the trading crowd sentiment has touched its highest in six months and second highest bullish sentiment in the past 14 months. The data indicates that traders are treating Bitcoin’s price rebound as a signal of a possible bigger breakout in the near future. The term “crowd/investor sentiment” describes how investors generally feel about a specific asset or financial market. It refers to the mood or tenor of a market, or the psychology of its participants, as expressed by activity and changes ...

FTX profited from Sam Bankman-Fried’s inflated coins: Report

Sam Bankman-Fried, the former CEO of the FTX crypto exchange, used his influence in the crypto industry to inflate some coins prices through a coordinated strategy with FTX’s sister company, Alameda Research, a New York Times report claimed on Jan. 18. As a way to keep FTX and the companies under its umbrella profitable, Bankman-Fried allegedly approached developers behind projects, insisting that they make their trading debuts on the exchange’s platform. Following that, the report claimed, Alameda Research would buy some of these freshly listed coins to raise their value. Bankman-Fried thenallegedly relied on his popularity to advertise the projects and persuade the crypto community to invest in these “Samcoins.” As a result, Alameda appeared to be in a stronger position than it actually ...

Digital Dollar Project urges US to take action on CBDC development

The Digital Dollar Project (DDP) released a new version of its white paper “Exploring a U.S. CBDC” on Jan. 18. The project expanded the paper in order to examine central bank digital currency projects internationally, though its focus is still on the United States. The DDP introduced its “champion model” of an intermediated wholesale and retail CBDC in the first version of the paper in May 2020. Since that time, CBDC projects worldwide have increased from 35 to 114. The updated DDP paper retained the core tenets of the champion, such as those on privacy and monetary policy, and it discussed technological advancements of recent years. The new ideas in the report mainly revolved the authors’ warnings about the United States falling behind in CBDC research and leade...