The nonprofit organization behind Cardano has partnered with blockchain analytics provider Coinfirm to ensure ADA is in compliance with the Financial Action Task Force’s guidelines.

In an Aug. 24 announcement, the Cardano Foundation said it would be using Coinfirm’s services to provide Anti-Money Laundering, or AML, and Combating the Financing of Terrorism, or CFT, analytics for Cardano’s native cryptocurrency ADA. According to the foundation, the integration will allow the project to be “in full compliance” with the guidelines set forth by the Financial Action Task Force, the European Union’s Sixth Anti-Money Laundering Directive, or 6AMLD, and other regulations applicable to Cardano.

“AML/CFT analytics is essential for a cryptocurrency to receive mass adoption within regulated markets,” said Cardano Foundation’s head of technical integrations Mel McCann. “The tools and services provided by Coinfirm enables every exchange, custodian, and all other third-parties to clearly track the history of ada held in their wallets.”

Coinfirm said it would be able to provide the same AML/CFT analytics for assets minted on Cardano, a number which may grow as the project prepares to expand to smart contracts. News of the integration comes as blockchain firm dcSpark announced it would be building its Milkomeda sidechain, connecting the Cardano blockchain to Ethereum.

Related: B ADA now staked as Alonzo smart contract excitement builds

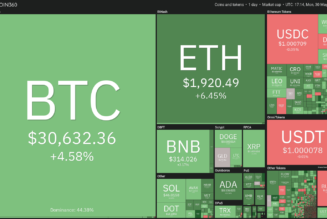

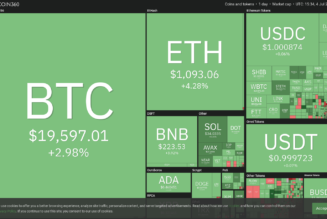

The price of the ADA token has significantly increased in the last month, reaching an all-time high of $2.92 on Aug. 22. As data from Cointelegraph Markets Pro shows, the token currently has a market capitalization of more than $88 billion, making it the third largest cryptocurrency ahead of Binance Coin.