Across the deals, Kilometre says it acquired underlying copyrights and royalty streams associated with all the songs, but it did not purchase master recordings or revenues from masters. The company declined to reveal purchase prices.

According to calculations by Kilometre, the fund now co-owns 10% of the 100 most-streamed songs on Spotify of all time, and 7% of Spotify’s “Billions Club” – songs with one billion streams or more.

The Kilometre deals, along with recent acquisitions by Dutch music management company Pythagoras Music Fund, are the latest purchases of publishing catalogs worldwide by investor-backed song funds like London-based Hipgnosis Song Funds as well as the publishing arms of major labels Universal Music Group, Warner Music Group and Sony Music Entertainment. In recent months, the catalogs of such stars as Bob Dylan, Tina Turner, Neil Young, Paul Simon and Stevie Nicks have been acquired.

Kilometre landed its first deal in April with Shaun Frank for his portion of The Chainsmokers’ “Closer,” followed in June by its deal with Canadian rapper Belly for 50% of 180 songs, among them The Weeknd’s “Blinding Lights,” “Earned It,” “The Hills,” “Save Your Tears” and “In Your Eyes.”

While some other funds and publishing companies are going after the catalogs of legacy artists with careers and hits spanning 30, 40 and even 50 years, Kilometre is targeting younger stars with more recent hits.

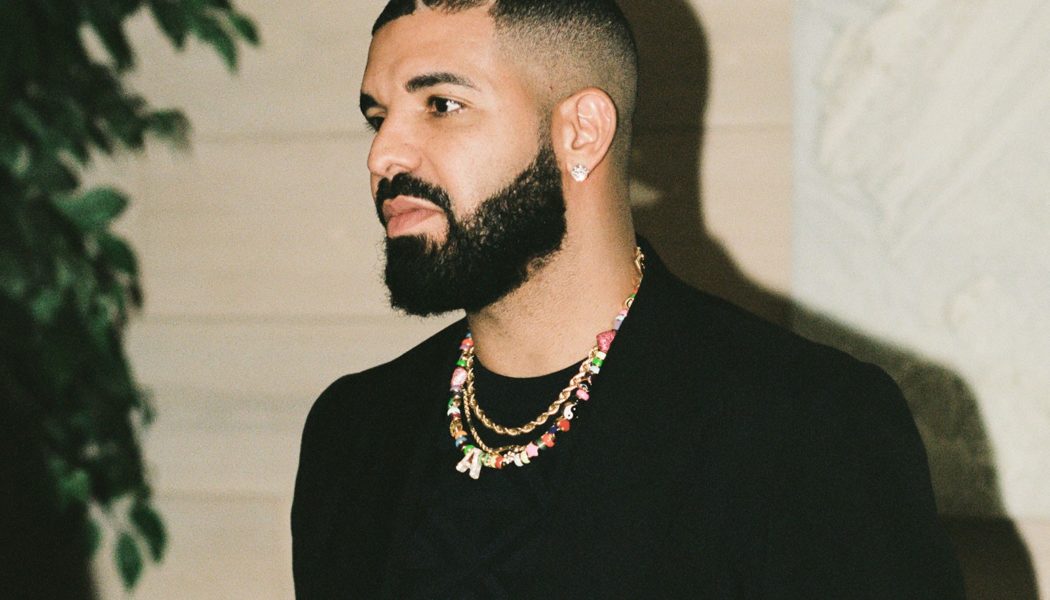

“We have 56 songs by The Weeknd, 31 by Drake, 26 songs by Post Malone and 12 by Bieber,” says Rodney Murphy, Kilometre’s president of A&R and acquisitions. “We believe it’s worth investing in those songs because those are going to be the biggest catalog songs of the future. We’re in the business of nostalgia and legacy lifelong copyrights and believe that these are the ‘Stairway to Heaven,’ and The Beatles and Michael Jackson catalog songs of tomorrow.”

Atweh and Belly, both LA-based, are managed by Wassim “Sal” “Slaiby, who also manages The Weeknd. They have all known Murphy for over 15 years via SOCAN. Kilometre was created by former EMI Music Publishing and SOCAN executive Michael McCarty, producer-songwriter Gavin Brown and Murphy, who worked with McCarty at SOCAN.

Murphy says Kilometre’s three catalog deals with Canadians are attracting other potential sellers. “Our next few deals are with some other big catalogs that aren’t Canadian,” he says.

Overseas, Pythagoras Music Fund, a $100 million euro ($116 million) Dutch music management firm financed by private and institutional investors, appears to be plotting a similar course. The Laren, Netherlands-based company, which launched in February, says it is focused on acquiring music rights worldwide with a focus on continental Europe. Last month, it completed the purchase of Nanada Music’s music copyrights and Red Bullet’s master recordings from the companies’ owner and founder Willem van Kooten. Those catalogs contain 30,000 copyrights and 6,500 master recordings, including songs from global hitmakers Golden Earring (“Radar Love,”), Shocking Blue (“Venus”) and Focus (“Hocus Pocus”) as well as significant Dutch acts such as BZN, Earth & Fire and Sandy Coast, according to a press release. (“Venus” has reached No. 1 on Billboard’s Hot 100 three times by three different artists: Shocking Blue, Stars on 45 and Bananarama.)

The fund will manage Nanada and Red Bullet’s assets, while van Kooten will remain on the board as non-executive director, the company says.

“Willem is the godfather of the Dutch music business,” says Pythagoras co-founder Hein van der Ree in a press release. “We feel privileged that Willem has entrusted PMF with his legacy.”

Pythagoras was co-founded by publishing veteran Van der Ree, Dutch composer-producer John Ewbank, investment specialist Michiel Boere and lawyer Rob Hendriks. John Brands is a co-founder and consultant.