This week, Burberry became the latest luxury company to report lacklustre quarterly results, saying sales in the 12 weeks through September had risen just 1 percent from a year earlier compared to an 18 percent jump the previous quarter. Sales in Mainland China and the US fell 9 and 10 percent, respectively.

“There’s a challenging macro environment coming across from all regions,” CEO Jonathan Akeroyd told reporters. “I think this is something that has been quite unique, because historically if you get softness in one region you’re able to pick it up in another.”

Burberry’s numbers added to mounting signs that the post-pandemic boom in luxury spending may be reaching its end: LVMH and Richemont both reported quarterly growth that slowed sharply from the first half of the year, while sales at Gucci-owner Kering fell 9 percent.

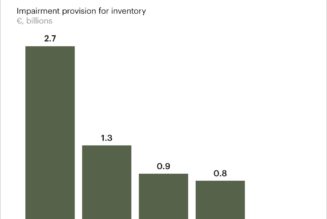

Growth is on track to slow further next year, according to consultancy Bain. After rising 8 percent at constant exchange rates to €362 billion ($387 billion) this year, luxury sales will likely rise 1 to 4 percent next year.

Amid the darkening outlook, where can brands turn next for growth?

There aren’t really any alternatives to the US and China. If one — or preferably, both — doesn’t rebound, brands will have a hard time making up growth elsewhere, even in fast-growing markets like the Middle East or India.

Of the two, the biggest upside potential for luxury brands is still in China, and among Chinese customers more broadly.

Last month, Beijing announced it would unleash a package of fiscal stimulus measures aimed at reviving the country’s fragile post-pandemic economy. Youth unemployment and falling real estate values are among the challenges that have dogged China’s economy in recent months — holding back a hoped-for rebound in luxury spending as anti-coronavirus measures lifted.

While the local luxury market has expanded since 2020, Chinese customers are still spending below pre-pandemic levels overall, as a consumer culture marked by big shopping sprees at duty-free hubs around the world only partly bounced back.

China injected funds worth over $500 billion into its banking system this week — the biggest single stimulus since 2016 — in the latest move hoped to turn the situation around. But how fast and how much stimulus measures will help remains to be seen.

While the US could remain fairly challenging short-term, it could be another source of positive surprise now that inflation is more firmly under control. Earlier this week, the Bureau of Labor Statistics reported that consumer prices rose 3.2 percent on an annual basis in October, the slowest pace since March 2021. Later, the department reported that wholesale prices actually fell last month.

If inflation is truly beaten, that will clear the way for the Federal Reserve to begin lowering interest rates next year, freeing up investment and, inevitably, spending on high-ticket items.

“The current trading is still not good, but the fundamentals of the economy are quite strong, and the US has shown it tends to react quite strongly once growth and equity values improve,” Bain partner Claudia d’Arpizio said.

Luxury brands also invested heavily in expanding their footprints in the US in recent years. Some newer luxury shopping hubs in the South, Midwest and West may continue to struggle if clients spend more time and money in bigger cities again. But others like Austin, Atlanta and Denver will start to realise their potential, as their relevance is underpinned by population growth and good jobs.

What does the outlook look like beyond next year?

Looking ahead, Bain expects he market for personal luxury goods to grow from €360 billion this year to €540 billion in 2030. But capturing that growth will be likely be more competitive and more complex as big markets like the US and China mature.

After over a decade of rapid growth powered by a few big opportunities like casualisation — which unlocked new categories and ushered in a new generation of luxury shoppers — and a booming Chinese economy, opportunities for pacey growth are likely to be scattered across geographies, product categories and price points.

At the top of the market, luxury brands could capitalise on the momentum with big spenders who increasingly seek a 360-degree luxury lifestyle — including yachts, art, furniture, hotel stays and food in addition to fashion and beauty. Brand extensions like Bulgari and Armani hotels, Dior and Gucci’s museums or Louis Vuitton’s restaurants and airport lounges could become more common.

To stay relevant to the wider world, however, brands will also need to find a way to reinvigorate their entry-price offer, as aggressive price hikes for flagship accessories in recent years have alienated many clients.

THE NEWS IN BRIEF

FASHION, BUSINESS AND THE ECONOMY

Burberry shares fell 10 percent. Revenue grew 1 percent on a comparable basis in the 12 weeks through September, but the company will be unable to meet its full-year outlook if softer demand in the global luxury market continues.

Gap surpassed third quarter expectations. Adjusted earnings of 59 cents a share were triple the average analyst estimate. The results show CEO Richard Dickson is succeeding at improving the company’s performance.

Roger Federer-backed shoemaker On saw sales surge. The brand posted earnings growth of 44 percent. The stock rose 7.1 percent in pre-market trading in New York.

China’s Singles Day festival wrapped up with e-commerce giants reporting sales growth. Expectations for sales growth for the festival, which is viewed as a gauge of consumer confidence, were subdued this year as the economy struggles to recover.

Alibaba’s quarterly revenue is in line with expectations. The Chinese e-commerce giant posted revenue of 224.79 billion yuan ($31.01 billion) in the quarter, compared with analysts’ average estimate of 224.32 billion yuan.

Macy’s rises as profit beats forecasts on improved inventory. The results underscore an emerging trend for retailers this quarter, which have reported improvements to profitability but have struggled to maintain the sales growth that powered them through the pandemic.

TJ Maxx parent sees downbeat holiday earnings as higher costs weigh. The results signalled that spiralling costs were weighing on the off-price retailer’s margins even as it saw steady demand from bargain-hungry customers.

Target CEO signals a halt to revenge spending and delays in impulse buys. A slowdown in sales of big ticket items in recent quarters has posed a distinct challenge for the brand amidst belt-tightening.

Walmart lifts targets as shoppers pick low-priced items for the holiday. The US retail giant used its size and scale to keep prices low despite inflation, drawing in not just low-income shoppers but also more high-income consumers looking for cheaper options.

JD.com’s revenue beat estimates after discounts drove sales. Net income rose 33 percent to 7.9 billion yuan. Its shares rose 4.5 percent in pre-market trading in New York.

Rolex and Patek Philippe prices fell to fresh two year lows on the secondary market. The declines follow a massive surge in prices for the most in-demand Rolex, Patek Philippe and Audemars Piguet timepieces during the pandemic. A Rolex brand index fell 1.5 percent last month and is now down 27 percent since the April 2022 market peak.

De Beers will stockpile unsold diamonds after prices tumble. The producer will allow buyers to refuse purchase of stones they are contracted to buy. This further points to a slump in the diamond industry.

Gucci handbags disappoint at auction as luxury fervour cools. Two Gucci Bamboo bags failed to meet the low pre-sale estimate at an online auction held by Christie’s that ended Tuesday, while a third just reached the low estimate, according to preliminary results.

Selfridges’ Thai co-owner Central Group took control of the business as Signa’s financial woes deepened. Thai conglomerate Central Group converted a loan into equity and will gain a majority stake in the joint-venture company that runs London’s landmark Selfridges department store after the financial woes of its Austrian partner Signa deepened.

Rich Chinese shoppers’ appetite slows as confidence falters. There has been a “decline in optimism” since April among Chinese high-net-worth individuals in the past six months. Headwinds that will face the €1.5 trillion ($1.6 trillion) global luxury market in the fourth quarter include macroeconomic tensions in China and sparse signs of recovery in the US.

US retailers stuck with excess stock offer bargains as holiday season nears. Stuffed stockrooms are especially challenging for retailers this year because American shoppers are expected to spend just 3 percent to 4 percent more this season, roughly on par with inflation.

US retail sales fell slightly in October. They slipped 0.1 percent last month, according to the Commerce Department’s Census Bureau. It is a sign that consumers are feeling the heat from higher interest rates.

UK retail sales fell unexpectedly in October. The volume of goods sold in stores and online dropped 0.3 percent. The drop adds to the impression that interest rate hikes designed to lower inflation are hindering economic activity.

The US makes biggest seizure of knock-off luxury items at $1 billion. Two people were charged with the trafficking of counterfeit goods in Manhattan. More than 83,000 knock-off items were taken.

REI accused of widespread labour law violations at unionised US stores. Workers at stores in New York, California, Chicago and Boston, among others, filed a total of 80 complaints with the National Labour Relations Board seeking to force the company to bargain with their unions.

THE BUSINESS OF BEAUTY

Bath and Body Works trims sales forecast as demand slows into the holiday season. The retailer expects its 2023 net sales to fall by 2.5 percent to 4 percent. Analysts have noted the company’s product offerings have limited room for growth and are not recession-resistant as they come at high price points.

Shiseido posts biggest drop in 16 years after forecast cut. The stock fell as much as 14 percent by midday in Tokyo on Monday. The company is struggling following a boycott from Chinese consumers over the release of treated water from the wrecked Fukushima nuclear plant.

Harry Styles’ Pleasing debuts fragrances with Selfridges. The line is scented by Jerôme Épinette who also worked with Byredo and Victoria Beckham, and was created in collaboration with fragrance house Robertet.

Sephora announces Black-owned beauty grant. The retailer announced a grant in partnership with the Fifteen Percent Pledge that will award one Black beauty business owner $100,000.

Beauty company Avon will open its first UK stores in its 137-year history. The company, known for its house calls, has had to strategically rethink its business model after the pandemic. The company is set to open franchises as it expands its deal with Superdrug.

Brazil’s Natura sells The Body Shop to Aurelius in $254 million deal. Natura said the agreement includes a potential earn-out of £90 million. The move represents the second major divestment by Natura this year as part of a broader organisational shakeup.

Revolution Beauty posted its revenue growth and upgraded its fiscal outlook. The British beauty has seen revenue growth of 20 percent. Lauren Brindley, the group’s CEO, said the group is developing a strategic plan to deliver future growth.

Hair care label Odele receives minority investment from Stride Consumer Partners. Stride’s stake will include two board seats. Odele co-founders Britta Chatterjee, Lindsay Holden and Shannon Kearney will remain majority shareholders.

PEOPLE

Louis Vuitton extended Nicolas Ghesquière’s contract for another five years. Ghesquière joined the French house in 2013, replacing Marc Jacobs. His work at the brand has helped Louis Vuitton grow its revenues to a record €20 billion in annual sales last year.

Napapijri taps Christopher Raeburn as global creative director. Raeburn’s first capsule collection will drop in Spring/Summer 2025, followed by a full collection in Fall/Winter 2025. He will be tasked with elevating VF Corp.-owned outerwear brand’s identity and design credibility, including in sustainability.

Nike hires Amazon fashion executive as new tech chief. Erdirik Dogan, who spent 16 years at Amazon in various consumer categories and deliveries, is taking the helm as the new chief technology officer.

Canadian fashion mogul Peter Nygard is found guilty of four counts of sexual assault. Nygard, 82, was on trial in the Ontario Superior Count for five counts of sexual assault and one count of confinement charges. He was found not guilty on a fifth count.

The BeautyHealth company announced a leadership shakeup. Andrew Stanleick, the company’s CEO, is stepping down and relinquishing his seat on the board effective Nov. 19. Stanleick joined BeautyHealth in January 2022 having previously served as executive vice president, Americas at Coty.

Sustainable Apparel Coalition CEO Amina Razvi will step down. She helmed the organisation through a greenwashing controversy centred on its sustainability tools. She will depart on Dec. 29.

MEDIA AND TECHNOLOGY

Model Karlie Kloss is acquiring i-D magazine. Once the deal is closed, Kloss will take on the role of chief executive at the publication, with current editor-in-chief Alastair McKimm will expand his purview under the new title of chief creative officer and global-editor-in-chief.

Google is rolling out new generative-AI shopping features in time for the holidays. One of the features uses AI to suggest gift ideas and another creates photorealistic variations of items consumers would like to see. The features will only be available in the US.

Klarna brings its Creator Shops platform to the US. Buy now, pay later company Klarna is expanding its Creator Shops platform, which allows influencers to monetise their content through affiliate links and setting up their own “shop” pages on Klarna.com, to the US.

Tencent Holdings’ profit beat estimates in defiance of China’s downturn. The WeChat operator reported growth across divisions from gaming and advertising to fintech, driving a 10 percent gain in revenue to 154.6 billion yuan ($21.4 billion) for the September quarter.

Meta challenges EU’s crackdown on dominance of big tech firms. The company argued that the European Commission was wrong to put Facebook’s Marketplace and Messenger services within the scope of the bloc’s new digital antitrust rules.

Fashion recycling platform SuperCircle raised $7 million in a pre-series A financing round. The reverse logistics business, whose clients include Reformation and Uniqlo, sits in an emerging space in the market, as more brands look to ensure the clothes they sell can be recycled at the end of their life.

Compiled by Yola Mzizi.