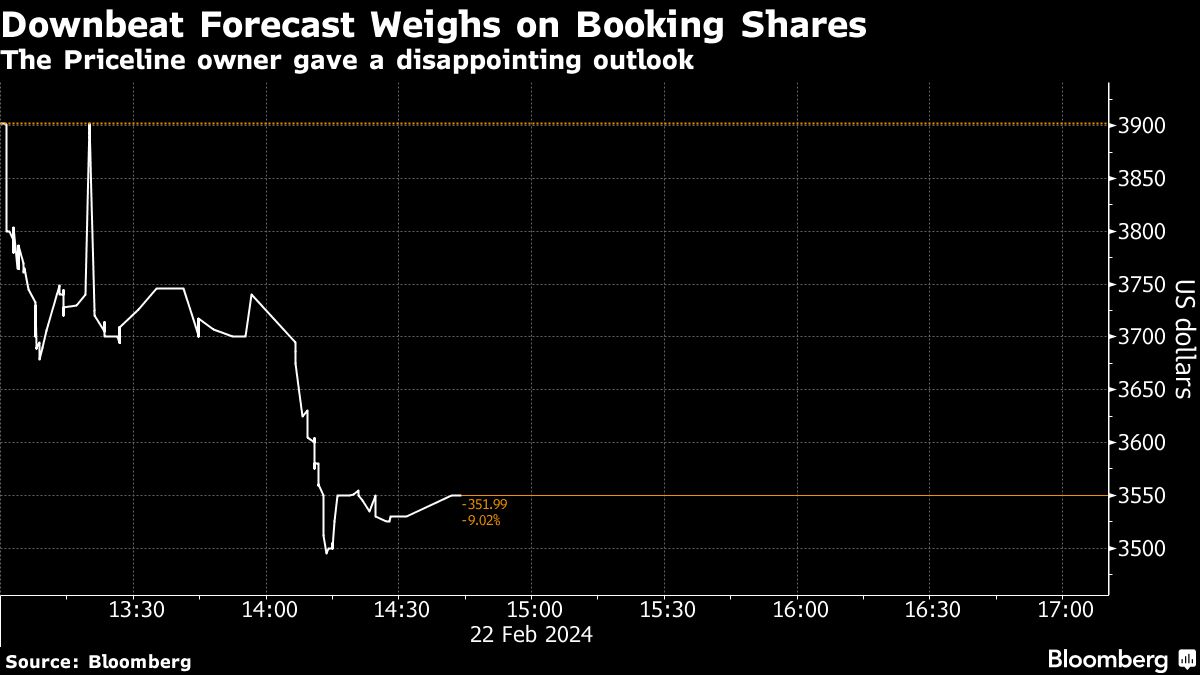

(Bloomberg) — Booking Holdings Inc. shares fell the most in 20 months on Friday after giving a disappointing forecast for travel reservations and gross bookings, with the war in Israel and currency fluctuations weighing on results.

Most Read from Bloomberg

The growth of room nights booked — a closely watched measure for the company — will be 4% to 6% in the first quarter, Booking said on a conference call following its earnings report Thursday. For the full year, the company expects gross bookings to increase “slightly faster than 7%” as it accounts for the negative impact from exchange rates and the war. That compares with an average analyst estimate of 9.9%.

Investors have been looking for signs that a post-pandemic travel boom remains strong, and Booking’s outlook wasn’t reassuring. Shares of the company tumbled as much as 8.7% Friday morning, the most on an intraday basis since June 2022, making it the second worst performing stock in the S&P 500 Index. The shares closed at an all-time high a day earlier.

Booking operates six major brands, including Agoda, Priceline.com and Kayak, and has a bigger presence in Europe and the Middle East than its peers. That makes the Norwalk, Connecticut-based company a barometer of global travel.

Room nights booked for the three months ended Dec. 31 grew 9.2%. That missed the average analyst expectation for a 9.7% increase. Gross travel bookings, which includes taxes and fees, were $31.7 billion, compared with a projection of $31.3 billion.

Chief Executive Officer Glenn Fogel said fourth-quarter room nights booked gained 11% excluding business associated with Israel, “which was significantly impacted by the war.” Chief Financial Officer David Goulden added during the call that the conflict is expected to hurt the first-quarter outlook by a percentage point. The company also expects changes in exchange rates to negatively affect growth by a little more than 1 percentage point, he said.

Booking also initiated a quarterly dividend of $8.75 a share. It will be paid on March 28 to shareholders of record on March 8, the company said.

Booking shares had been rallying this year. They rose 61% in the past 12 months through Thursday’s close, far outpacing the S&P 500 Index.

The company’s revenue grew 18% to $4.78 billion in the fourth quarter, topping the $4.73 billion analysts had projected. Adjusted earnings before interest, taxes, depreciation and amortization came in slightly above estimates, though Booking’s margin on that basis was just shy of predictions.

The mixed results add to concerns after rival Expedia Group Inc. gave a downbeat forecast earlier this month. It cited lower airline prices and harder-to-follow performance after an especially strong travel season in early 2023 — a stretch that followed the Omicron wave of Covid-19.

Home rental company Airbnb Inc., meanwhile, said last week that overall demand was starting to normalize coming out of the pandemic.

On the call with analysts, Fogel said he believes Booking is now on a stronger footing than before the pandemic. “Our ambition going forward in a normalized growth environment for the travel industry is to continue to grow our gross bookings, revenue and earnings per share faster than we did in 2019,” he said.

Fogel said Thursday that he continues to see “resiliency in global leisure travel demand” as the summer season approaches.

“As we look to the year ahead, we see strong growth on the books for travel that’s scheduled to take place in 2024, which gives early indications of potentially another record summer travel season,” he said.

(Updates shares move in lede and third paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.