The Cointelegraph Research Terminal, the leading provider of premium databases and institutional-grade research on blockchain and digital assets, has added a new report to its expanding library from the industry leader in tokenization.

The report, from Security Token Market and sister company Security Token Advisors, covers the rapidly emerging asset-backed real estate tokenization industry. It has information on the developing shifts in the industry and is a must for any firm or business with a portfolio that encompasses real estate.

The tokenized real estate industry is growing rapidly amid the current market frenzy. With investors looking for a more secure investment that utilizes emerging technology, the demand for blockchain-based investment opportunities backed by real-world assets is increasing. Real estate assets account for upward of 40% of the pipeline for certain technology providers in the industry, likely making it the largest and most “urgent” sector when it comes to future security token offerings.

Download the full report, complete with charts and infographics, from the Cointelegraph Research Terminal

To understand what the 2022 landscape looks like, the report sheds light on notable developments and deals. This sector of tokenization offers investors access to high-performing fractionalized investments that can be purchased with cryptocurrency and traded via secondary markets.

Emerging technology, disrupting a traditional market

The existing tokenized real estate market can be broken into the following tranches: assets securitized on the blockchain, assets that are fully tokenized but not actively trading on secondary markets and assets that are fully tokenized and actively trading on secondary markets.

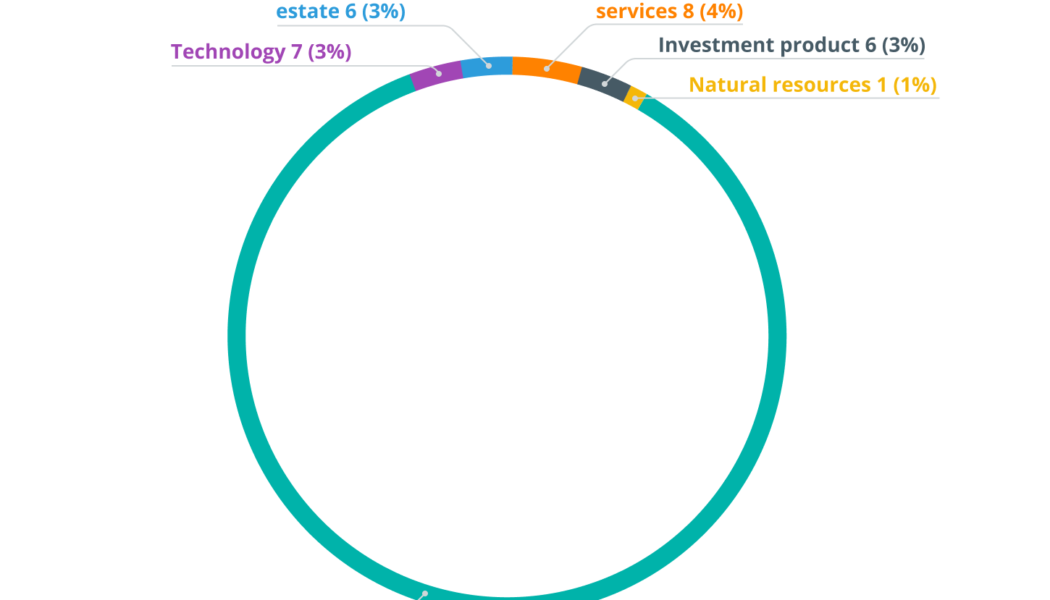

Historically, real estate has been one of the most illiquid asset classes, perhaps next to hedge funds and private equity. This comes as no surprise, as real estate often involves extensive planning requirements, cost constraints, property management, safety requirements and legal prowess. These variables can cost an investor months and years in time, alongside expenses like unavoidable fees, depending on the size and scale of the project. Since the last Cointelegraph Research report, real estate still makes up 89% of the pie in the total securities market; however, the overall pie has grown. The number of commercial real estate deals grew from 2% a few months ago to 3% of the total number of security tokens being invested in.

The tokenization of assets such as real estate allows for these historically illiquid investments to realize additional liquidity. By trading fractionalized portions of a property, investors can enjoy the yield generated by rent and operations without the legal and time-consuming hassles associated with paper-based real estate investing and management.

Market capitalization

Both residential and commercial real estate continue to increase in terms of capitalization over time. In June 2021, there was a modest $65 million capitalization, but May 2022 had $194 million in total monthly market capitalization. The aggregate market capitalization of all security tokens is over $16.4 billion, of which real estate is currently around 1.2%. This may seem small now, but it is the largest growing security token sector and should be watched closely.

Research report authors

Security Token Market has conducted extensive research for over four years. This coverage can be used to inform issuers, investors and trading firms at multiple stages in the tokenization process.

Peter Gaffney is the head of research at Security Token Advisors, a full-suite consulting firm that facilitates the tokenization of assets on behalf of clients, where he develops the security token ecosystem that helps to connect organizations and services.

Aneesh Shinkre works on the data science team at Security Token Market, where he statistically analyzes, visualizes and narrates the market performance of tokenized assets while also ensuring consistency of data systems to deliver in-depth research.

Thor Wahlestedt also works on the data science team at Security Token Market. Wahlestedt manages Security Token Market’s data assets and infrastructure while covering the security token ecosystem via analyst reports and market summaries.

This article is for information purposes only and represents neither investment advice nor an investment analysis or an invitation to buy or sell financial instruments. Specifically, the document does not serve as a substitute for individual investment or other advice.

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

Tagged: Cointelegraph Consulting, crypto blog, Crypto news, Report, Research, Tokenization