- The Fed’s decision to tighten monetary policy has primarily caused this increased correlation

- Bitcoin’s correlation with the dollar strength index is as high as March 2020

Analysts at Arcane Research have published a report detailing that Bitcoin’s 30-day correlation with the stocks has reached heights not seen since July 2020. The post revealed that the flagship crypto’s correlation with gold is now at an all-time low, all of which are bearish indicators for the leading digital asset token.

Further, it also noted that Bitcoin’s correlation to the U.S. Dollar index had reached 0.53, the highest since March 2020, as the dollar continues regaining strength.

Impact of the U.S. Fed policy

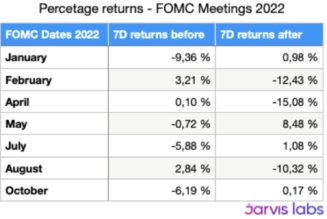

One huge cause for this shift is the U.S. Federal Reserve policy. While the leading digital asset by market cap was deemed a hedge against inflation for the larger part of 2021, the narrative is changing.

Though the U.S. Fed maintained the interest rates in January, it indicated it was taking an aggressive approach, saying it would hike the rates over the course of the year to counter inflation, aiming to bring it down to 2% in the long term.

While the European Central Bank (ECB) has taken a more relaxed stance on the inflation in Europe, the U.S. Fed’s decision to tighten monetary policy the soonest has caused an increased correlation with tech stocks.

“The strengthening dollar is a result of the FED’s hawkish stance and reinforced expectations of faster U.S. policy tightening while ECB and other central banks are more dovish. ECB’s Lagarde has recently commented that the ECB has no clear time frame for when ECB rates will start to rise, and the ECB revealed a more dovish response to the inflation news than the market expected,” the blog post explained.

What does this mean?

The correlation between Bitcoin and tech stocks has been seen as pessimistic to crypto markets. Arcane Research explained that the poor performance of tech stocks since November has been a swing factor in the crypto markets’ poor performance in recent months.

In fact, the correlation with tech stocks has been at significant levels since March 2020, indicating that investors are categorizing Bitcoin with other risk-on assets.

“Inflation expectations and FED policies impact tech. Costs of borrowing become more expensive and the growth projections narrow. Bitcoin’s elevated correlation with tech stocks since March 2020 paints a picture of institutional investors bundling bitcoin with other risk assets.”

However, with increasing adoption, the correlation is expected to fall from today’s astronomical levels.

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

Tagged: Analysis, Bitcoin, crypto blog, Crypto news