Bitcoin (BTC) has suddenly fallen below $47,000 on Dec. 4, losing nearly 20% in the past 24 hours. This makes this the biggest one-day drop since May 15, when Bitcoin price momentarily came down to nearly $33,000.

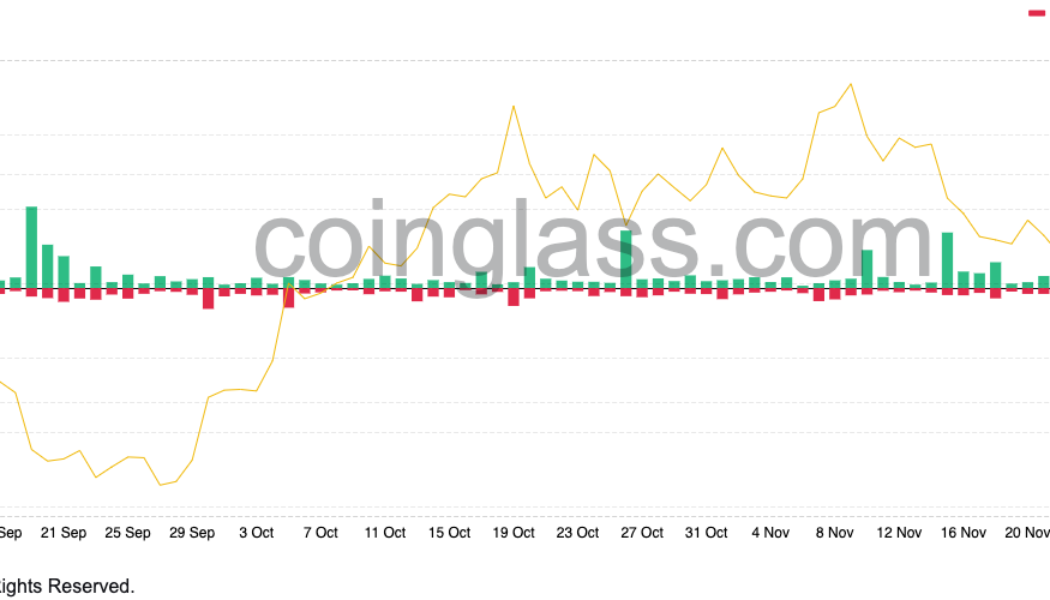

The market price of BTC fell down 26.4% from week-long support of $57,206 to go down to $42,268 before recovering back to the $45k mark. According to ByBit data, the Bitcoin market experienced $1.3B total liquidations in the past hour, with $735M liquidated in BTC longs on this drop.

As a result, Bitcoin’s bear market cancels out the 2-month long bull market since Sept. 29, where BTC soared over 63% to attain an all-time high of $67, 602 by Nov. 08. However, numerous Bitcoin analysts including TechDev point out a similar trend with Bitcoin’s price action for every year.

Every #Bitcoin cycle in history has ended with a red month followed by 2 or 3 very green months. pic.twitter.com/zr1055PvkL

— TechDev (@TechDev_52) October 18, 2021

Another reason for Bitcoin’s two-month low bearish streak can also be attributed to mainstream resistance from the US regulators that have invited the CEOs of prominent crypto exchanges including FTX and Binance US for a hearing on crypto-assets.

On the other hand, some believe that the price of Bitcoin can now stabilize following the decline. For example, CEO of crypto educational platform Eight Global Michaël van de Poppe stated:

Bottom is in.

— Michaël van de Poppe (@CryptoMichNL) December 4, 2021

Despite concerns surrounding volatility and non-compliance with traditional financial practices, Bitcoin continues to rise as a viable asset for jurisdictions with unstable economies.

Related: Zimbabwe may be the next country to embrace Bitcoin as legal tender

Following the footsteps of El Salvador, the government of Zimbabwe is considering the mainstream use of Bitcoin. As Cointelegraph reported, retired Brigadier Colonel Charles Wekwete, the permanent secretary and head of the office of the president and cabinet’s e-government technology unit, confirmed that discussions with businesses are already underway.

Related: El Salvador stacks 150 Bitcoin after BTC price crashes below $50k

According to Wekwete, the authorities intend to develop regulations to protect consumers against financial threats such as unregistered cross-border transfers, externalization of money and money laundering.