- Bitcoin climbed above $47,200 late on Sunday and continued hovering around this range in the morning Asian trading hours

- Analysts expect the Satoshi coin to maintain the uptrend in the short term

The majority of cryptocurrencies in the market are trading in the green, having recorded decent profits on Sunday. Bitcoin, the market leader, surged from around $44,720 on 11:00pm (UTC +3 hours) Sunday to a multi-week high of $47,290 on 3:40am (UTC +3 hours) Monday as per CoinMarketCap data.

Markedly, the ascent past $47,200 represents the first time Bitcoin hit breakeven since the turn of the year. After starting the year at $46,700, Bitcoin consistently posted gains in the first three days, peaking above $47,730. It has, however, failed to reclaim this level with every attempt – except yesterday’s – to overcome resistance at $45,000 suffering rejection.

Altcoins soared too

The flagship crypto has since corrected slightly, settling just below $47,000 as of this writing. Bitcoin’s Sunday price action was reflected in several altcoins, including Ethereum, which managed to rise above $3,300 where it is currently trading. CoinMarketCap shows that the total cryptocurrency market capital is back above $2.1 trillion – the first time it has consistently swung around this range since the first week of January.

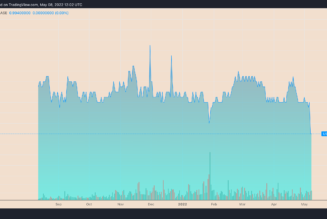

Bitcoin’s rise comes on the back of successive gains since last Monday. The BTC/USD 7-day trading chart shows that the coin has charted a steady uptrend, swelling 14.26%.

This climb has been propelled by news of Terra founder Do Kwon planning to acquire up to $10 billion worth of Bitcoin that will serve as a reserve for Terra. Industry experts contend that Bitcoin will continue range trading around January highs in the near term, citing an increase in the prices of global assets as a factor that will sustain the momentum.

A further uptrend is on the cards but not guaranteed

Trading volumes across the board are up – an indication that buyers are flooding in to turn resistance zones into support and gain more ground, according to BitBull Capital’s Joe DiPasquale. In his note to CoinDesk, DiPasquale argued that it is crucial for bulls to hold above the new resistances; otherwise, Bitcoin risks falling and consolidating at lower heights.

It’s worth noting that Q1 comes to an end this week, and amid the political drama in Ukraine and the economic situation (Federal Reserve raising interest rates), many are watching the direction Bitcoin market takes. The leading cryptocurrency by market capital remained resilient throughout last week – a stretch of days that many anticipated would be bumpier.

Despite Bitcoin’s latest price action painting a somewhat bullish picture, it is imperative that the asset remains above $46k as a slip below could see its gains erased.

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

Tagged: Bitcoin, crypto blog, Crypto market, Crypto news, Markets