“Sophisticated passive buying” on Bitcoin (BTC) spot exchanges coincides with the trend of BTC leaving exchanges to cold storage.

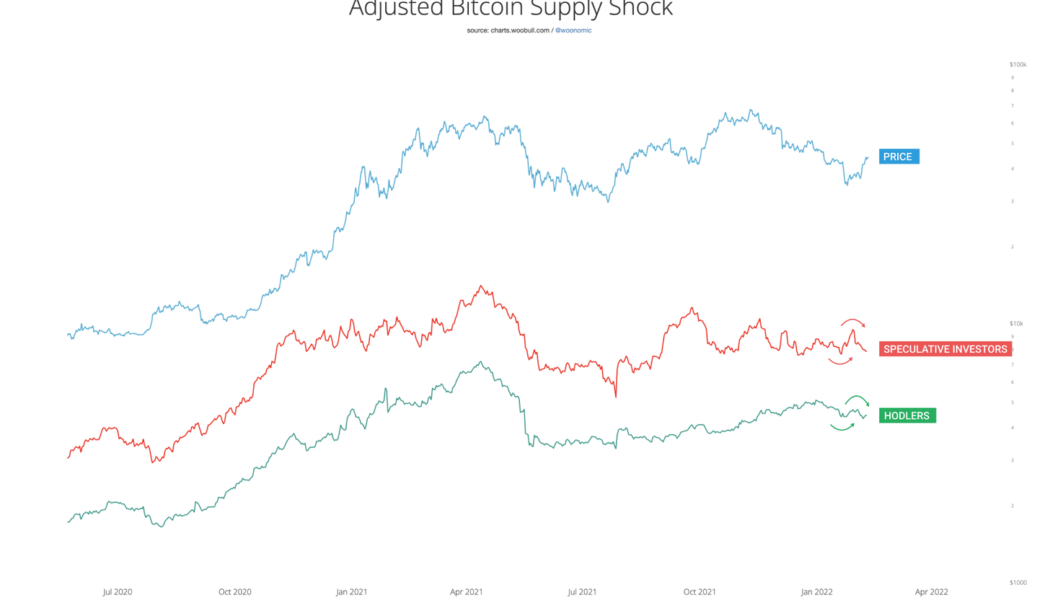

The price recovery witnessed in the Bitcoin market across the last two weeks coincided with a rise in hodlers and speculative investors selling their coins, according to data provided by researcher Willy Woo.

Nonetheless, BTC’s price ability to withstand the selling pressure meant there was buying pressure coming from elsewhere. As Cointelegraph reported earlier this week, so-called Bitcoin whales are accumulating BTC at current price levels.

“This selling is contrasted by exchange data showing sophisticated passive buying on spot exchanges and movement of coins to whale-controlled wallets,” wrote Woo, adding:

“This view is supported by coins moving away from exchanges to cold storage. Meanwhile, whales who hold more than 1,000 BTC ($45m) are accumulating. This hints at institutional money deploying capital.”

Despite the price of Bitcoin retreating going into the weekend, the rise in whale addresses controlling 1,000 to 10,000 BTC has also not gone unnoticed by on-chain data resource Ecoinometrics.

The #Bitcoin whales addresses are on a buying spree… so even though BTC could dip following a stock market crash there are signs long term holders find the current price to be a good entry point. pic.twitter.com/z0xSR5pzml

— ecoinometrics (@ecoinometrics) February 12, 2022

BTC price targets

Hunain Naseer, a researcher at OKEx, said Bitcoin would need more time to consolidate ahead, given its recent rejections and deviation from its 20-day moving average, as shown in the chart below. Nonetheless, reclaiming $46,000 would likely have BTC’s price test $50,000 next.

On the other hand, Woo called $33,000 a solid bottom for Bitcoin, given the recent selling sentiment among hodlers and speculative investors. As Cointelegraph reported, $40,000 remains a key level to hold while $46,000-$48,000 remains a heavy resistance area for the bulls.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

Tagged: Bitcoin, BTC, CPI, crypto blog, Crypto Exchanges, Crypto news, debt, Federal Reserve, Inflation, Interest Rate, Investment, Trading, Willy Woo