- Commodity strategist Mike McGlone has said that Bitcoin will survive the current market forces

- He, however, noted that it is very likely the flagship cryptocurrency hasn’t hit its lowest thus far

Bloomberg Intelligence’s senior commodity strategy has delivered another bullish projection on the leading cryptocurrency.

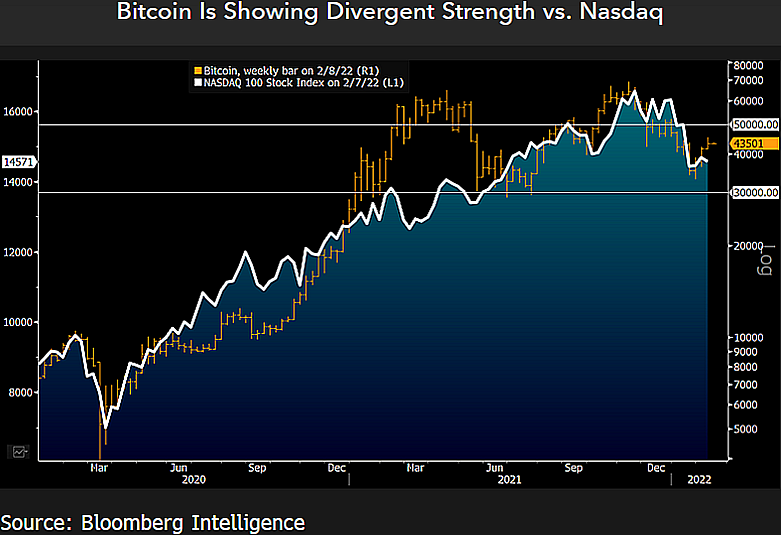

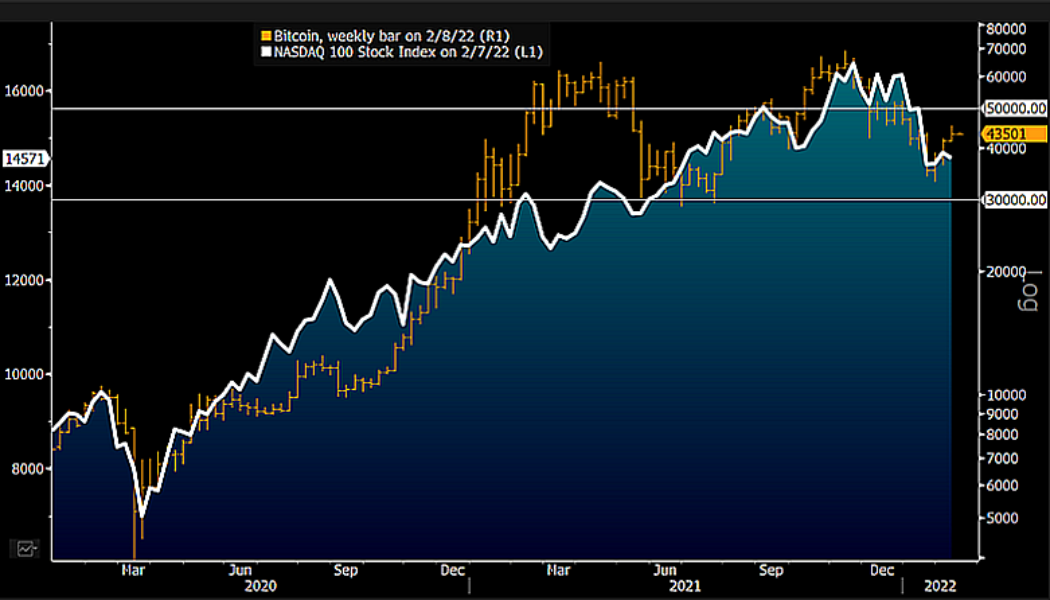

In a tweet sent out today, the commodity expert noted that Bitcoin is showing divergent strength against stocks but warned that the asset hasn’t reached the bottom. He reckons that the crypto asset will sink to its bottom when the stock market pulls a similar move.

McGlone, who has previously predicted Bitcoin to touch $100,000 by the end of the year, also observed that many traditional assets are currently enduring deflationary forces resulting from the state of the market last year.

He added that, unlike other assets, Bitcoin is uniquely placed to survive this turbulence as it continues evolving to become global digital collateral.

“Has Bitcoin Bottomed? It Looks Unlikely If stock market Hasn’t – Most assets in 2022 face strong deflationary forces from the excesses of 2021, but Bitcoin appears well poised to come out ahead as it matures to the status of global digital collateral and shows divergent strength,” he posted.

Last week, McGlone explained via a tweet that the poor performance of stocks could compel the Federal Reserve to keep the interest rates at their current level. Such a case, he argued, could work in favour of Bitcoin and Gold, spurring their growth as they are widely recognised haven assets.

“Bitcoin May Notch Win-Win vs. the stock market – The fact that a primary force to reverse potential Federal Reserve rate hikes — a stock-market decline — may enhance store-of-value assets like gold and Bitcoin is a basis for diversification,” the commodity strategist said at the time.

Bitcoin is currently trading at $43,880, having seen approximately 1.10% of gains in the last 24 hours as per data from CoinMarketCap. The OG cryptocurrency surged to a four-week high of $45,294 during yesterday’s trading session but has since failed to reclaim $45,000.

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

Tagged: Analysis, Bitcoin, crypto blog, Crypto market, Crypto news