Bitcoin (BTC) failed to break the critical $50,000 psychological barrier on Aug. 23 and has since then retested the $47,000 support. If historical data plays any role in Bitcoin price, the month of September presented negative performances in 4 of the previous 5 years.

Cointelegraph contributor and market analyst Michaël van de Poppe recently said that Ether’s (ETH) break above $3,500 could be a leading indicator for Bitcoin’s next bull run, and now that Ether trades at $3,700, traders anxiously await BTC’s next move.

Bulls could be excited for El Salvador’s Bitcoin Law, which is scheduled to take effect on Sept. 7. In addition, the recent $150 million Bitcoin Trust approval by the country’s Legislative Assembly is another potentially bullish development.

The money will be used to support the installation of government-backed crypto ATMs and to offer incentives that encourage the adoption of Chivo, the government-backed digital wallet.

This week, Coinbase also saw a large Bitcoin outflow after a relatively stable period. The move brought the exchange’s balance below 700,000 BTC, a figure last seen in December 2017. These movements are usually considered bullish because they signal that holders are less likely to sell coins in the short term.

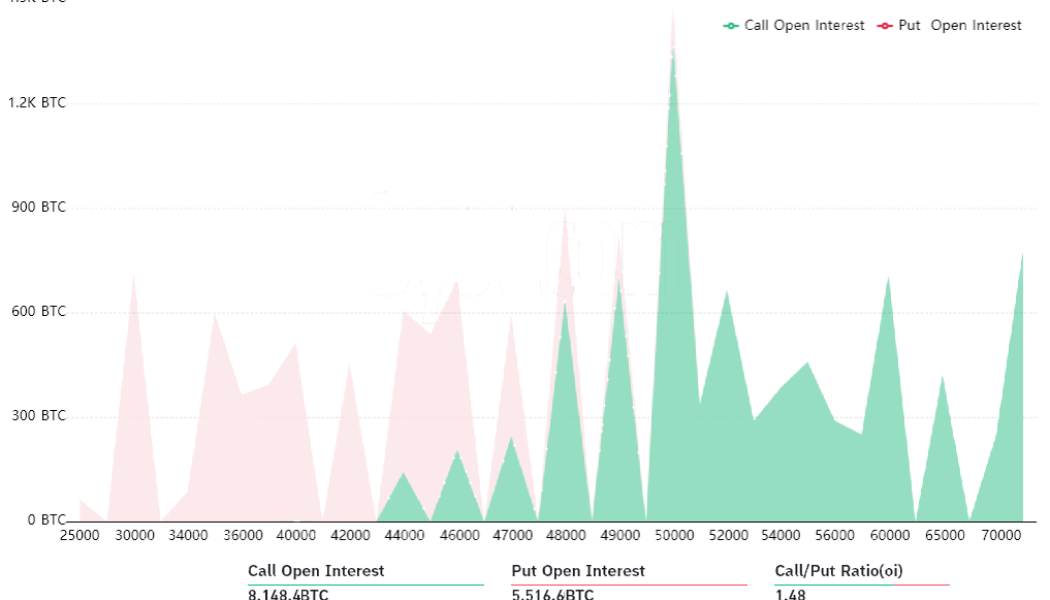

The Sept. 3 expiry will be a test of strength for bulls because 93% of the $390 million call (buy) options have been placed at $48,000 or higher.

Moreover, these neutral-to-bullish instruments dominate the weekly expiry by 48% compared to the $265 million protective put options.

However, the 1.48 call-to-put ratio is deceiving because the excessive optimism seen from bulls could wipe out most of their bets if Bitcoin price remains below $48,000 at 8:00 am UTC on Friday. After all, what good is a right to acquire Bitcoin at $52,000 if it’s trading below that price?

Bears were also caught by surprise

Seventy-eight percent of the put options, where the buyer holds a right to sell Bitcoin at a preestablished price, have been placed at $46,000 or lower. These neutral-to-bearish instruments will become worthless if Bitcoin trades above that price on Friday morning.

Below are the four most likely scenarios that consider the current price levels. The imbalance favoring either side represents the potential profit from the expiry.

- Between $45,000 and $46,000: 140 calls vs. 1,220 puts. The net result is $48 million favoring the protective put (bear) instruments.

- Between $46,000 and $48,000: 590 calls vs. 735 puts. The net result is balanced between bears and bulls.

- Between $48,000 and $50,000: 1,930 calls vs. 120 puts. The net result is $88 million favoring the call (bull) options.

- Above $50,000: 3,310 calls vs. 0 puts. The net result is a complete dominance with $165-million worth of bullish instruments.

The above data shows how many contracts will be available on Friday, depending on the expiry price.

This crude estimate considers calls (buy) options being used in bullish strategies and put (sell) options exclusively in neutral-to-bearish trades. Unfortunately, real life is not that simple, because it’s possible that more complex investment strategies are being deployed.

For example, a trader could have sold a put option, effectively gaining a positive exposure to Bitcoin above a specific price. Still, there’s no easy way to measure this effect, so the simple analysis above is a best guess.

Incentives are in place for bulls to try to break $50,000

These two competing forces will show their strength, and the bears will try to minimize the damage. On the other hand, the bulls have modest control over the situation if BTC price remains above $48,000.

The most important test will be the $50,000 level because bulls have significant incentives to obliterate every single protective put option and land a $165 million advantage.

The bears’ only hope resides in some surprise regulatory newsflow or a negative outcome for Bitcoin price coming from the U.S. jobless claims data on Sept. 2.

Even though there’s still room for additional volatility ahead of the expiry, the bulls seem to be better positioned.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.