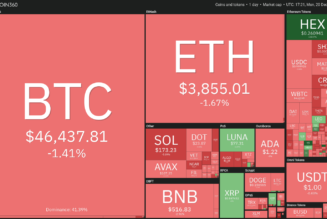

- Bitcoin saw a ballistic upswing late yesterday, peaking at $44,000

- The number of wallets holding more than 1,000 BTC has risen in the last 24 hours

Bitcoin had a fairly decent run in February compared to January, when it fell from $46.73k at the start of the year to $37.45k on the last day of the month. Last month, the flagship cryptocurrency mostly traded above $42k in the first two weeks before paring down in the third week.

The correction was followed by a steep crash to a monthly low of $34,459 last Thursday. A renewed rally kicking off late yesterday has put the coin in an uptrend, reclaiming $44k. Along with the price gains, the number of holders in different groups (based on the amount of bitcoin they hold) has increased.

Whales are taking up crypto at a faster rate

Data from CoinMetrics shows that the number of blockchain wallets holding north of 100 bitcoins (translating to $4.364 million at current market prices) increased from 15.755k to 15.953k yesterday. Whale addresses holding more than 1,000 bitcoins (the equivalent of $43.64 million at current market prices) similarly increased from 2,127 to 2,266.

A closer look at the accumulation figures shows that the increase in whale addresses is 6.535%, while that of addresses with more than 100 bitcoins (includes whales) is 1.25%. This suggests that much of the accumulation is happening among holders with large holdings.

Referencing Glassnode data, Cake DeFi’s chief executive Julian Hosp similarly observed earlier today that there are 150 more addresses with more than 1,000 bitcoins.

“Wow! About 150 new #bitcoin addresses with > 1,000 BTC on them. This either means some rebalancing of exchanges or custodial services (non-event) or a group of people with deep pockets suddenly have strong interests to get into #bitcoin (big event!) Which one is it gonna be?” he wrote.

The king cryptocurrency has seen massive gains in the last 36 hours. CoinMarketCap data estimates that the coin has gained 15.16% in the last 24 hours bringing the weekly gains to just over 17.50%.

Interestingly, even though Bitcoin has posted double figures in the 24-hr and 7-day timeframes, on-chain signals largely lean on the bearish side. Meanwhile, the proportion of holders ‘in the money’ as of writing is 65%, while 28% are seeing losses. The remaining proportion is at breakeven.

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

Tagged: Bitcoin, Bitcoin whales, crypto blog, Crypto news, Markets